- United States

- /

- Software

- /

- NasdaqCM:HTCR

Investors Aren't Entirely Convinced By HeartCore Enterprises, Inc.'s (NASDAQ:HTCR) Revenues

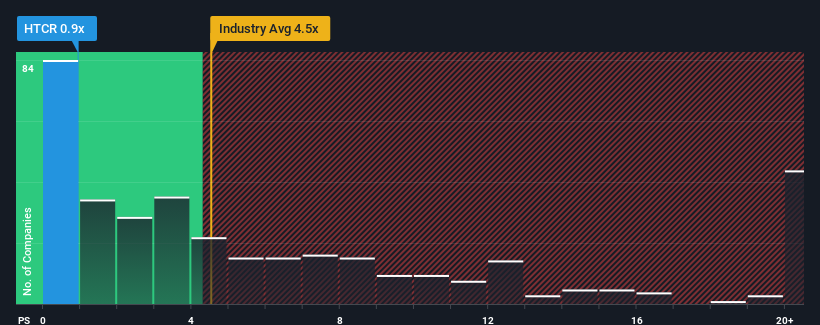

You may think that with a price-to-sales (or "P/S") ratio of 0.9x HeartCore Enterprises, Inc. (NASDAQ:HTCR) is definitely a stock worth checking out, seeing as almost half of all the Software companies in the United States have P/S ratios greater than 4.5x and even P/S above 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for HeartCore Enterprises

How Has HeartCore Enterprises Performed Recently?

HeartCore Enterprises hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HeartCore Enterprises.Is There Any Revenue Growth Forecasted For HeartCore Enterprises?

In order to justify its P/S ratio, HeartCore Enterprises would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 3.2% decrease to the company's top line. Even so, admirably revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 89% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this in consideration, we find it intriguing that HeartCore Enterprises' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does HeartCore Enterprises' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at HeartCore Enterprises' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware HeartCore Enterprises is showing 4 warning signs in our investment analysis, and 2 of those can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HeartCore Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HTCR

HeartCore Enterprises

A software development company, provides software as a service solutions to enterprise customers in Japan, the United States, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives