David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that i3 Verticals, Inc. (NASDAQ:IIIV) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is i3 Verticals's Debt?

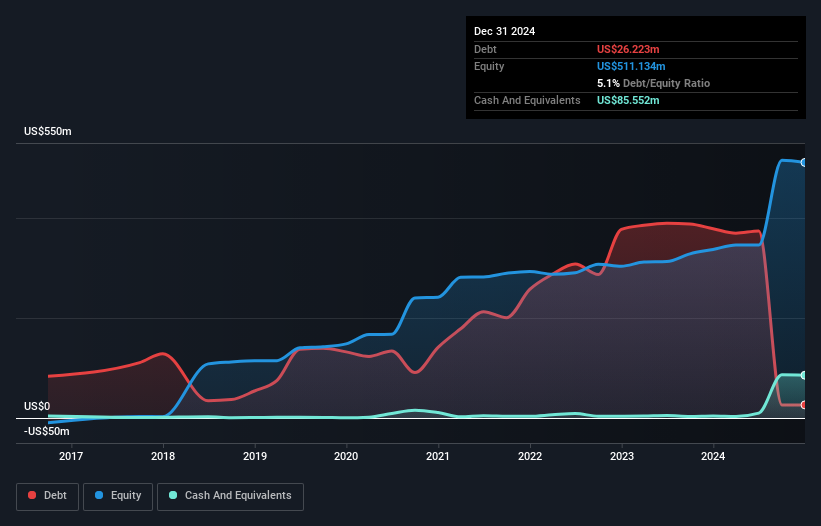

The image below, which you can click on for greater detail, shows that i3 Verticals had debt of US$26.2m at the end of December 2024, a reduction from US$378.5m over a year. However, it does have US$85.6m in cash offsetting this, leading to net cash of US$59.3m.

How Healthy Is i3 Verticals' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that i3 Verticals had liabilities of US$163.4m due within 12 months and liabilities of US$51.7m due beyond that. Offsetting these obligations, it had cash of US$85.6m as well as receivables valued at US$51.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$78.0m.

Given i3 Verticals has a market capitalization of US$813.3m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, i3 Verticals boasts net cash, so it's fair to say it does not have a heavy debt load!

Check out our latest analysis for i3 Verticals

Notably, i3 Verticals's EBIT launched higher than Elon Musk, gaining a whopping 286% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if i3 Verticals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While i3 Verticals has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, i3 Verticals actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that i3 Verticals has US$59.3m in net cash. The cherry on top was that in converted 171% of that EBIT to free cash flow, bringing in US$29m. So we don't think i3 Verticals's use of debt is risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that i3 Verticals insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if i3 Verticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IIIV

i3 Verticals

i3 Verticals, Inc. builds, acquires, and grows software solutions in the public sector and healthcare vertical markets in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives