- United States

- /

- Software

- /

- NasdaqGS:HUT

How Will Hut 8’s Texas Expansion and Cedarvale Progress Shape Its Low-Cost Model Strategy (HUT)?

Reviewed by Simply Wall St

- Hut 8 Corp. recently released an operations update highlighting progress on energizing new infrastructure at its Cedarvale site and advancing commercialization efforts for its 205-megawatt Texas Panhandle project, both aimed at strengthening its low-cost operations model.

- The company's clear timeline for expanding and upgrading to next-generation ASICs reflects an intensifying focus on operational efficiency and future-ready capacity.

- We'll examine how the successful energization of new infrastructure at Cedarvale could influence Hut 8's evolving investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hut 8 Investment Narrative Recap

For someone considering a stake in Hut 8, belief centers on the company’s ability to deliver sustainable growth through disciplined cost management and upgrades to cutting-edge mining infrastructure. The recent energization at Cedarvale and the clear commercialization efforts align with the drive for operational efficiency, but do not resolve the primary near-term catalyst: successful and timely deployment of its Texas Panhandle site, nor do they materially reduce the most pressing risk, sensitivity to Bitcoin price volatility and ongoing high capital requirements. Against this backdrop, the expansion of Hut 8's Bitcoin-backed credit facility from US$65,000,000 to US$130,000,000 in June plays a key role. This announcement is particularly relevant as it enhances the company's liquidity position to support fleet upgrades and project execution, directly influencing the catalyst of scaling infrastructure and reinforcing resilience against potential capital or operational shortfalls. But as advancing projects can boost growth, unexpected changes in Bitcoin prices or access to affordable capital remain risks investors should be alert to...

Read the full narrative on Hut 8 (it's free!)

Hut 8's narrative projects $689.1 million in revenue and $125.5 million in earnings by 2028. This requires 73.3% yearly revenue growth and a $179 million increase in earnings from -$53.5 million today.

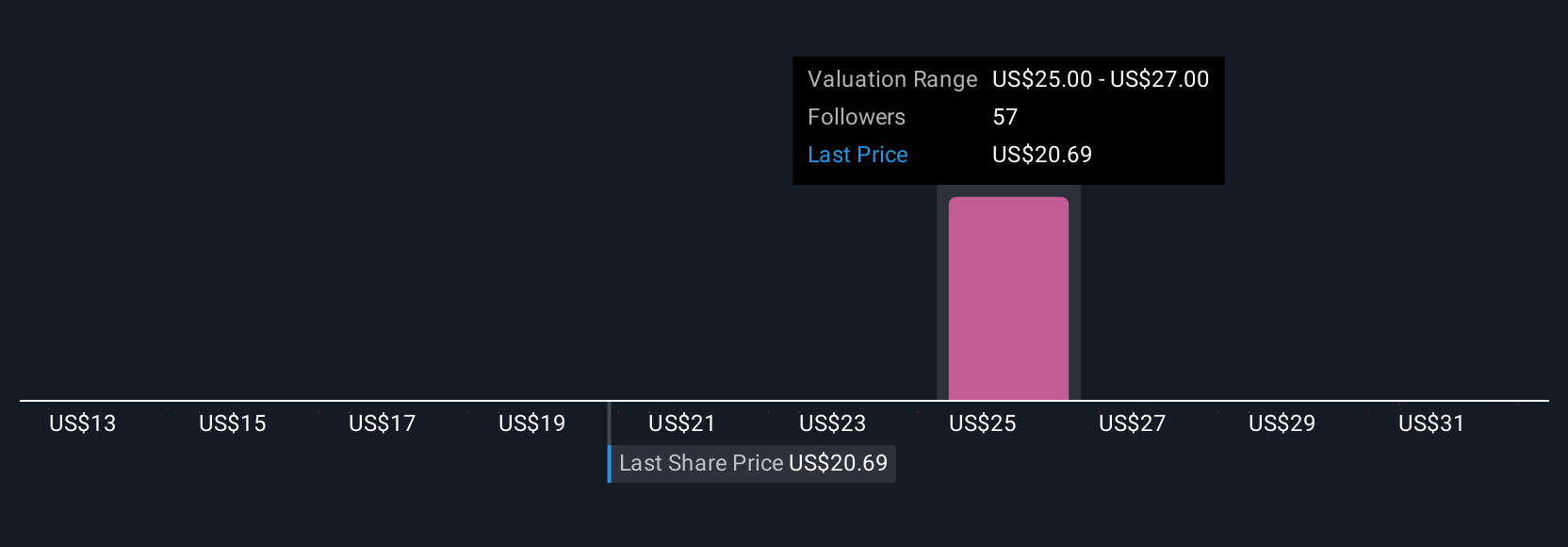

Uncover how Hut 8's forecasts yield a $26.73 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community gave fair value estimates for Hut 8 Corp. ranging from US$13 to US$33 per share, reflecting broad divergence in outlooks. While infrastructure growth is a promising catalyst, swings in digital asset prices can still shape performance, inviting you to examine several alternative viewpoints among market participants.

Explore 3 other fair value estimates on Hut 8 - why the stock might be worth as much as 56% more than the current price!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives