- United States

- /

- IT

- /

- NasdaqGS:KC

Kingsoft Cloud (NasdaqGS:KC) Valuation: Assessing Shareholder Value After Major HKD 2.8B Equity Raise

Reviewed by Kshitija Bhandaru

Kingsoft Cloud Holdings (NasdaqGS:KC) has just completed a follow-on equity offering in Hong Kong, raising about HKD 2.8 billion by issuing 338 million new shares at HKD 8.29 each. This move directly impacts the company’s capital structure and catches investor attention.

See our latest analysis for Kingsoft Cloud Holdings.

Kingsoft Cloud Holdings’ steady stream of recent news around its equity offering comes at a time when momentum is just starting to build. While the stock’s share price has been flat for much of the year, a modest uptick over the last quarter hints at shifting market sentiment. Its 1-year total shareholder return stands at 2.7%, a slight climb that suggests long-term holders are only just beginning to see gains from the company’s efforts to strengthen its financial footing.

If this move has you wondering what else is gaining traction in the market, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With fresh capital on the balance sheet and a recent uptick in share price, does Kingsoft Cloud Holdings present a hidden value opportunity for investors, or has the market already priced in all possible future gains?

Most Popular Narrative: 17.8% Undervalued

With the narrative consensus setting fair value at $18.57, Kingsoft Cloud Holdings is seen as offering notable upside versus its last close of $15.26. This suggests market expectations remain modest compared to the narrative’s bullish case.

Ongoing advances in AI and generative AI adoption across multiple sectors are rapidly increasing demand for intelligent computing and scalable cloud services, driving strong revenue growth. This is evidenced by AI-related gross billings up 120%+ YoY and forming 45% of public cloud revenue, indicating the addressable market and future top-line expansion remain underappreciated.

Want to discover the real reason this valuation is so high? It’s not just about optimism; this narrative hinges on big bets in future earnings and a premium profit outlook. Intrigued by the bold financial predictions and exotic growth drivers backing that price? Get the details that move this fair value target.

Result: Fair Value of $18.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from high infrastructure costs or the loss of major ecosystem clients could quickly challenge this upbeat narrative.

Find out about the key risks to this Kingsoft Cloud Holdings narrative.

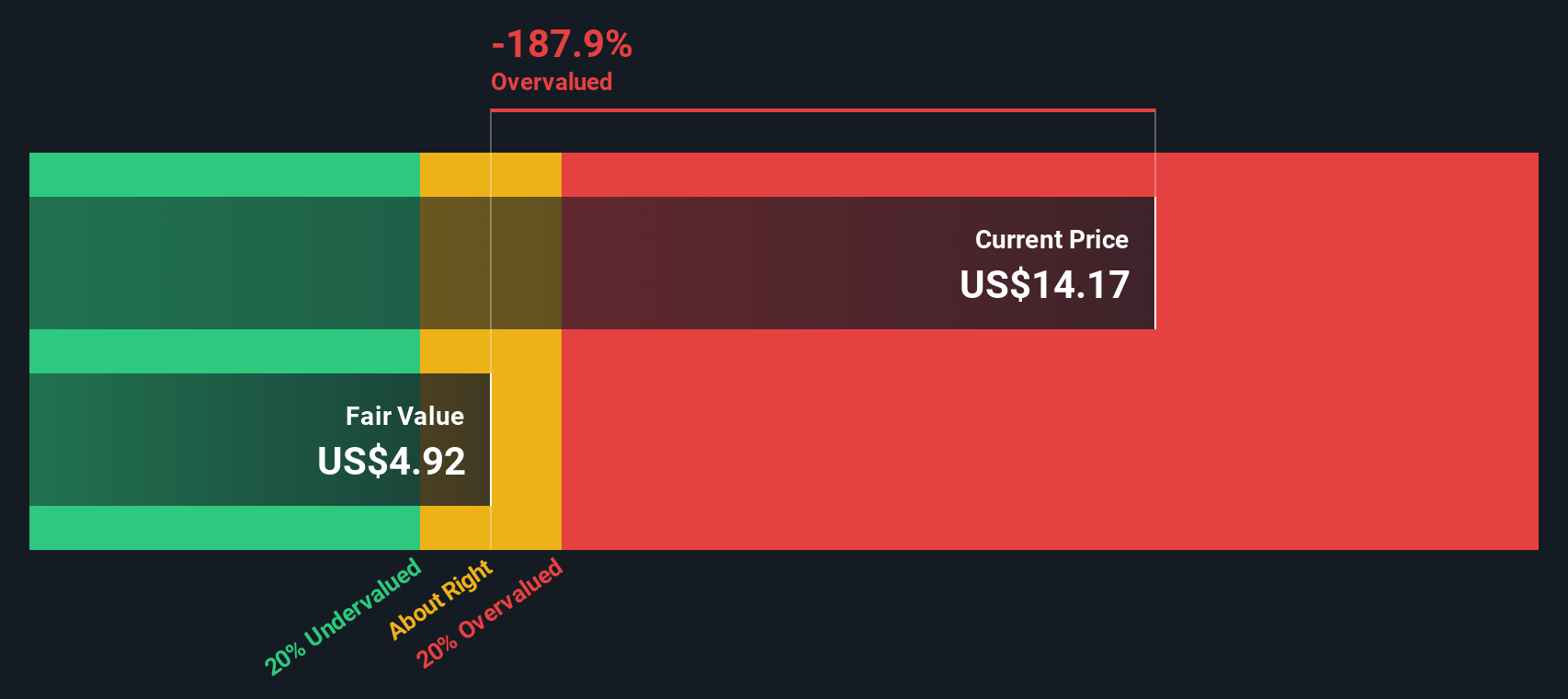

Another View: SWS DCF Model Suggests a Different Story

While analyst consensus points to a sizable upside, our SWS DCF model reaches a much more pessimistic conclusion. It estimates a fair value of just $5.26, suggesting Kingsoft Cloud Holdings may actually be trading well above what its long-term cash flows justify. Could the upbeat narrative be missing risks that matter most?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kingsoft Cloud Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kingsoft Cloud Holdings Narrative

If you think the story could go another way or want your own angle, you can craft your personal narrative in just a few minutes: Do it your way

A great starting point for your Kingsoft Cloud Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit your portfolio to just one story. There are powerful trends and untapped gems waiting for you. Step up your investing game by targeting ideas that truly stand out.

- Capture growth potential with these 24 AI penny stocks as artificial intelligence transforms industries and creates new market leaders.

- Enhance your income stream by scanning these 19 dividend stocks with yields > 3% with consistently high yields for reliable returns above 3%.

- Be early to emerging financial revolutions by analyzing these 78 cryptocurrency and blockchain stocks at the forefront of blockchain and digital asset innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives