- United States

- /

- Software

- /

- NasdaqGS:HUT

Hut 8 (NasdaqGS:HUT): Assessing Valuation After Recent Shift in Share Price Momentum

Reviewed by Simply Wall St

Hut 8 (NasdaqGS:HUT) shares have caught attention following a recent change in performance metrics. Investors are taking stock of the company’s returns, especially as the stock jumped 3% on the day after shifting trends earlier this month.

See our latest analysis for Hut 8.

After a rough patch earlier this month, Hut 8’s 1-day share price return of 2.55% signals momentum may be picking up again, even though the 7-day and 30-day share price returns remain negative. Looking at the bigger picture, the stock is still up an impressive 68.75% year-to-date, and the total shareholder return over the past year comes in at 46.24%. This is a solid performance with volatility that reflects shifting sentiment as investors balance growth potential against ongoing risks.

If this kind of rebound grabs your attention, it might be a smart move to broaden your search and discover fast growing stocks with high insider ownership.

With the stock still trading at a noticeable discount to analyst price targets despite its strong year-to-date rally, investors must ask themselves whether there is untapped value here or if the market is already factoring in Hut 8’s growth prospects.

Most Popular Narrative: 34% Undervalued

With analysts setting a fair value for Hut 8 at $56 per share based on their projections, this stands well above the last close at $36.94, suggesting there may be significant upside if their assumptions play out. Whether this optimism is warranted depends on complex strategic shifts and capacity expansion plans in the years ahead.

The Power First strategy, featuring sizable pipeline origination (10.8 GW under diligence; 3.1 GW under exclusivity) and dual-purpose sites for both Bitcoin mining and AI compute, provides scalability and flexibility to benefit from rising institutional adoption of digital assets and accelerating demand for clean energy-powered blockchain infrastructure, bolstering future revenue and earnings growth.

Want to see what’s fueling this bullish call? The numbers behind the narrative include bold projections for revenue scale, margin shifts, and a future earnings multiple that could surprise even seasoned investors. Don’t miss out. See how the story is built.

Result: Fair Value of $56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on Bitcoin prices and regulatory uncertainty in energy markets could quickly undermine Hut 8’s bullish growth story.

Find out about the key risks to this Hut 8 narrative.

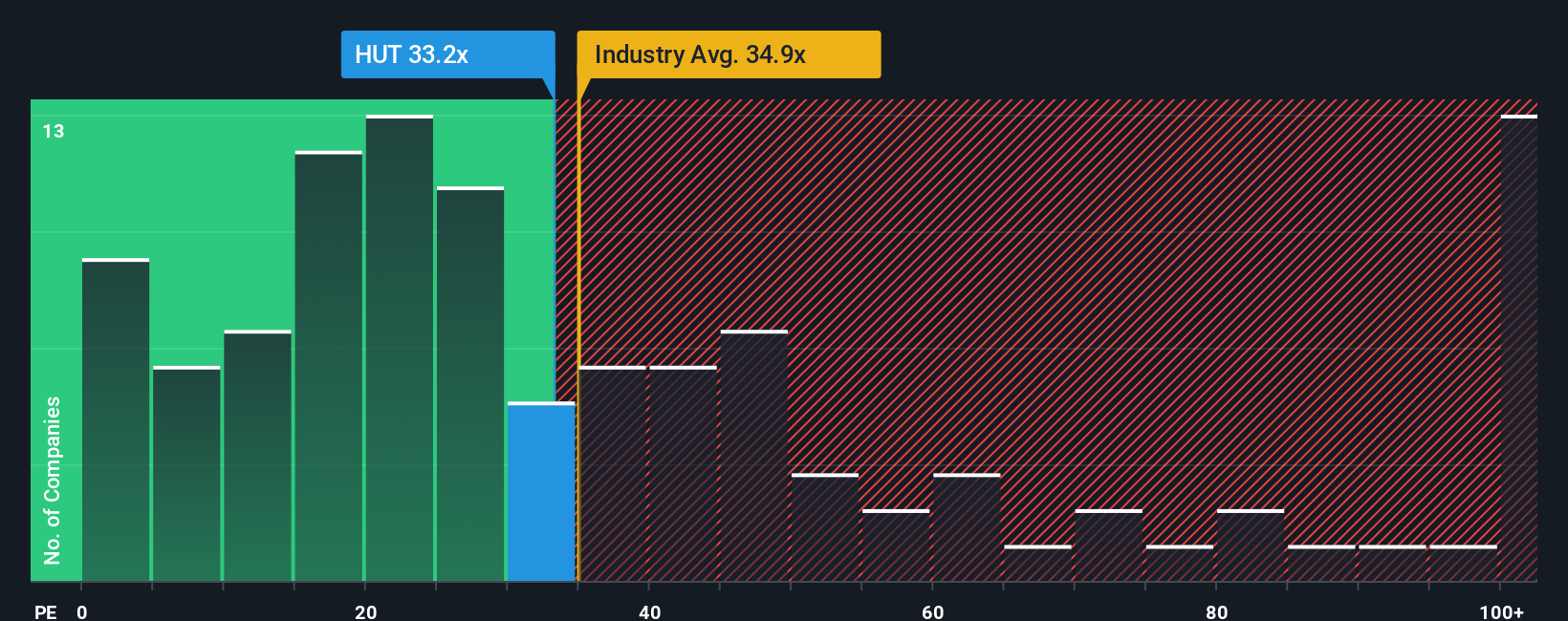

Another View: What Do Earnings Ratios Tell Us?

Looking at Hut 8's earnings valuation, its price-to-earnings ratio currently stands at 19.6x, much lower than the software industry average of 32.7x and well above its peer group’s average of -4.7x. However, compared to the fair ratio of 10.2x for this business, Hut 8 appears expensive on this measure. This raises questions about whether investors are already pricing in much of its future potential. Does this suggest the market is running ahead of the fundamentals, or is it a sign of sector optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hut 8 Narrative

If you see a different story in the numbers, or want to dig into the figures yourself, it’s quick and easy to build your own perspective. Do it your way.

A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Even More Smart Ideas?

The most successful investors never stop searching for their next opportunity. Tap into unique sectors and spot potential winners before the crowd. These curated screens make sure you never miss what’s next.

- Uncover rapid growth potential by targeting these 886 undervalued stocks based on cash flows poised for market re-rating and strong fundamentals.

- Earn more from your portfolio by targeting these 16 dividend stocks with yields > 3% that offer attractive yields and reliable payouts above 3%.

- Jump ahead of the curve by hunting down future leaders among these 24 AI penny stocks pushing the limits with artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives