- United States

- /

- Software

- /

- NasdaqGS:LPSN

Little Excitement Around LivePerson, Inc.'s (NASDAQ:LPSN) Revenues As Shares Take 27% Pounding

LivePerson, Inc. (NASDAQ:LPSN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

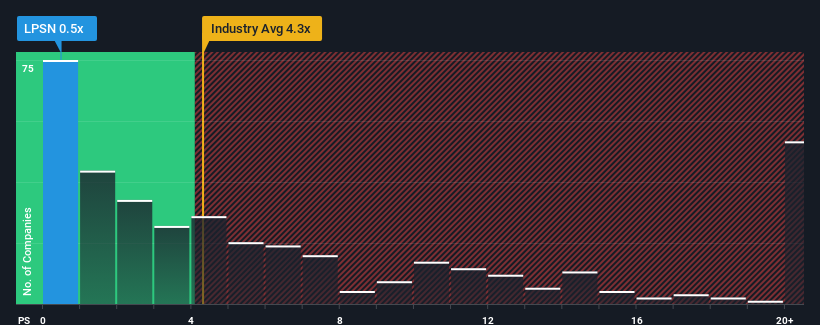

Following the heavy fall in price, LivePerson's price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.3x and even P/S above 12x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for LivePerson

What Does LivePerson's P/S Mean For Shareholders?

LivePerson could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think LivePerson's future stacks up against the industry? In that case, our free report is a great place to start.How Is LivePerson's Revenue Growth Trending?

LivePerson's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 6.4% during the coming year according to the nine analysts following the company. That's not great when the rest of the industry is expected to grow by 15%.

With this in consideration, we find it intriguing that LivePerson's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does LivePerson's P/S Mean For Investors?

Shares in LivePerson have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of LivePerson's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 2 warning signs for LivePerson that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LPSN

Medium-low risk and fair value.

Similar Companies

Market Insights

Community Narratives