- United States

- /

- Software

- /

- NasdaqGS:IDCC

Assessing InterDigital (IDCC) Valuation After A Strong Year And Mixed Recent Share Price Moves

Reviewed by Simply Wall St

InterDigital (IDCC) has drawn investor attention after recent trading left the shares with mixed short term returns and a strong 1 year total return, prompting a closer look at how the business fundamentals compare with the current price.

See our latest analysis for InterDigital.

The recent rebound, with a 1 day share price return of 2.94% and a 7 day share price return of 3.30%, follows a softer 30 day share price return of a 5.45% decline and a modest 90 day share price return of a 4.16% decline. This sits alongside a 1 year total shareholder return of 81.40% and suggests that short term momentum is trying to reassert itself within a longer term uptrend.

If InterDigital has caught your eye, it can be useful to see how it compares with other tech and AI names, so you may want to review high growth tech and AI stocks for more ideas.

With the shares up strongly over 1 year but trading below the US$412 analyst price target, the key question is whether InterDigital is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 18.5% Undervalued

InterDigital's most followed narrative places fair value at about US$412 per share versus the last close of US$335.84. This frames the current discount and sets up a detailed set of expectations behind that gap.

The analysts have a consensus price target of $266.5 for InterDigital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $311.0, and the most bearish reporting a price target of just $220.0.

Curious how a higher fair value emerges despite forecasts for shrinking revenue, lower margins, and a much richer future earnings multiple than the software industry average? The narrative leans heavily on specific long term cash flow assumptions and a discount rate that does a lot of work behind the scenes. If you want to see how those moving parts fit together and what kind of earnings power is being baked into that US$412 figure, the full story lays out every step.

Result: Fair Value of $412 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story could still be knocked off course if big licensing renewals disappoint or if expectations for streaming and consumer electronics revenue prove too optimistic.

Find out about the key risks to this InterDigital narrative.

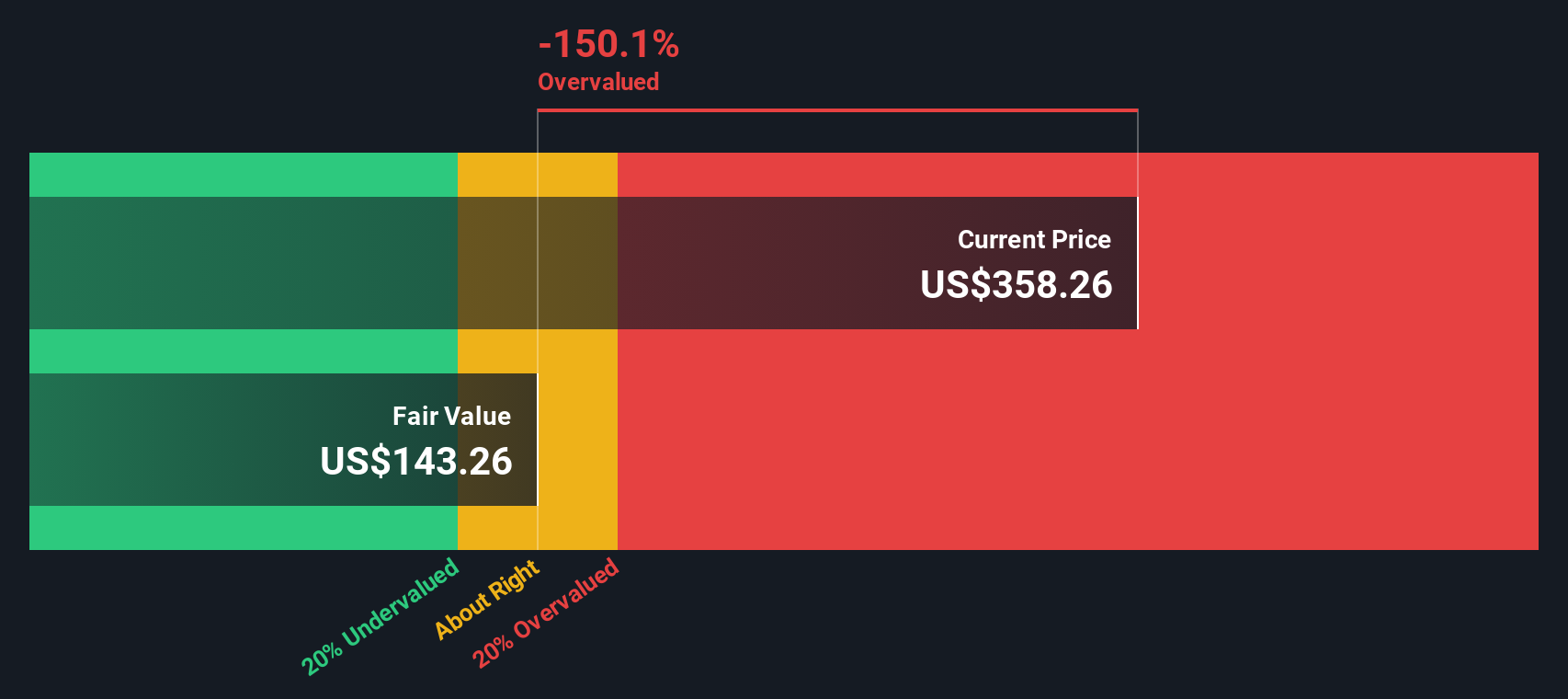

Another View: DCF Paints a Very Different Picture

While the US$412 fair value narrative points to upside, the SWS DCF model lands in a very different place. On that approach, InterDigital's recent price of US$335.84 sits well above an estimated fair value of US$70.98, which screens as expensive rather than undervalued. So which story do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you are not fully on board with either view, or prefer to weigh the assumptions yourself, you can shape your own InterDigital thesis in just a few minutes by starting with Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger watchlist, it is worth scanning other opportunities now so you are not chasing them after they move.

- Target potential value opportunities early by checking out these 877 undervalued stocks based on cash flows that match your preferred fundamentals before they attract wider attention.

- Spot future focused themes by reviewing these 29 quantum computing stocks that could benefit if quantum computing adoption broadens across industries.

- Strengthen your income watchlist by filtering for these 14 dividend stocks with yields > 3% that might suit a more yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion