- United States

- /

- Software

- /

- NasdaqGS:IDCC

InterDigital (IDCC): Evaluating Valuation After Earnings Gains and New Video Technology Unveiling

InterDigital (IDCC) just made headlines with two developments that could shape how investors think about this stock’s trajectory. The company is preparing to showcase its latest video innovation, an advanced combination of Versatile Video Coding and film grain preservation, at the upcoming International Broadcasting Convention in Amsterdam. At the same time, InterDigital’s recent improvements in both earnings and margins have sparked conversations about whether the company is turning operational strength into sustainable growth, especially as it grabs industry attention with its technology advances.

These announcements come after a year marked by meaningful upward momentum for InterDigital’s share price. The stock has outperformed, delivering strong gains across both short and long timeframes. That performance is unfolding even as InterDigital moves to demonstrate leadership in video compression and streaming technology, aiming to set a standard for next-generation media delivery.

With InterDigital pushing both financial and innovation boundaries, is the current share price factoring in too much future optimism or is there a real opportunity to be uncovered?

Most Popular Narrative: 12.5% Overvalued

The most widely followed narrative sees InterDigital trading above fair value, with major assumptions about its growth trajectories and premium assigned to its future earnings.

The recent 67% uplift in the Samsung license and an all-time high annualized recurring revenue, driven by multi-year agreements with major OEMs, have set highly optimistic expectations for continued outsized growth in future contract renewals. This may potentially inflate valuation multiples and overstate the sustainable revenue trajectory.

What is driving this bold price tag? The narrative leans on aggressive forecasts for future margins, licensing wins, and the expansion into new markets. However, the numbers behind this story—future revenue, profits, and contract assumptions—are not what you might expect from a typical software stock. Think the growth outlook is obvious? Consider the key projections powering this valuation call.

Result: Fair Value of $266.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, breakthrough license renewals with major manufacturers or rapid expansion into new verticals could quickly challenge the view that InterDigital is overvalued.

Find out about the key risks to this InterDigital narrative.Another View: Sizing Up the Numbers

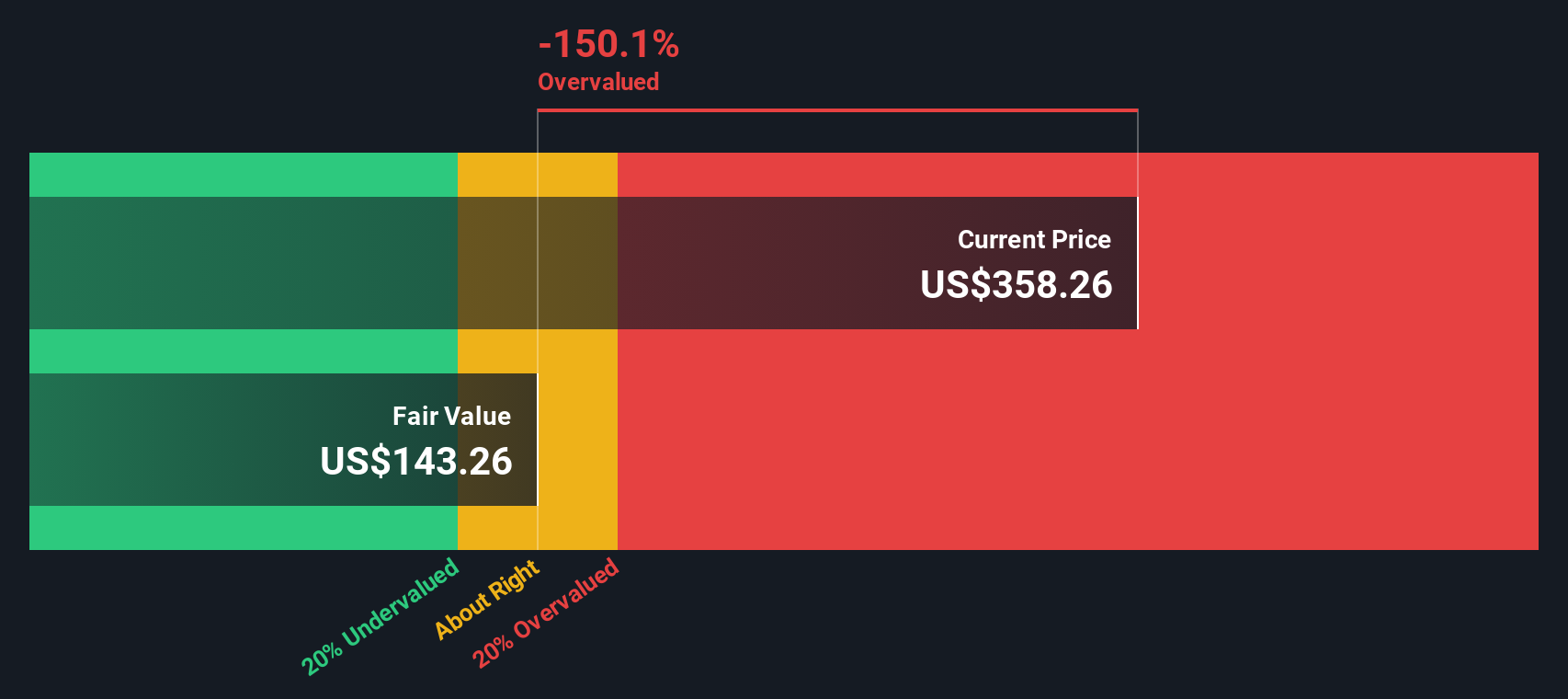

Looking at InterDigital through our DCF model, the story changes. This method suggests the shares may be trading far above what underlying cash flows support. Could future growth make up the gap, or is caution needed?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding InterDigital to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own InterDigital Narrative

If you’re looking to dig into the numbers yourself or approach the story from a fresh perspective, you can craft your own take on InterDigital in just a few minutes. Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big opportunity pass you by. Leap ahead with handpicked investment ideas designed to match different strategies, sectors, and breakthrough trends.

- Capitalize on digital transformation by tracking innovators in the artificial intelligence sector with our selection of AI penny stocks.

- Boost your portfolio’s income potential by targeting stable companies offering attractive yields using our collection of dividend stocks with yields > 3%.

- Discover undervalued gems with potential for growth by tapping into our suite of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.