Undiscovered Gems Featuring 3 Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

In light of recent market developments, where U.S. stocks have shown a solid recovery and retail sales have surged to their highest in 18 months, the focus on small-cap stocks has intensified. The S&P 600 for small-cap companies has also seen gains, reflecting growing optimism about the economy achieving a "soft landing." When identifying promising small-cap stocks, strong fundamentals such as robust financial health, sustainable growth prospects, and competitive advantages are crucial. In this article, we explore three undiscovered gems that exhibit these qualities despite flying under the radar in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 46.79% | 18.26% | -3.91% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Taclink Optoelectronics Technology | 1.29% | 24.61% | -1.11% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 8.57% | 6.93% | 21.97% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Bumi Resources Minerals (IDX:BRMS)

Simply Wall St Value Rating: ★★★★★★

Overview: PT Bumi Resources Minerals Tbk, through its subsidiaries, engages in the exploration and development of mineral properties in Asia and has a market cap of IDR22.54 trillion.

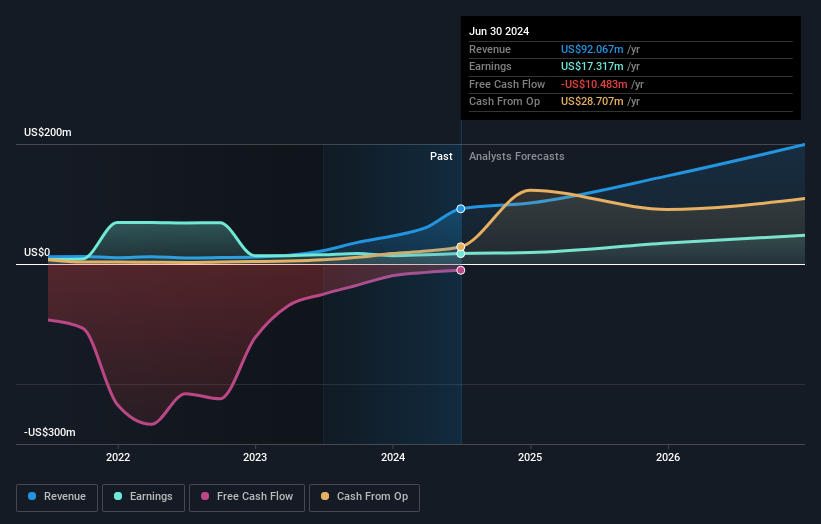

Operations: BRMS generates revenue primarily from its mining segment, amounting to $92.23 million.

BRMS's recent earnings report reveals a significant increase in sales to US$61.27 million from US$15.84 million last year, with net income rising to US$8.96 million from US$5.56 million. The company's debt-to-equity ratio has improved over five years, now at 10%, down from 24.9%. Despite profit margins falling to 18.8% from last year's 70.2%, BRMS's earnings growth of 12.5% outpaced the industry average of -7%.

- Navigate through the intricacies of Bumi Resources Minerals with our comprehensive health report here.

Gain insights into Bumi Resources Minerals' past trends and performance with our Past report.

Helport AI (NasdaqCM:HPAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helport AI Limited, with a market cap of $317.57 million, is an AI technology company that offers intelligent products, solutions, and a digital platform to enhance communication between businesses and their customers to boost sales performance.

Operations: Helport AI generates revenue primarily from its Software & Programming segment, which brought in $21.31 million. The company has a market cap of $317.57 million.

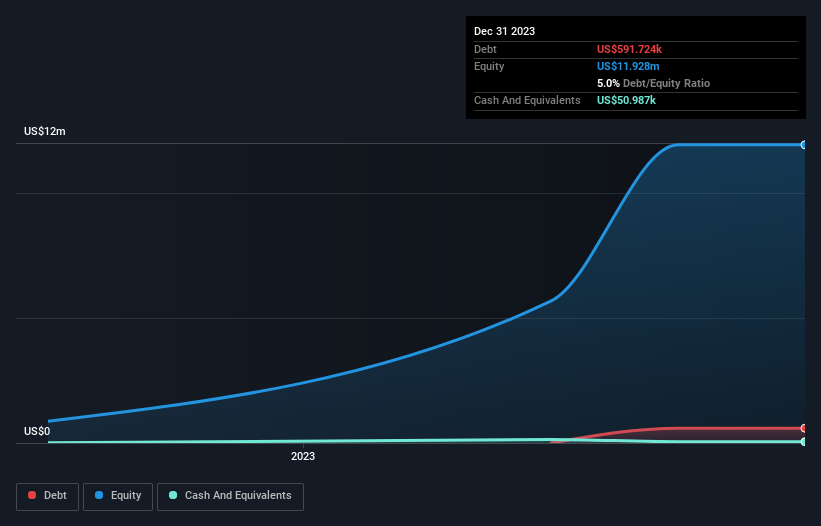

Helport AI, a small-cap tech player, has shown impressive growth with earnings up 208% in the past year. Trading at 88% below its estimated fair value and boasting a net debt to equity ratio of 4.5%, it demonstrates financial prudence. The company’s interest payments are well covered by EBIT at 403x coverage, highlighting robust operational health. Recently added to the NASDAQ Composite Index, Helport AI is gaining traction in the market despite its volatile share price over the last three months.

- Delve into the full analysis health report here for a deeper understanding of Helport AI.

Understand Helport AI's track record by examining our Past report.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Speciality Chemicals Corporation manufactures and sells specialty electronic-graded gases and chemicals in Taiwan, with a market cap of NT$23.02 billion.

Operations: Revenue for Taiwan Speciality Chemicals Corporation primarily comes from the research, development, and sales of precision chemical materials, totaling NT$751.68 million. The company has a market cap of NT$23.02 billion.

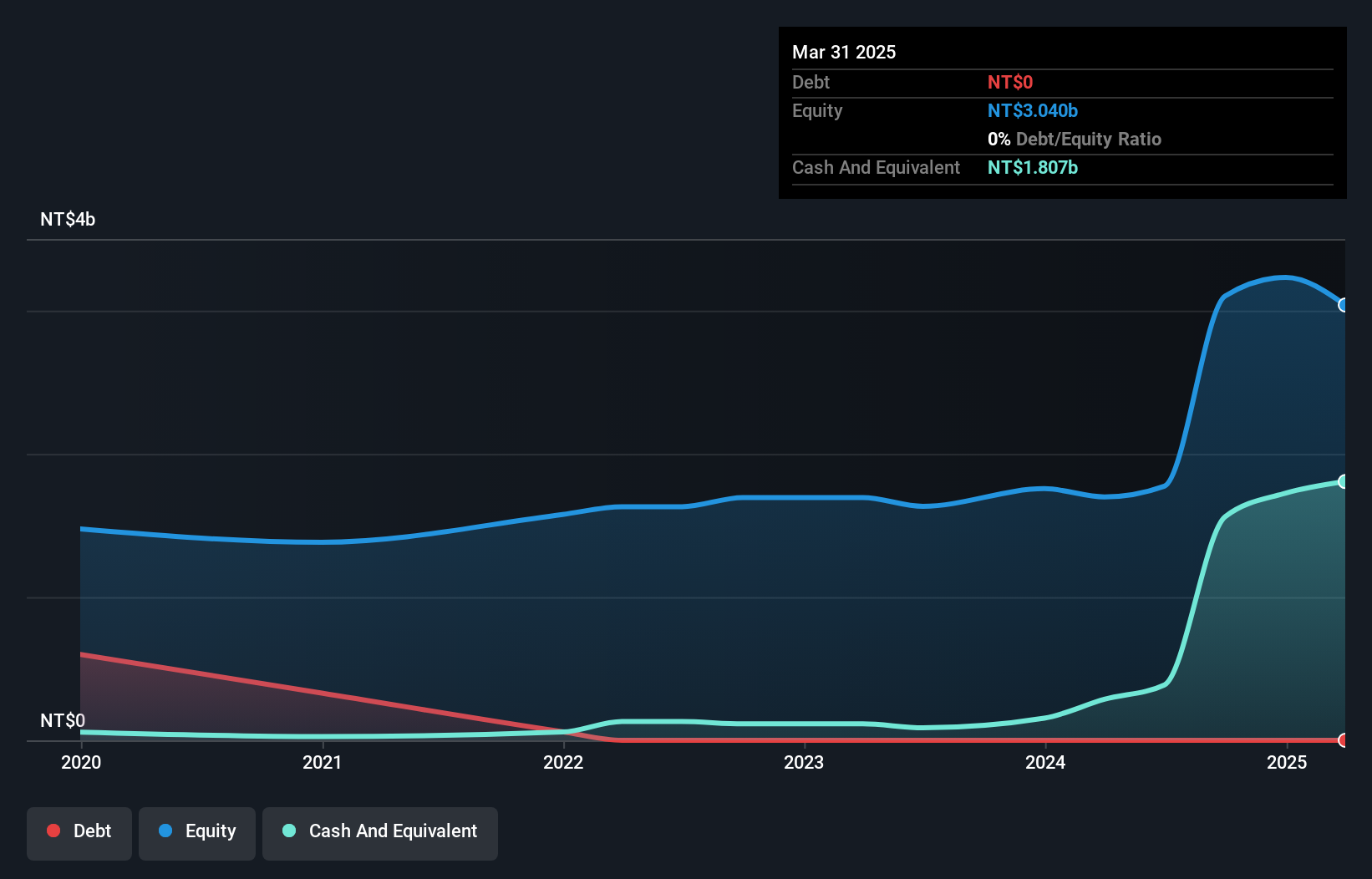

Taiwan Speciality Chemicals has demonstrated impressive growth, with earnings surging by 188.3% over the past year, outpacing the Chemicals industry’s 13.1%. The company reported TWD 187.73 million in sales for Q2 2024, up from TWD 113.19 million a year ago, while net income jumped to TWD 75.01 million from TWD 20.61 million in the same period last year. Furthermore, basic earnings per share rose to TWD 0.54 from TWD 0.15 a year ago.

Taking Advantage

- Access the full spectrum of 4889 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Speciality Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4772

Taiwan Speciality Chemicals

Manufactures and sells specialty electronic-graded gases and chemicals in Taiwan.

Flawless balance sheet with solid track record.