- United States

- /

- IT

- /

- NasdaqGS:HCKT

Where The Hackett Group, Inc. (NASDAQ:HCKT) Stands In Terms Of Earnings Growth Against Its Industry

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Measuring The Hackett Group, Inc.'s (NASDAQ:HCKT) track record of past performance is a valuable exercise for investors. It allows us to understand whether or not the company has met or exceed expectations, which is an insightful signal for future performance. Today I will assess HCKT's recent performance announced on 29 March 2019 and compare these figures to its historical trend and industry movements.

See our latest analysis for Hackett Group

Did HCKT's recent earnings growth beat the long-term trend and the industry?

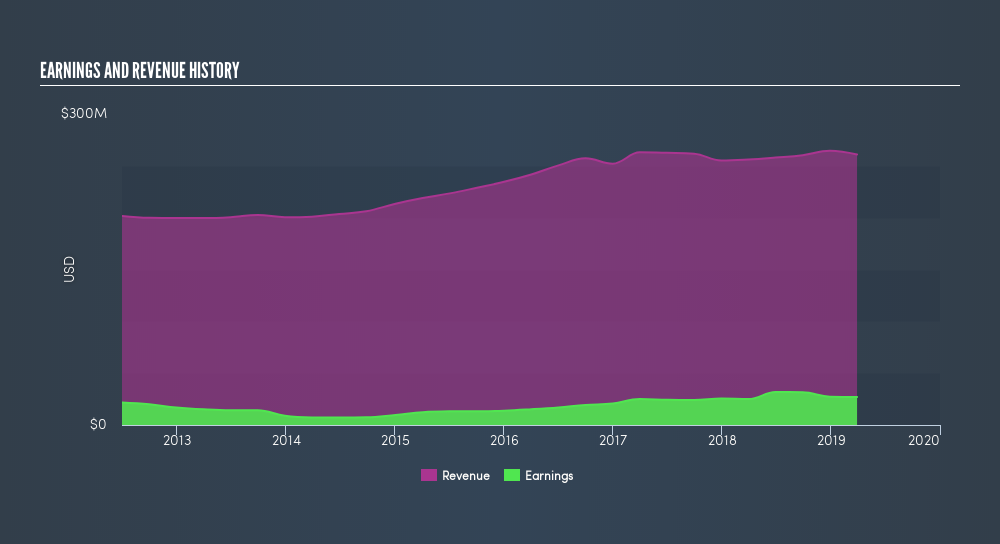

HCKT's trailing twelve-month earnings (from 29 March 2019) of US$27m has increased by 8.5% compared to the previous year.

However, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 26%, indicating the rate at which HCKT is growing has slowed down. What could be happening here? Well, let's examine what's occurring with margins and if the entire industry is experiencing the hit as well.

In terms of returns from investment, Hackett Group has invested its equity funds well leading to a 21% return on equity (ROE), above the sensible minimum of 20%. Furthermore, its return on assets (ROA) of 15% exceeds the US IT industry of 5.6%, indicating Hackett Group has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for Hackett Group’s debt level, has increased over the past 3 years from 23% to 24%. This correlates with a decrease in debt holding, with debt-to-equity ratio declining from 33% to 5.8% over the past 5 years.

What does this mean?

Though Hackett Group's past data is helpful, it is only one aspect of my investment thesis. Companies that have performed well in the past, such as Hackett Group gives investors conviction. However, the next step would be to assess whether the future looks as optimistic. You should continue to research Hackett Group to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for HCKT’s future growth? Take a look at our free research report of analyst consensus for HCKT’s outlook.

- Financial Health: Are HCKT’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 29 March 2019. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:HCKT

Hackett Group

Operates as an intellectual property platform-based generative artificial intelligence strategic consulting and executive advisory digital transformation in the United States, Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives