- United States

- /

- Software

- /

- NasdaqGS:GTLB

GitLab (GTLB) Valuation Check After Recent Share Price Slide and Growth Reassessment

Reviewed by Simply Wall St

Short term stock performance and recent moves

GitLab (GTLB) has quietly slipped over the past 3 months, with the stock down around 21% and roughly 32% lower year to date, even as revenue continues to grow.

See our latest analysis for GitLab.

That slide has left GitLab with a roughly 32 percent year to date share price return in the red and a 1 year total shareholder return of about negative 36 percent. This suggests momentum has cooled as investors reassess the balance between strong growth and ongoing losses at a 38.38 dollar share price.

If GitLab has you rethinking how you get exposure to software growth, it could be worth scanning other high growth tech and AI names through high growth tech and AI stocks.

With shares now trading at a steep discount to analyst targets despite double digit revenue growth, investors face a key question: is GitLab a mispriced growth story, or is the market already discounting its future gains?

Most Popular Narrative: 28.5% Undervalued

With GitLab closing at 38.38 dollars against a narrative fair value near the mid 50s, the valuation debate hinges on ambitious growth and margin lift.

The ongoing migration from on premises to cloud based development, coupled with GitLab's scaling SaaS and Dedicated offerings (with SaaS up 39% YoY and Dedicated ARR up 92% YoY), will likely improve gross margin leverage, aid in operating efficiency, and support expansion of net margins and free cash flow.

Curious how this cloud shift, faster recurring revenue and a richer margin profile combine to justify a premium future earnings multiple? Unlock the full narrative to see the math behind that upside case.

Result: Fair Value of $53.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating AI tools and intensifying competition from GitHub could compress pricing power, slow ARR growth, and challenge the bullish margin expansion narrative.

Find out about the key risks to this GitLab narrative.

Another Angle on Valuation

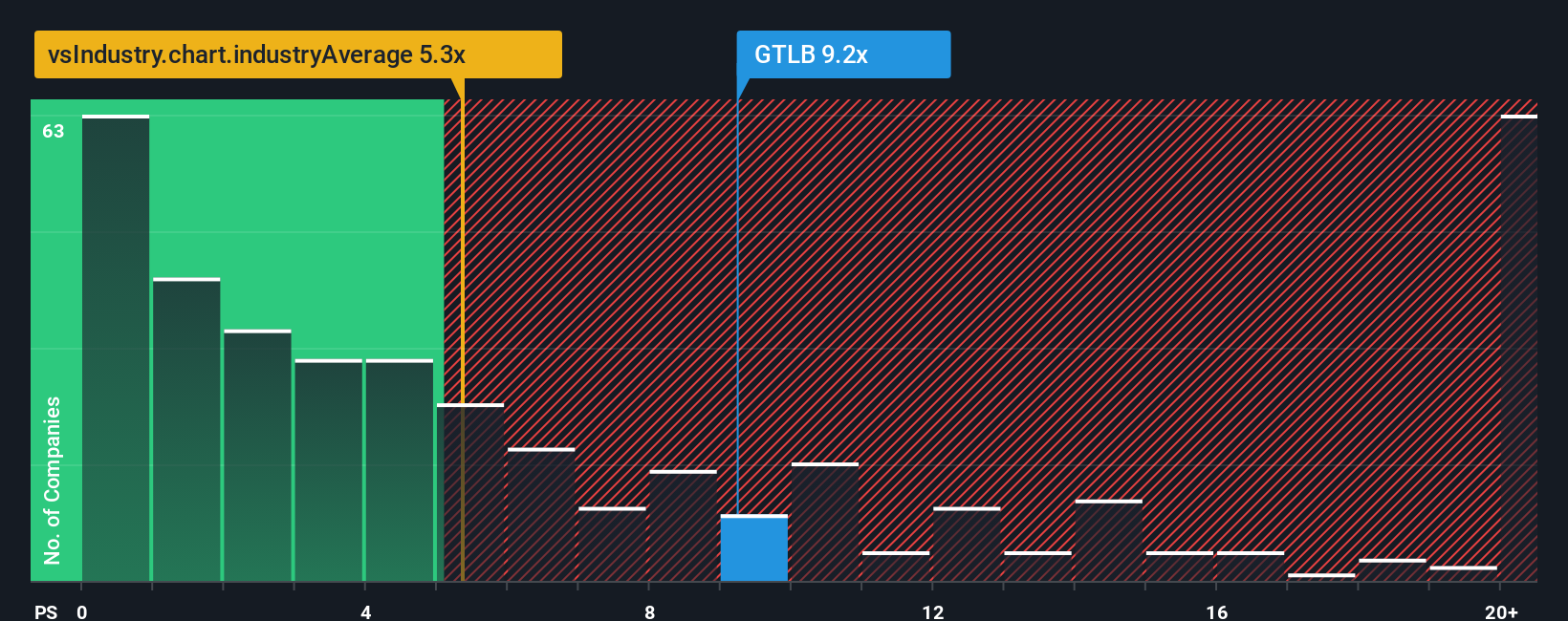

Multiples tell a mixed story, with GitLab looking pricey versus the broader US software sector but cheaper than close peers and its own fair ratio. In practice that means there could be upside if sentiment normalizes, but also real downside if growth disappoints and the market resets expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GitLab Narrative

If our view does not quite match yours, or you would rather dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next smart move? Use the Simply Wall Street Screener to uncover focused opportunities so you are not the one hearing about winners after they run.

- Capture powerful upside potential by targeting quality names trading below their cash flow value through these 898 undervalued stocks based on cash flows.

- Ride the next wave of innovation by zeroing in on early stage innovators shaping the future of intelligent software with these 24 AI penny stocks.

- Strengthen portfolio income by hunting for reliable payers offering attractive yields and resilient cash generation via these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion