- United States

- /

- Software

- /

- NasdaqGS:GEN

Is Gen Digital a Fair Deal After Product Innovations and Recent Price Drop?

Reviewed by Bailey Pemberton

- Wondering if Gen Digital could be a smart addition to your portfolio, or maybe just fairly priced in today's market? Let's look at what might set it apart from the pack and whether recent moves suggest an opportunity.

- The stock has been on a bit of a rollercoaster lately, dipping by 5% over the past week and down 10.2% for the last month. It remains up over 30% in the past five years, which hints at underlying resilience.

- Recent headlines have kept Gen Digital in the spotlight, with discussions focusing on its product innovations and steps to expand its cyber protection offerings. These news items have spurred conversations about Gen's future, especially as market sentiment shifts around the broader tech sector.

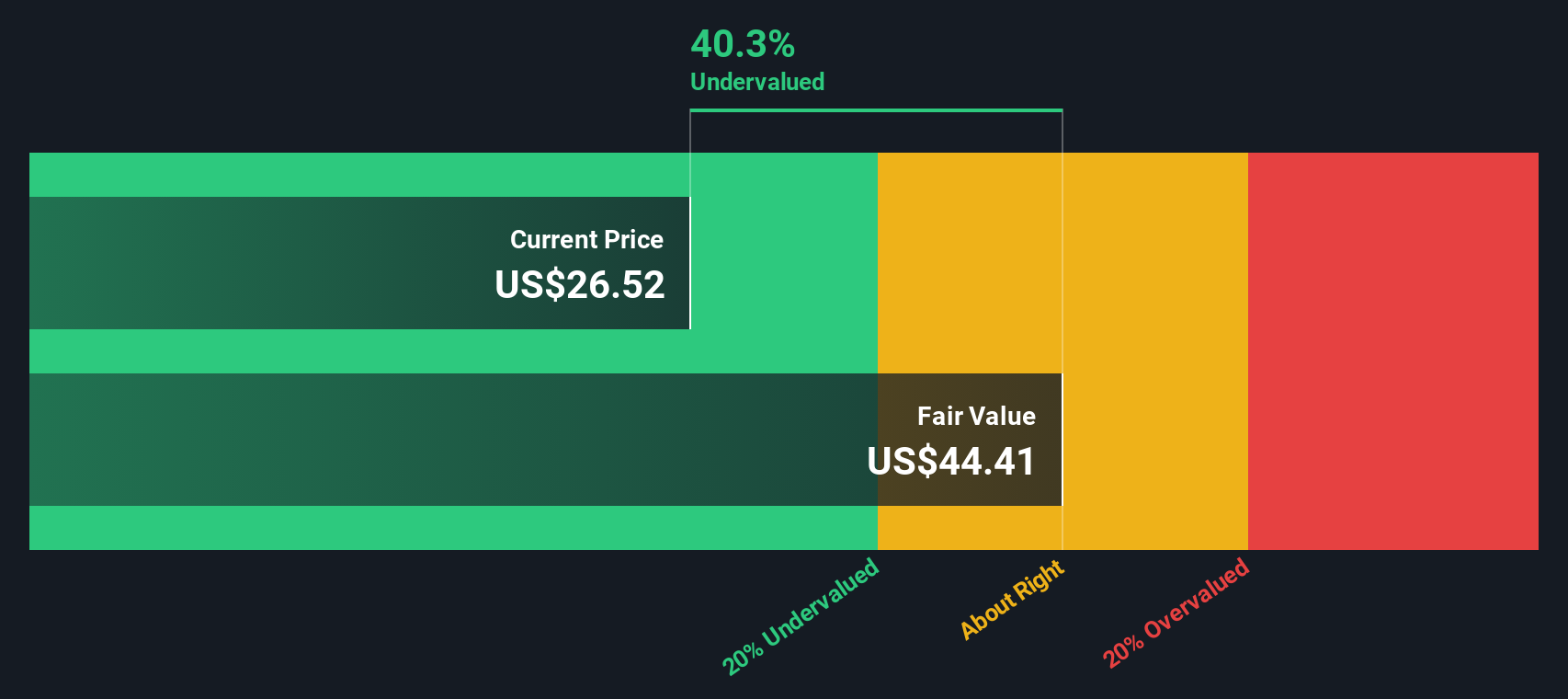

- On our checks, Gen Digital scores a perfect 6 out of 6 for undervaluation. This makes it one of the rare finds in today's market. In the next sections, we will walk through the valuation angles that drive this score and finish with a perspective on what valuation really means for long-term investors.

Find out why Gen Digital's -2.3% return over the last year is lagging behind its peers.

Approach 1: Gen Digital Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method aims to capture what Gen Digital is really worth based on how much cash it can generate for shareholders over time.

Gen Digital’s latest reported Free Cash Flow (FCF) stands at $1.35 billion. Looking ahead, analysts expect the company’s annual FCF to grow, reaching about $1.53 billion by 2028. Projections then extend further and ultimately see FCF climb above $1.9 billion (discounted back to today’s terms) over the following decade, with these mid- to long-range numbers extrapolated for illustration by Simply Wall St.

After running these numbers through the DCF valuation, the estimated fair value per share is $34.19. That is approximately 24.4% higher than Gen Digital’s current trading price, signaling a solid margin of safety for investors. Based on this analysis, Gen Digital stock appears meaningfully undervalued by the market at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gen Digital is undervalued by 24.4%. Track this in your watchlist or portfolio, or discover 850 more undervalued stocks based on cash flows.

Approach 2: Gen Digital Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Gen Digital because it focuses on how much investors are willing to pay for each dollar of earnings. A lower PE can suggest undervaluation, while a higher PE may imply strong growth expectations or reduced risk.

What counts as a “normal” or “fair” PE depends on a company’s growth prospects, profit margins, and risk profile. Fast-growing, resilient businesses often command a premium, as investors anticipate higher future profits. Conversely, companies with muted growth or higher risk trade at lower multiples.

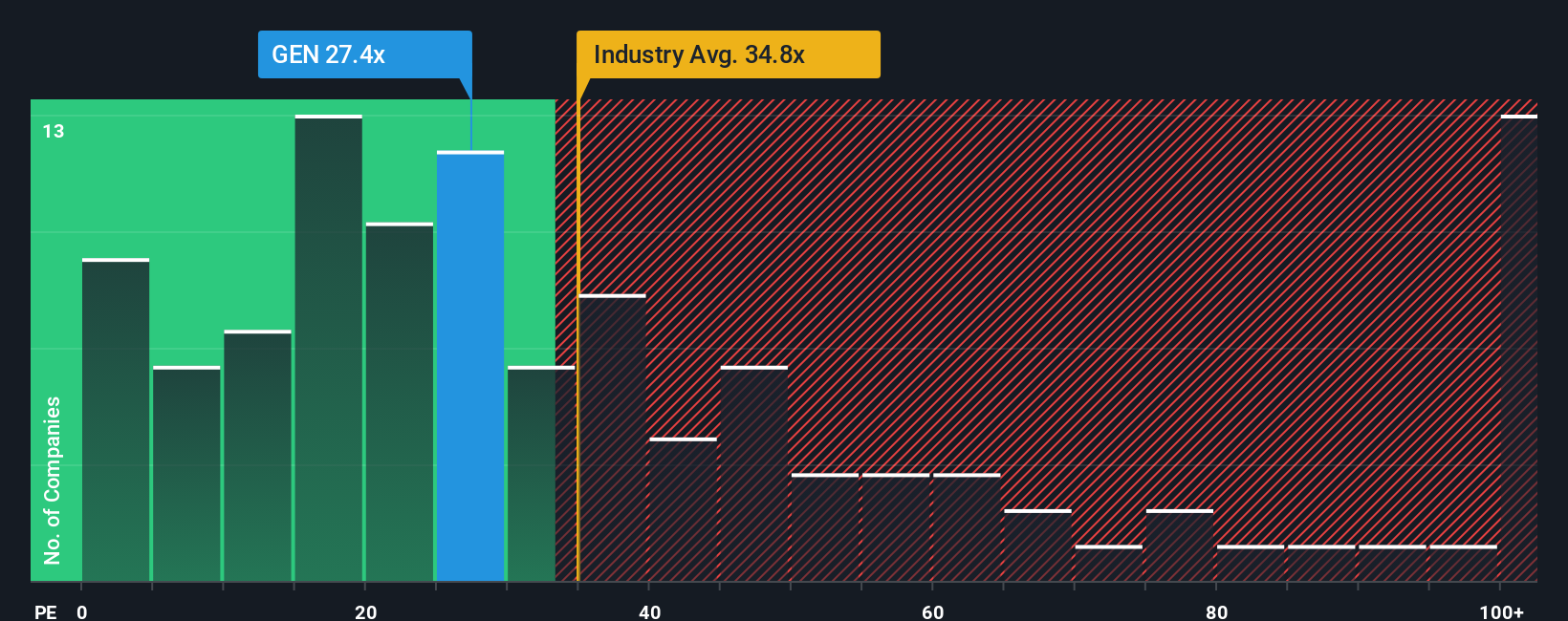

Gen Digital currently trades at a PE of 26.7x. By comparison, the software industry average sits at 34.8x, and direct peers average a higher 36.5x. Simply Wall St’s proprietary Fair Ratio for Gen Digital is 35.7x. This is calculated using factors such as the company’s earnings growth forecasts, risk, profit margin, industry characteristics, and market capitalization.

Unlike a basic peer comparison, the Fair Ratio gives a more nuanced picture by adjusting for variables that pure industry averages or peer group benchmarks overlook. This helps investors judge whether a stock is truly a bargain or just looks cheap on the surface due to unique company circumstances.

Comparing Gen Digital’s current PE of 26.7x to its Fair Ratio of 35.7x suggests the stock is currently trading at a meaningful discount and appears undervalued through this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1388 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gen Digital Narrative

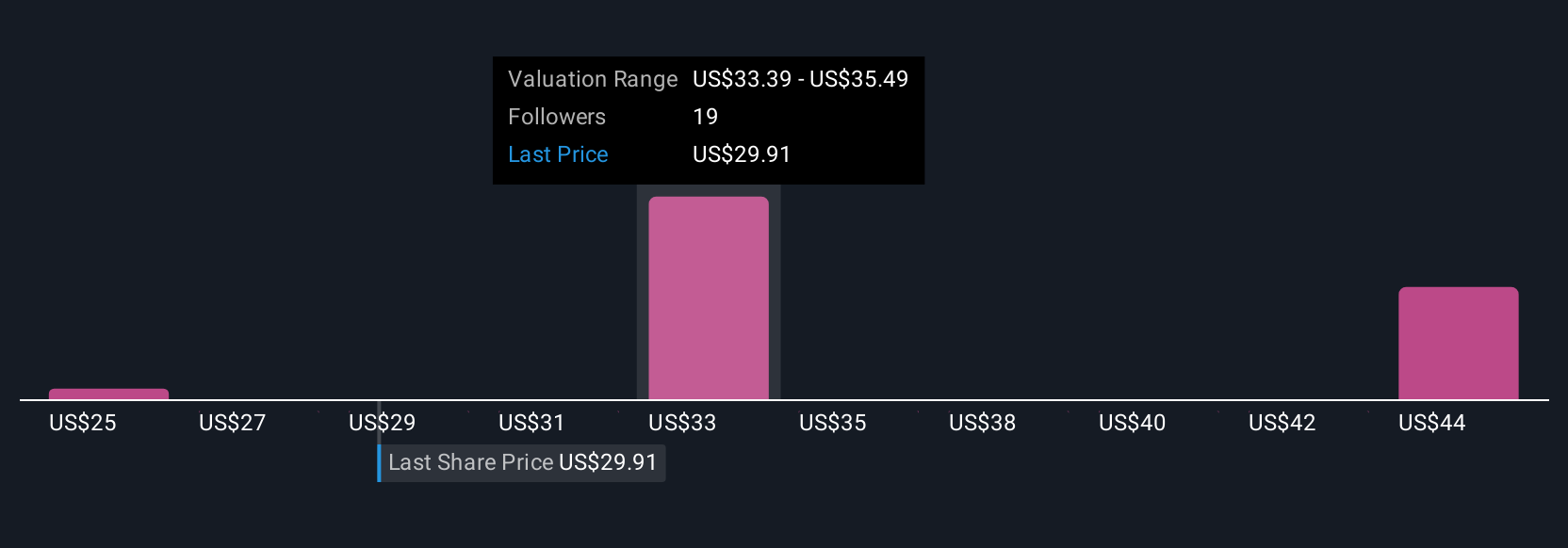

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your investment story, the unique way you interpret Gen Digital’s future by linking your own assumptions about its growth, margins, and industry position to a personal fair value and outlook.

Narratives connect the company’s story to a financial forecast and ultimately to a clear, actionable fair value, helping you decide if now is the right time to buy or sell. On Simply Wall St’s Community page, millions of investors are already building and sharing their Narratives, changing them dynamically as fresh news, earnings, or business developments come to light.

Using Narratives is easy and accessible, whether you’re a seasoned investor or brand new. Simply set your revenue and margin expectations for Gen Digital, and the platform instantly translates your story into a fair value and clear decision signal. For example, one investor might see Gen’s AI-driven product launches and recurring revenue model as supporting an optimistic price target of $46.00, while another, cautious about integration risks and competition, may land at $25.00. Narratives empower you to put your perspective into practice and respond instantly as the story evolves.

Do you think there's more to the story for Gen Digital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives