- United States

- /

- Software

- /

- NasdaqGS:HUT

Evaluating Hut 8 (HUT) After Its 15‑Year, Multibillion‑Dollar AI Hosting Deal With Fluidstack

Reviewed by Simply Wall St

Hut 8 (HUT) just reshaped its story with a 15 year, 7 billion dollar lease to Fluidstack for 245 megawatts of AI hosting capacity at its River Bend campus in Louisiana.

See our latest analysis for Hut 8.

The announcement lands on top of an already strong run, with the latest share price at $44.12 and a year to date share price return of about 102 percent, signalling that investors see growing upside in Hut 8’s pivot toward AI infrastructure.

If this kind of AI driven rerating has your attention, it could be a good moment to explore other high growth tech and AI names using our high growth tech and AI stocks as a hunting ground for the next potential winner.

With the stock already having doubled this year and still trading at a steep discount to bullish analyst targets, the key question now is whether Hut 8 remains mispriced or if the market is already accounting for its AI supercharged growth.

Most Popular Narrative: 21.4% Undervalued

With Hut 8 closing at $44.12 against a narrative fair value near $56, the most widely followed view sees meaningful upside from its expanding power platform.

Analysts have modestly trimmed their average fair value estimate for Hut 8 to approximately $56 from about $58, even as they lift headline price targets into the $60 to $65 range on expectations that the company will unlock greater value from its multi gigawatt development pipeline and expanding high performance computing opportunities.

Want to see what turns a volatile miner into a potential infrastructure compounder? The narrative leans on aggressive revenue expansion and rich future earnings multiples. Curious which assumptions really carry that valuation load and how far margins can stretch in an AI hungry world? Read on to unpack the full playbook behind this fair value call.

Result: Fair Value of $56.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Bitcoin weakness or regulatory backlash against fossil fuel based power could still derail Hut 8’s ambitious AI and multi gigawatt expansion path.

Find out about the key risks to this Hut 8 narrative.

Another Lens On Value

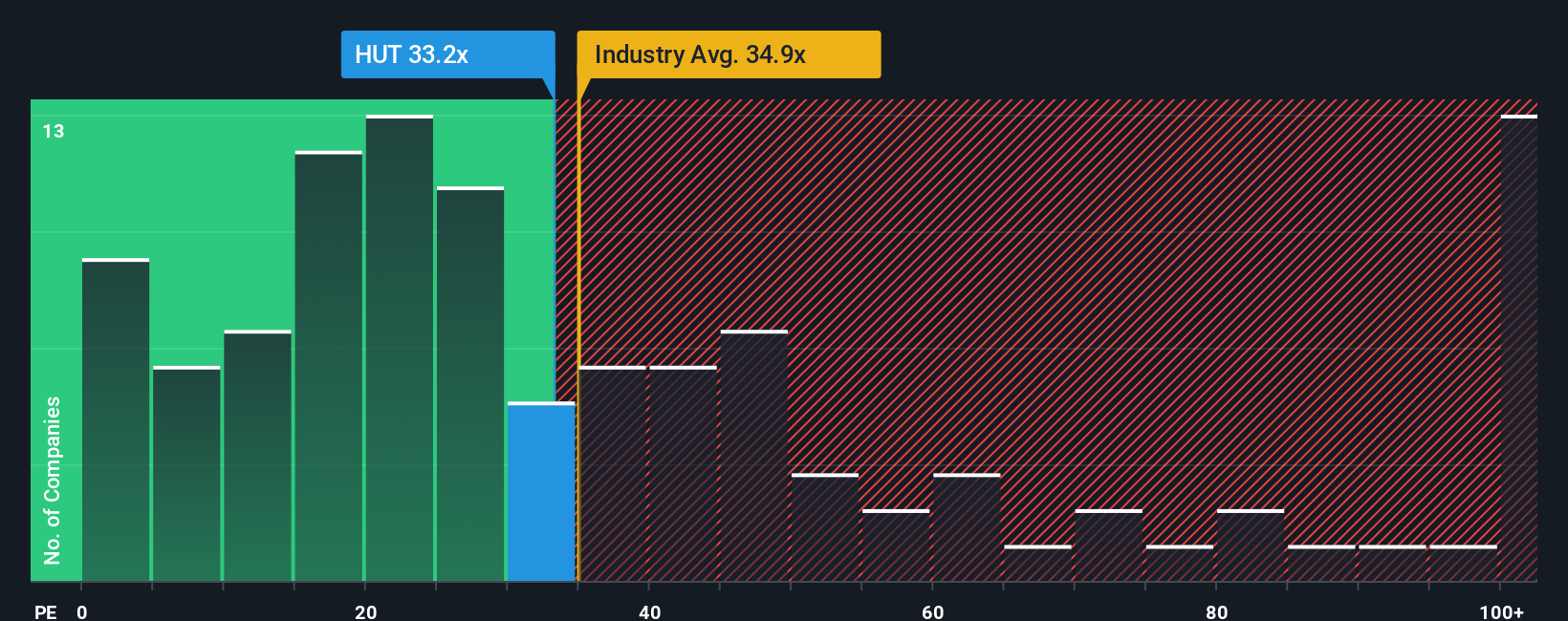

On simple earnings math, Hut 8 looks stretched. Its current P E ratio of 23.4 times sits above our fair ratio of 7.9 times and well ahead of peers on a fundamental basis, even if it still trades below the broader US Software average. Is the market already paying up for perfect execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hut 8 Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning focused stock ideas from our powerful screener so you are not chasing yesterday’s winners.

- Explore early stage momentum by targeting strong balance sheets and resilient business profiles across these 3632 penny stocks with strong financials that may change your portfolio’s trajectory.

- Position yourself for structural trends in automation and data by focusing on these 29 healthcare AI stocks reshaping diagnostics, treatment, and medical efficiency.

- Reinforce your income strategy by reviewing stable payout histories from these 12 dividend stocks with yields > 3% that can support a disciplined approach through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion