- United States

- /

- Software

- /

- NasdaqGS:IDCC

Assessing InterDigital (IDCC) Valuation After Strong Licensing Gains And Mixed Recent Share Performance

InterDigital (IDCC) has drawn investor attention after recent trading left the stock with a mixed return profile, including a small daily decline and a modest gain over the past month alongside a weaker past 3 months.

See our latest analysis for InterDigital.

Zooming out, InterDigital’s recent soft share price returns over the week and quarter sit alongside a much stronger 1 year and multi year total shareholder return. This points to fading short term momentum after a period of substantial gains as investors reassess growth potential and risk.

If this kind of tech royalty story has your attention, it could be a good time to look at other high growth tech and AI stocks that are catching market interest right now.

With InterDigital trading at US$326.44, carrying a value score of 4 and sitting at a clear discount to the US$462.67 analyst target, is this a mispriced tech royalty stock, or is the market already factoring in expectations about its future growth?

Most Popular Narrative: 20.8% Undervalued

InterDigital’s most followed narrative sets a fair value of $412 per share versus the last close of $326.44, framing the current price as a discount worth unpacking.

The recent 67% uplift in the Samsung license and an all time high annualized recurring revenue, driven by multi year agreements with major OEMs, have set highly optimistic expectations for continued outsized growth in future contract renewals, potentially inflating valuation multiples and overstating sustainable revenue trajectory.

Curious what kind of revenue path and margin profile could justify that higher fair value and a rich future earnings multiple? The full narrative lays out specific assumptions about contracting revenue, shrinking margins, and still premium valuation expectations that go well beyond simple top line projections. It ties recurring licensing, catch up payments, and future standard setting into one pricing story investors will want to test for themselves.

Result: Fair Value of $412 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those assumptions could be knocked off course if licensing wins outside smartphones take longer to materialize or if tighter patent rules squeeze those high margin royalties.

Find out about the key risks to this InterDigital narrative.

Another View: DCF Flips the Story

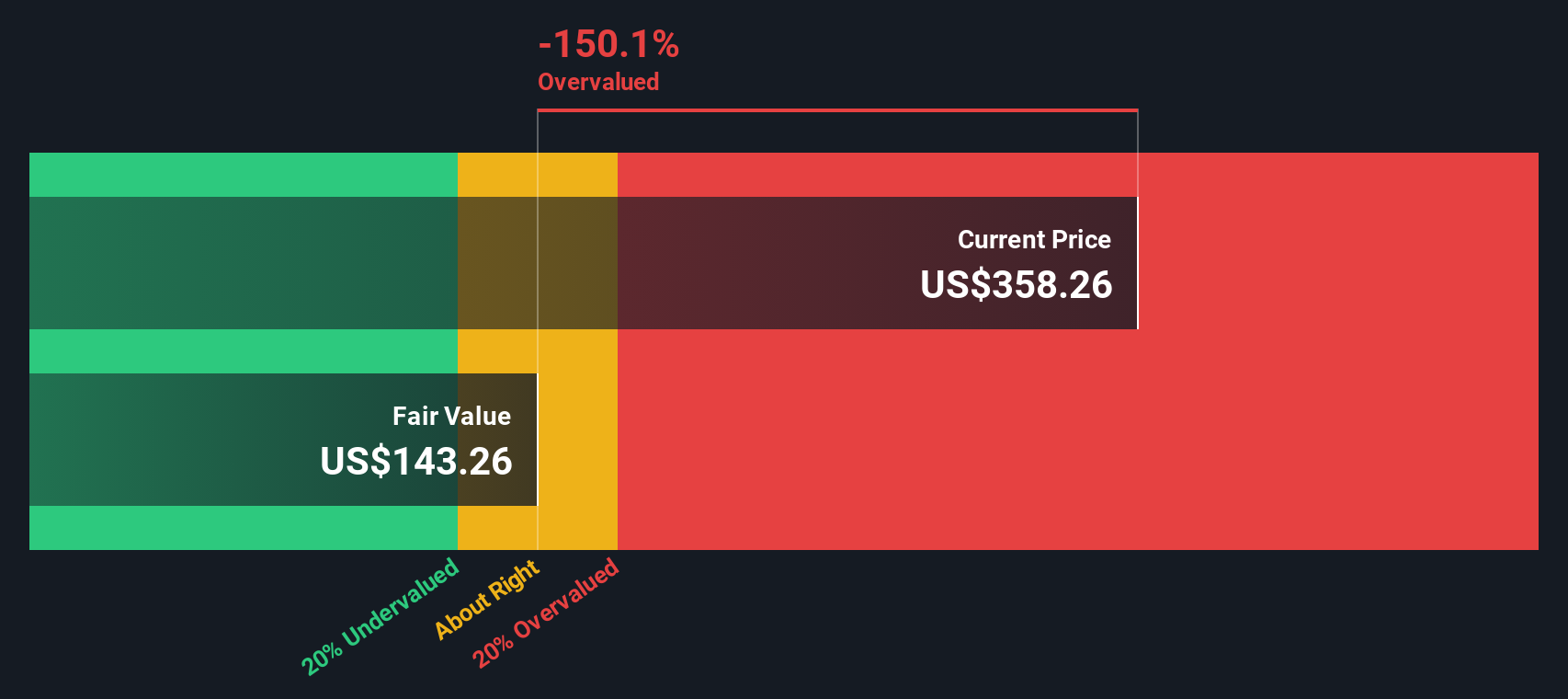

While the popular narrative and analyst targets frame InterDigital as 20.8% to 41.7% undervalued, the SWS DCF model points the other way. On that cash flow view, the current $326.44 price sits well above an estimated $73.24 value, raising questions about how durable today’s earnings really are.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you see the numbers differently or prefer to lean on your own homework, you can pull the same data, pressure test the assumptions, and Do it your way in just a few minutes.

A great starting point for your InterDigital research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If InterDigital has sharpened your thinking, do not stop here. Simply Wall St's screener lets you quickly surface other opportunities that match how you like to invest.

- Target potential bargains by scanning these 868 undervalued stocks based on cash flows that line up with your preferred fundamentals and risk profile.

- Explore technology exposure by checking out these 25 AI penny stocks that are tied to real business models.

- Consider income-focused opportunities by reviewing these 14 dividend stocks with yields > 3% that may suit a long term cash flow focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion