- United States

- /

- Software

- /

- NasdaqGS:IREN

How IREN’s (IREN) Settlement With NYDIG Could Reshape Its Post-Litigation Growth Outlook

Reviewed by Simply Wall St

- In August 2025, Bitcoin miner IREN reached a confidential settlement with creditor NYDIG, ending a legal dispute involving $105 million in defaulted equipment loans and the examination of its co-founders in relation to bankruptcy proceedings spanning Australia and Canada.

- This resolution removes a significant source of legal uncertainty for IREN and marks the conclusion of a nearly three-year dispute that had posed ongoing operational and reputational risks.

- We'll explore how resolving this protracted litigation may affect IREN's investment narrative and outlook for future growth.

Find companies with promising cash flow potential yet trading below their fair value.

IREN Investment Narrative Recap

To own IREN, you need to believe in its dual growth story: capitalizing on strong global demand for AI infrastructure and digital assets, while managing the risks of volatile Bitcoin mining revenues and heavy infrastructure spending. Resolving the NYDIG legal dispute helps clear an overhang on reputation and leadership, but does not fundamentally affect the company’s key short-term catalyst, which remains scaling high-density data centers and increasing exposure to AI workloads; the largest risk still centers around execution and capital requirements as it pursues major expansion projects.

The most relevant recent announcement is IREN’s upcoming fiscal year 2025 earnings release scheduled for August 28, 2025, which will provide investors insight into cash flow and operational stability following the protracted legal case. With legal distractions removed, market attention is likely to focus more closely on IREN's operational execution and how effectively the company can ramp up its Sweetwater and Childress projects amid shifting capital market conditions.

On the other hand, any missteps securing the substantial funding required for these expansions could spell challenges that investors should be aware of...

Read the full narrative on IREN (it's free!)

IREN's narrative projects $1.5 billion revenue and $560.9 million earnings by 2028. This requires 57.6% yearly revenue growth and a $596.6 million earnings increase from -$35.7 million.

Uncover how IREN's forecasts yield a $22.18 fair value, a 4% upside to its current price.

Exploring Other Perspectives

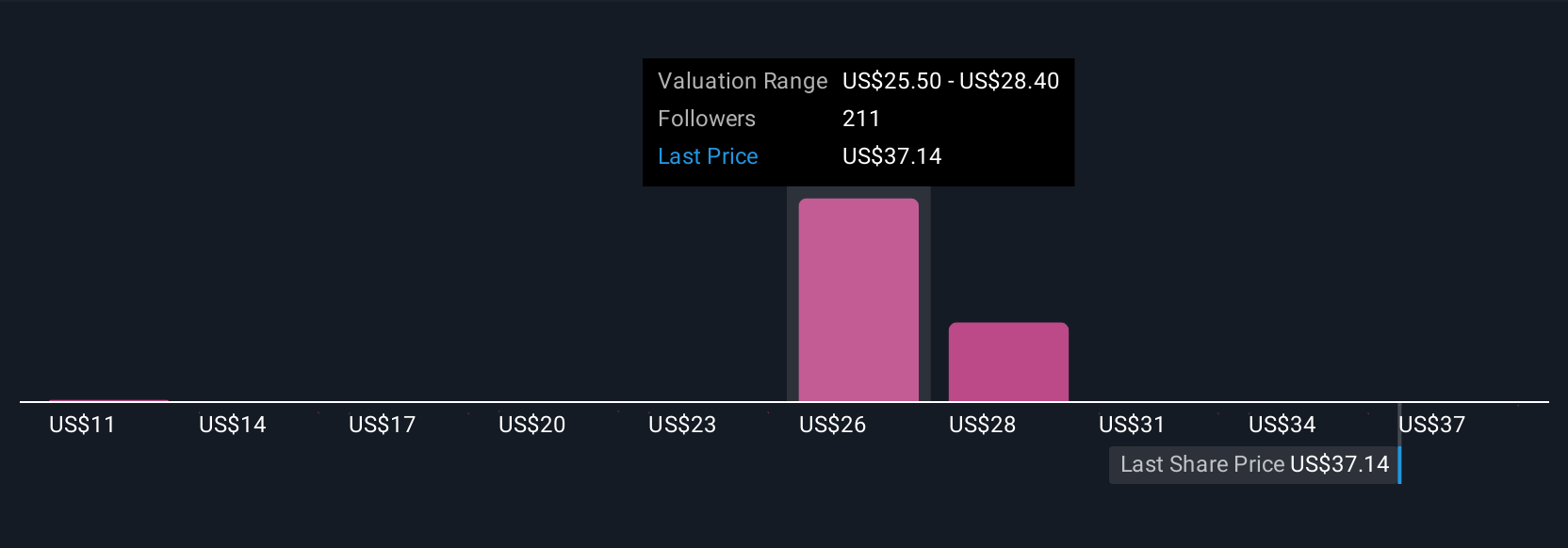

Simply Wall St Community members estimate IREN’s fair value from US$11.00 to US$26.54 across 12 analyses. Execution risk in large-scale projects remains a core theme that may influence future opinions and the company’s growth trajectory.

Explore 12 other fair value estimates on IREN - why the stock might be worth 49% less than the current price!

Build Your Own IREN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IREN research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IREN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IREN's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IREN

IREN

Operates in the vertically integrated data center business in Australia and Canada.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives