- United States

- /

- Software

- /

- NYSE:PLTR

Exploring High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.1% and is up 32% over the past year, with earnings forecasted to grow by 15% annually. In this environment of robust growth, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and scalability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Apellis Pharmaceuticals | 22.87% | 69.56% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| Travere Therapeutics | 27.18% | 69.88% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CrowdStrike Holdings (NasdaqGS:CRWD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market capitalization of approximately $74.10 billion.

Operations: With a revenue of approximately $3.52 billion from its Security Software & Services segment, CrowdStrike Holdings focuses on providing cybersecurity solutions globally.

CrowdStrike Holdings has recently showcased robust growth and innovation, particularly in its AI-driven cybersecurity solutions. With a significant 18% annual revenue growth forecast, the company is outpacing the broader US market's 8.8% growth rate. This year marked a pivotal turn as CrowdStrike became profitable, further underlined by an impressive projected earnings increase of 35% per year over the next three years. At the heart of this financial vigor is a strategic emphasis on R&D, which remains central to sustaining its competitive edge in cybersecurity technologies. Recent strategic partnerships and product launches reflect this focus, aiming to enhance enterprise-wide threat defense capabilities and streamline security operations across complex digital environments.

- Click to explore a detailed breakdown of our findings in CrowdStrike Holdings' health report.

Understand CrowdStrike Holdings' track record by examining our Past report.

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States with a market capitalization of $173.19 billion.

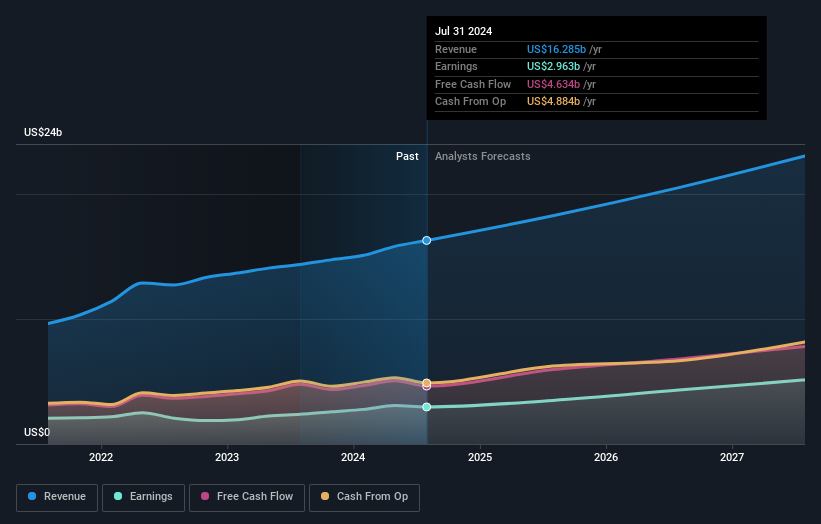

Operations: Intuit generates revenue through its diverse segments: Pro-Tax ($599 million), Consumer ($4.45 billion), Credit Karma ($1.71 billion), and Small Business and Self-Employed ($9.53 billion). The company's focus spans financial management, compliance, and marketing services in the U.S., contributing to its substantial market capitalization of $173.19 billion.

Intuit is capitalizing on its strong growth trajectory with a 10.5% annual revenue increase, outpacing the broader US market's 8.8% growth expectation. The company's recent introduction of Intuit Enterprise Suite marks a significant stride in enhancing productivity and profitability for mid-market businesses through AI-driven automation and financial management tools. Moreover, Intuit's sustained investment in R&D, which notably accounted for a substantial portion of its budget, underpins its commitment to innovation—evident from the development of GenOS and Intuit Assist platforms that streamline operations across various business segments using generative AI technologies. These strategic initiatives not only reinforce Intuit’s position in financial tech but also align with industry shifts towards more integrated and automated financial solutions, ensuring it remains at the forefront of technological advancements in finance.

- Click here and access our complete health analysis report to understand the dynamics of Intuit.

Evaluate Intuit's historical performance by accessing our past performance report.

Palantir Technologies (NYSE:PLTR)

Simply Wall St Growth Rating: ★★★★☆☆

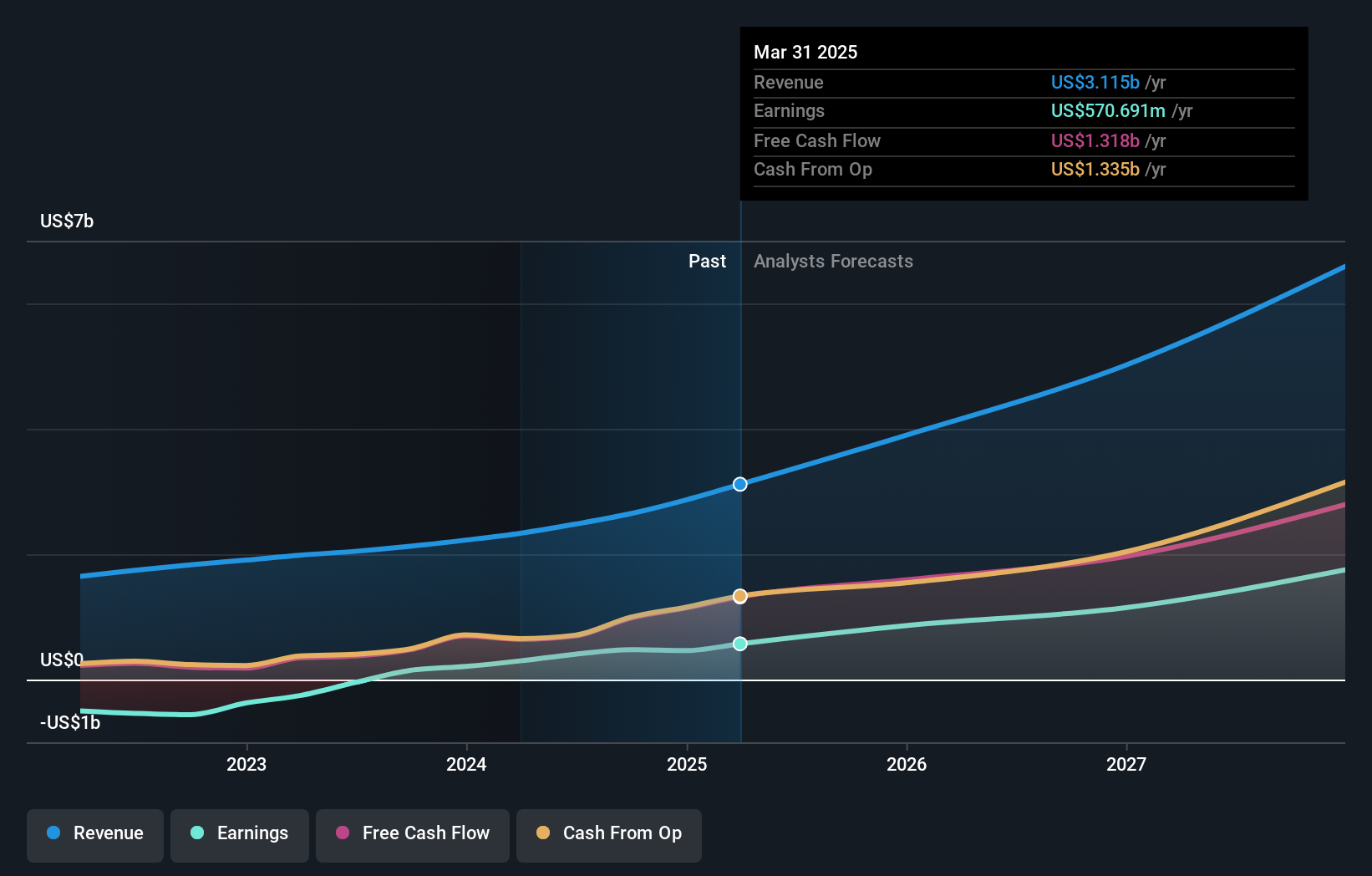

Overview: Palantir Technologies Inc. develops software platforms designed to support intelligence and counterterrorism operations globally, with a market cap of $95.02 billion.

Operations: Palantir Technologies generates revenue primarily through its software platforms, with the government segment contributing $1.34 billion and the commercial segment adding $1.14 billion. The company's focus is on providing solutions for intelligence and counterterrorism operations across various regions, including the United States and the United Kingdom.

Amidst a dynamic tech landscape, Palantir Technologies stands out with its recent strategic moves and robust financial performance. The company's revenue is forecasted to grow by 16.9% annually, outpacing the broader US market prediction of 8.8%. Notably, Palantir's earnings are expected to surge by 23% per year, highlighting its operational efficiency and innovative edge in software solutions. This growth trajectory is underpinned by significant R&D investments which accounted for a substantial portion of their budget last year, ensuring continuous innovation and enhancement of their AI-driven platforms like Foundry and Gotham. These initiatives not only solidify Palantir’s position in high-stakes industries such as defense and healthcare but also align with shifting industry paradigms towards more integrated data analytics solutions.

- Get an in-depth perspective on Palantir Technologies' performance by reading our health report here.

Make It Happen

- Access the full spectrum of 253 US High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.