- United States

- /

- Software

- /

- NasdaqGS:HUT

Hut 8 (NasdaqGS:HUT) Valuation in Focus After Strategic Power Plant Divestment to TransAlta

Reviewed by Simply Wall St

Hut 8 (NasdaqGS:HUT) has drawn fresh attention from investors after announcing the sale of its natural gas-fuelled power plants in northeastern Ontario to TransAlta. This move reflects a shift in strategy and capital allocation.

See our latest analysis for Hut 8.

The reshuffling of Hut 8’s assets has coincided with striking share price volatility. The 1-day share price return recently surged 6.2%, and the 7-day return jumped over 31%. However, the 30-day period saw an 11.2% decline. Still, the stock is up more than 100% year-to-date, and its total shareholder return over the past year stands at 60.6%, suggesting momentum is building around the company’s latest moves and renewed strategic focus.

If you’re eager to expand your search beyond Hut 8, now is a great time to discover fast growing stocks with high insider ownership.

With such a dramatic stock rally and ongoing strategic changes, the real question is whether Hut 8’s current share price still offers a bargain or if the market is already factoring in the company’s future growth prospects.

Most Popular Narrative: 22.2% Undervalued

Compared to Hut 8's last close price of $45.00, the most closely followed narrative assigns a significantly higher fair value. This highlights a notable mismatch in market expectations versus narrative-driven projections.

The Power First strategy, featuring sizable pipeline origination (10.8 GW under diligence; 3.1 GW under exclusivity) and dual-purpose sites for both Bitcoin mining and AI compute, provides scalability and flexibility to benefit from rising institutional adoption of digital assets and accelerating demand for clean energy-powered blockchain infrastructure. This supports future revenue and earnings growth.

Wondering what numbers are powering such an aggressive valuation? Take a closer look at the rapid-fire revenue expansion and bold margin assumptions beneath the surface. You'll want to see which game-changing metrics and leap-of-faith forecasts are at the heart of this hot take.

Result: Fair Value of $57.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, disruptions in Bitcoin prices or delays in converting the development pipeline into revenue could quickly challenge the bullish outlook surrounding Hut 8’s story.

Find out about the key risks to this Hut 8 narrative.

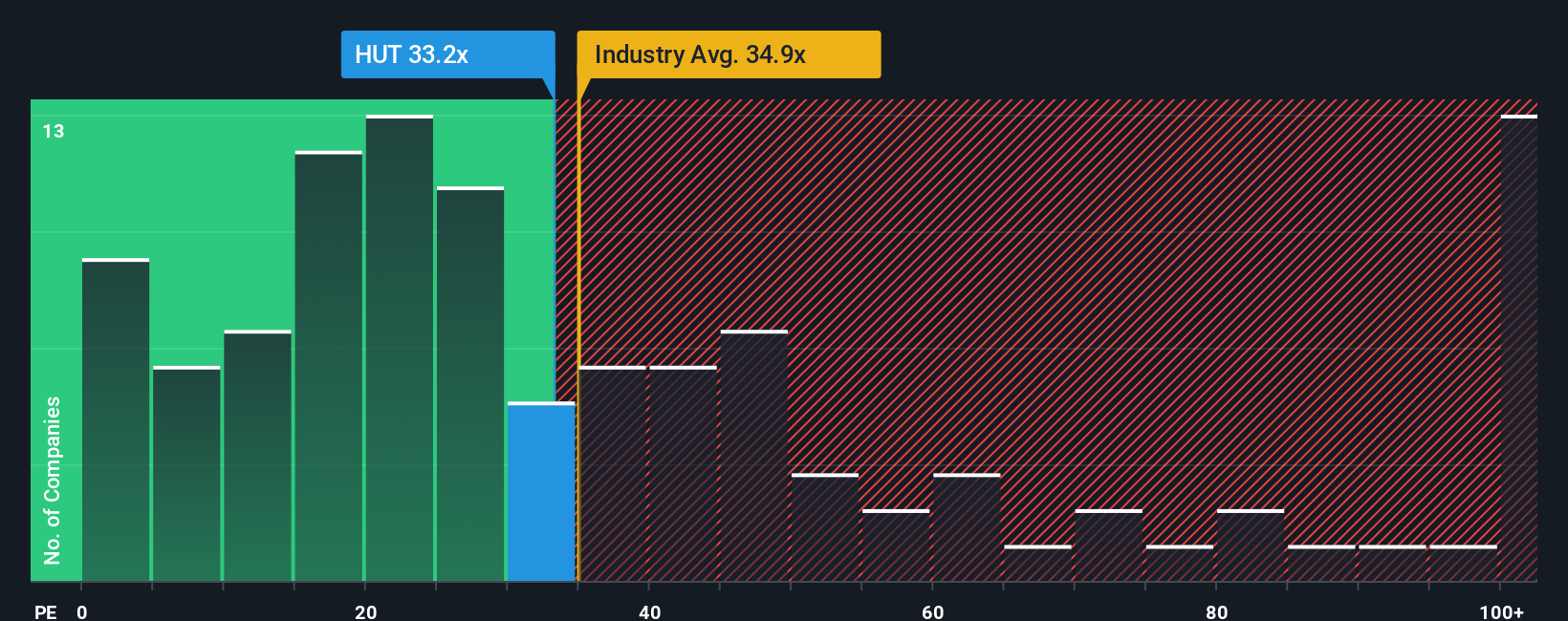

Another View: Looking at Market Ratios

While the narrative-based valuation pitches Hut 8 as markedly undervalued, our look at market price-to-earnings ratios paints a different picture. Hut 8's 23.8x ratio is well below the software industry average of 31.8x, yet it stands dramatically higher than its fair ratio of 7x and even above some peers. This gap suggests that, despite seemingly favorable comparisons, there may be valuation risk if the market reverts closer to the fair ratio over time, especially if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hut 8 Narrative

If these perspectives do not align with your own take, or if you prefer diving into the numbers personally, you can craft your own viewpoint in just a few minutes. Do it your way.

A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on unique opportunities as trends shift. Make your next move with confidence by tapping into these actionable stock lists below.

- Supercharge your portfolio with income potential by checking out these 15 dividend stocks with yields > 3% yielding over 3% and build cash flow into your strategy.

- Capitalize on unstoppable trends in technology by targeting these 25 AI penny stocks driving innovation and transforming entire industries.

- Get ahead of the crowd by zeroing in on value and hunt for exceptional opportunities using these 913 undervalued stocks based on cash flows based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026