- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

This Is Why We Think J2 Global, Inc.'s (NASDAQ:JCOM) CEO Might Get A Pay Rise Approved By Shareholders

Shareholders will probably not be disappointed by the robust results at J2 Global, Inc. (NASDAQ:JCOM) recently and they will be keeping this in mind as they go into the AGM on 07 May 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for J2 Global

How Does Total Compensation For Vivek Shah Compare With Other Companies In The Industry?

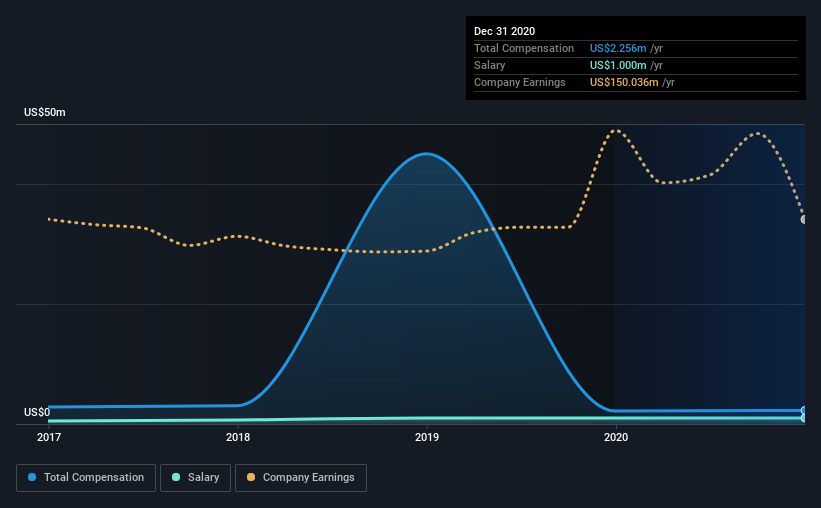

According to our data, J2 Global, Inc. has a market capitalization of US$5.5b, and paid its CEO total annual compensation worth US$2.3m over the year to December 2020. That's just a smallish increase of 5.0% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

For comparison, other companies in the same industry with market capitalizations ranging between US$4.0b and US$12b had a median total CEO compensation of US$6.2m. Accordingly, J2 Global pays its CEO under the industry median. What's more, Vivek Shah holds US$71m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.0m | US$1.0m | 44% |

| Other | US$1.3m | US$1.1m | 56% |

| Total Compensation | US$2.3m | US$2.1m | 100% |

On an industry level, around 11% of total compensation represents salary and 89% is other remuneration. It's interesting to note that J2 Global pays out a greater portion of remuneration through salary, compared to the industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

J2 Global, Inc.'s Growth

J2 Global, Inc. has seen its earnings per share (EPS) increase by 3.9% a year over the past three years. It achieved revenue growth of 8.5% over the last year.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has J2 Global, Inc. Been A Good Investment?

Boasting a total shareholder return of 53% over three years, J2 Global, Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for J2 Global you should be aware of, and 1 of them is a bit unpleasant.

Important note: J2 Global is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade J2 Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ziff Davis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives