Stock Analysis

- United States

- /

- Software

- /

- NasdaqGS:MANH

Manhattan Associates' (NASDAQ:MANH) investors will be pleased with their impressive 257% return over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is Manhattan Associates, Inc. (NASDAQ:MANH) which saw its share price drive 257% higher over five years. And in the last month, the share price has gained 9.1%. But this could be related to good market conditions -- stocks in its market are up 3.9% in the last month.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Manhattan Associates

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

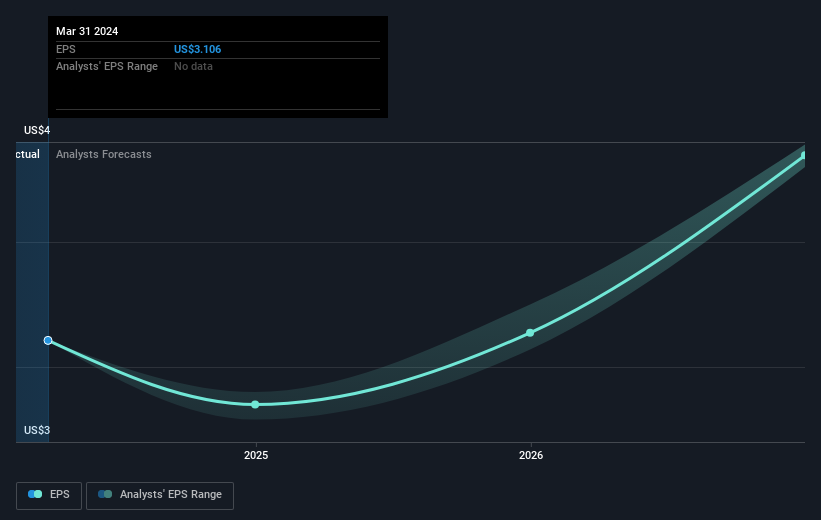

During five years of share price growth, Manhattan Associates achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is slower than the share price growth of 29% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 73.32.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Manhattan Associates has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Manhattan Associates stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Manhattan Associates provided a TSR of 27% over the year. That's fairly close to the broader market return. We should note here that the five-year TSR is more impressive, at 29% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Manhattan Associates .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Manhattan Associates is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Outstanding track record with flawless balance sheet.