- United States

- /

- Software

- /

- NasdaqGS:HUT

How New AI Data Center Expansions at Hut 8 (HUT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Following a recent surge in investor interest, Hut 8 Corp. attracted attention due to its growth in high-performance computing capacity and exclusive rights to expand further at multiple US locations.

- Industry optimism has also been reinforced by major data center investments from sector leaders, signaling increased demand for AI infrastructure beyond cryptocurrency mining.

- We'll explore how Hut 8's expanding US power pipeline and sector-wide AI infrastructure momentum may influence the company's investment outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Hut 8 Investment Narrative Recap

To be a shareholder in Hut 8, you need to believe in the company’s ability to leverage its rapid infrastructure expansion and growing AI/data center opportunities, while managing volatility in Bitcoin prices and execution risk for large-scale projects. The recent rally, fueled by sector-wide enthusiasm and Piper Sandler’s increased price target, supports optimism around Hut 8’s high-performance computing capacity, but does not materially change the short-term catalyst: commercialization of its new US sites. The biggest risk remains exposure to prolonged Bitcoin market weakness.

The most relevant recent announcement is Hut 8’s development of four new US sites, representing 1.5 gigawatts of power under construction plus exclusive rights to add another 1.3 gigawatts. This directly connects to the main catalyst, Hut 8’s effort to capture secular growth in AI and high-performance compute, which could help diversify revenue beyond crypto mining and support more stable cash flows in the future.

However, investors should also be aware that, despite optimism around the US expansion, shifting regulatory and decarbonization pressures on natural gas-fired assets remain a notable risk to future...

Read the full narrative on Hut 8 (it's free!)

Hut 8's narrative projects $767.3 million in revenue and $140.6 million in earnings by 2028. This requires 76.9% yearly revenue growth and a $13.4 million earnings decrease from $154.0 million today.

Uncover how Hut 8's forecasts yield a $34.00 fair value, a 32% downside to its current price.

Exploring Other Perspectives

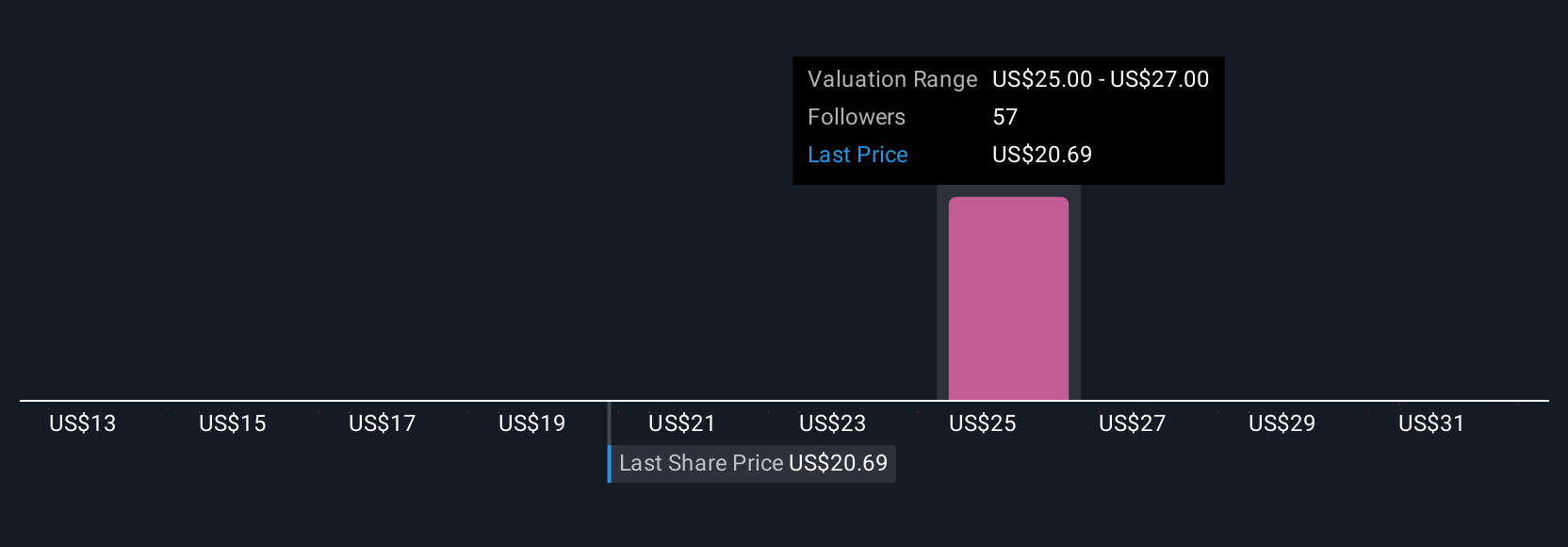

Five Simply Wall St Community fair value estimates for Hut 8 range from US$13 to US$36 per share. With most analyses focused on infrastructure growth and energy market trends, these signals reflect widely different expectations for the company’s ability to monetize its new US pipeline, inviting you to explore several compelling viewpoints.

Explore 5 other fair value estimates on Hut 8 - why the stock might be worth less than half the current price!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives