- United States

- /

- Software

- /

- NasdaqGS:IDCC

We Think InterDigital (NASDAQ:IDCC) Can Manage Its Debt With Ease

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that InterDigital, Inc. (NASDAQ:IDCC) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for InterDigital

What Is InterDigital's Net Debt?

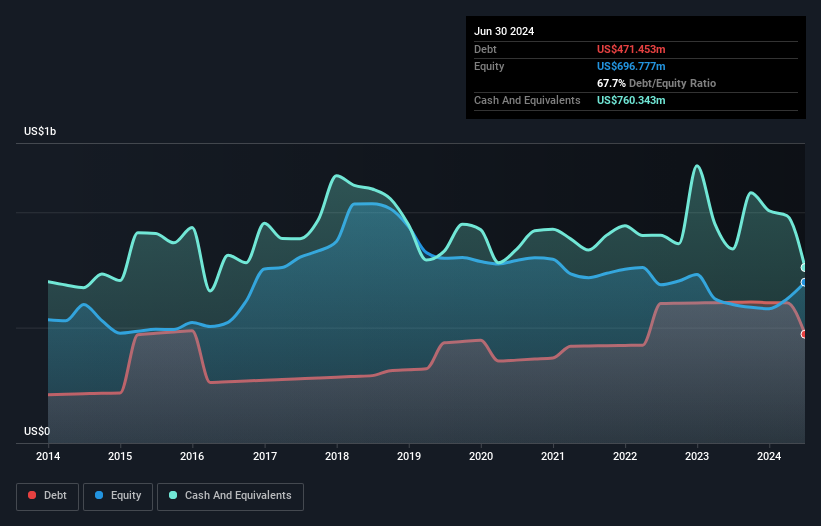

As you can see below, InterDigital had US$471.5m of debt at June 2024, down from US$609.5m a year prior. However, it does have US$760.3m in cash offsetting this, leading to net cash of US$288.9m.

How Healthy Is InterDigital's Balance Sheet?

The latest balance sheet data shows that InterDigital had liabilities of US$699.3m due within a year, and liabilities of US$240.2m falling due after that. On the other hand, it had cash of US$760.3m and US$245.2m worth of receivables due within a year. So it can boast US$66.0m more liquid assets than total liabilities.

This state of affairs indicates that InterDigital's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$3.85b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, InterDigital boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, InterDigital grew its EBIT by 45% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if InterDigital can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While InterDigital has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, InterDigital produced sturdy free cash flow equating to 77% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that InterDigital has net cash of US$288.9m, as well as more liquid assets than liabilities. And we liked the look of last year's 45% year-on-year EBIT growth. So we don't think InterDigital's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - InterDigital has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion