- United States

- /

- Software

- /

- NasdaqGS:IDCC

Why InterDigital (IDCC) Is Up 6.3% After German Court Win in Disney Patent Dispute – And What's Next

Reviewed by Sasha Jovanovic

- Earlier this month, InterDigital was awarded an injunction by a Munich court against Disney for infringing its patent related to HDR streaming technology, following previous legal wins in Germany and Brazil over similar video technologies.

- This ruling highlights InterDigital's determination to protect its intellectual property and could further strengthen its position in negotiating licensing agreements with major media companies.

- We'll consider how this legal victory in a significant patent dispute could influence InterDigital's long-term licensing strength and revenue outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

InterDigital Investment Narrative Recap

To invest in InterDigital, you need to believe that its unique patents and long-term licensing deals with global tech leaders will drive steady high-margin revenue, while risks center on the actual pace and sustainability of expansion beyond its core smartphone segment. The recent German court injunction against Disney underscores InterDigital’s legal strengths in enforcing its IP, but the biggest short-term catalyst, growing consumer electronics and IoT licensing revenue, remains dependent on the company converting more industry players to paying customers. At this stage, the Disney ruling reinforces InterDigital’s negotiating position but doesn’t materially change the key risk that revenue growth in new markets could lag investor expectations.

Among recent announcements, InterDigital’s latest patent license renewal with Sharp, alongside a new agreement with an electric vehicle charger manufacturer, aligns directly with efforts to broaden recurring revenue across non-smartphone products. These developments are relevant to the ongoing thesis that licensing expansion into adjacent markets supports future revenue and can reduce the company’s historic earnings volatility.

Yet, while court victories strengthen the company’s hand, it remains important for investors to understand what could happen if expectations for rapid monetization of new connected device markets do not play out as hoped...

Read the full narrative on InterDigital (it's free!)

InterDigital's outlook forecasts $633.9 million in revenue and $173.4 million in earnings by 2028. This reflects a 10.8% annual decline in revenue and a $290.1 million decrease in earnings from the current level of $463.5 million.

Uncover how InterDigital's forecasts yield a $412.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

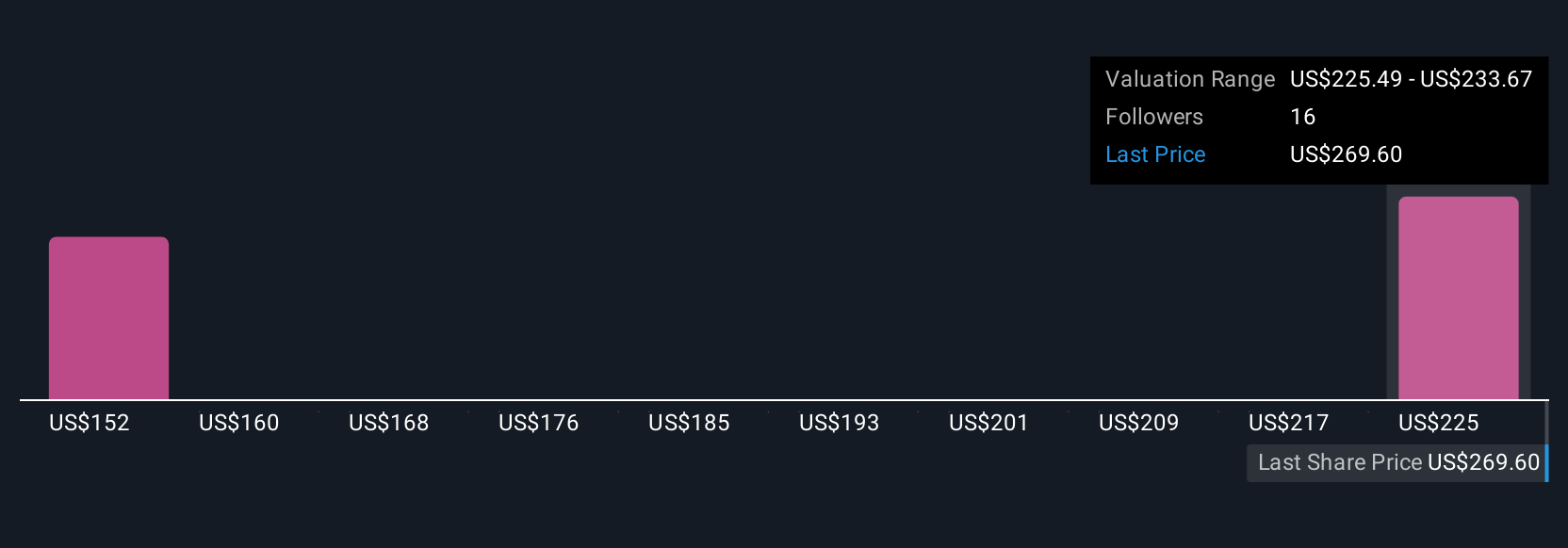

You can find four different fair value estimates for InterDigital in the Simply Wall St Community, stretching from US$71.52 to US$412. The bigger question on most minds right now concerns whether expanding patent wins can translate into sustainable licensing revenue outside smartphones, opinions on this vary widely.

Explore 4 other fair value estimates on InterDigital - why the stock might be worth as much as 15% more than the current price!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success