- United States

- /

- Software

- /

- NasdaqGS:IDCC

Strong Q3 Results and Share Buyback Could Be a Game Changer for InterDigital (IDCC)

Reviewed by Sasha Jovanovic

- InterDigital, Inc. recently reported its third quarter and nine-month 2025 earnings, highlighting sales of US$164.68 million for the quarter and net income of US$67.5 million, both showing strong increases from the previous year.

- An important insight is the company’s new earnings guidance for the fourth quarter and full year 2025, alongside the completion of a further share buyback tranche, which signals confidence in ongoing business momentum and commitment to shareholder returns.

- We’ll explore how InterDigital’s robust quarterly earnings, featuring marked year-over-year growth in revenue and profitability, affect its broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

InterDigital Investment Narrative Recap

InterDigital shareholders are betting on the continuation of robust licensing revenues primarily from leading smartphone makers, underpinned by long-term agreements and expansion into new technology verticals. The latest quarterly results reinforce confidence in the strength of recurring revenue and margins, though the company’s outlook signals slower earnings for Q4; however, these do not fundamentally alter the biggest catalyst, securing further multi-year licenses or renewals, or the risk that growth in non-phone markets may disappoint.

Among recent announcements, completion of another share buyback tranche stands out as most directly relevant, further highlighting management's ongoing focus on shareholder returns. With more than half the company’s shares now repurchased over the past decade, buybacks have had a tangible impact amid the backdrop of heightened earnings and guidance updates, reinforcing the market’s attention on capital allocation as a near-term consideration.

However, investors should be aware that expectations for quick monetization in adjacent industries like IoT and automotive may not match actual results...

Read the full narrative on InterDigital (it's free!)

InterDigital's narrative projects $633.9 million in revenue and $173.4 million in earnings by 2028. This requires a 10.8% annual revenue decline and a $290.1 million decrease in earnings from the current $463.5 million.

Uncover how InterDigital's forecasts yield a $328.75 fair value, a 15% downside to its current price.

Exploring Other Perspectives

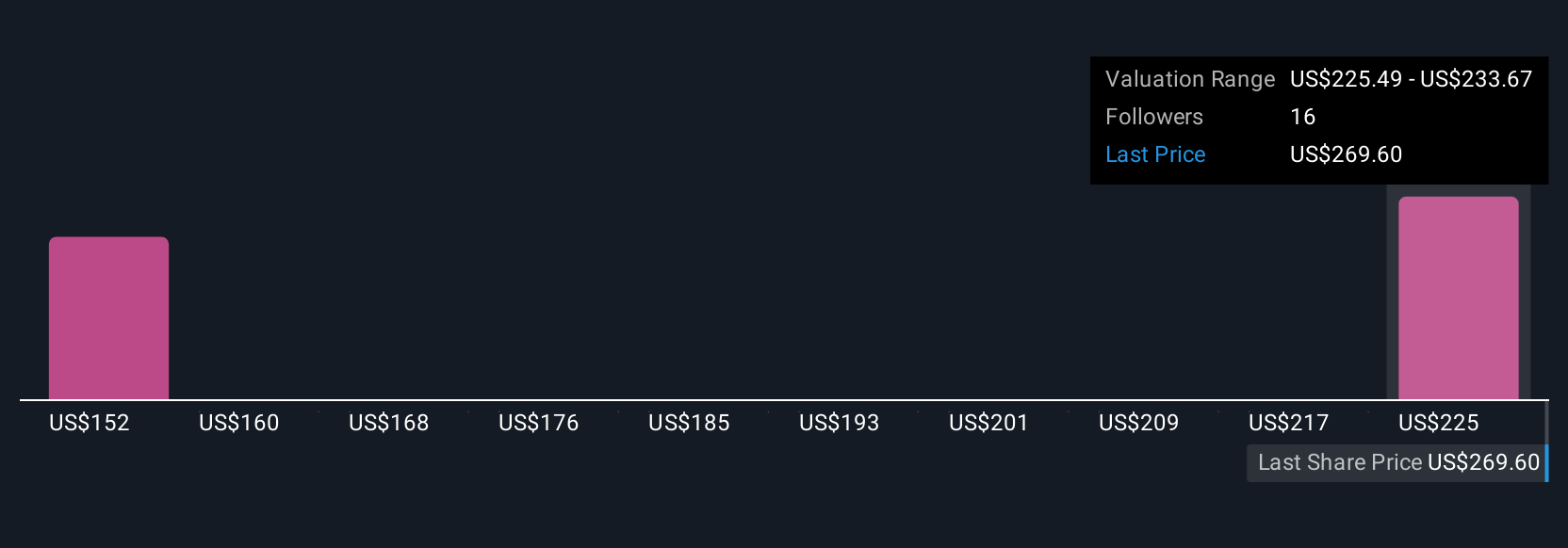

Four fair value estimates from the Simply Wall St Community span US$71 to US$329 per share, reflecting sharply different outlooks. While current results are bolstered by large licensing deals, the risk that revenue growth in new verticals underdelivers remains a key uncertainty for performance going forward.

Explore 4 other fair value estimates on InterDigital - why the stock might be worth as much as $328.75!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

No Opportunity In InterDigital?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives