- United States

- /

- Software

- /

- NasdaqGS:GEN

How Norton's Upgraded Cybersecurity Tools Could Shape Gen Digital's (GEN) Competitive Edge in SMB Market

- Earlier this week, Norton announced the expansion of its Small Business offering with enhanced Dark Web Monitoring and new Social Media Monitoring features aimed at protecting businesses from data breaches, scams, and account takeovers.

- With business data breaches up sharply in 2025, Norton’s updated services now monitor critical business details like Tax ID and VAT numbers for early detection of threats across both the dark web and major social platforms.

- We’ll explore how the launch of advanced small business cyber protection tools signals Norton’s commitment to addressing urgent market needs.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Gen Digital Investment Narrative Recap

To own Gen Digital stock, investors need to believe in the company's ability to drive sustainable growth from demand for comprehensive digital security, despite margin pressure and intense competition in cybersecurity. The recent launch of enhanced Norton Small Business tools directly supports Gen’s current growth catalyst, product innovation addressing urgent and visible security risks faced by small businesses in a rapidly evolving threat landscape, but does not materially alter the biggest risk, which remains commoditization and price competition.

Among recent developments, the July rollout of AI-powered deepfake protection within Norton Genie reinforces Gen Digital’s push to stay ahead of emerging cyber threats with advanced, differentiated capabilities. This announcement, closely linked to the latest dark web and social monitoring features, showcases how the company is prioritizing platform innovation to drive higher customer retention and cross-sell opportunities.

On the other hand, the ever-present risk of price competition and commoditization in cybersecurity software is something every investor should keep in mind, especially as...

Read the full narrative on Gen Digital (it's free!)

Gen Digital's narrative projects $5.3 billion revenue and $1.2 billion earnings by 2028. This requires 7.7% yearly revenue growth and a $603 million increase in earnings from $597 million today.

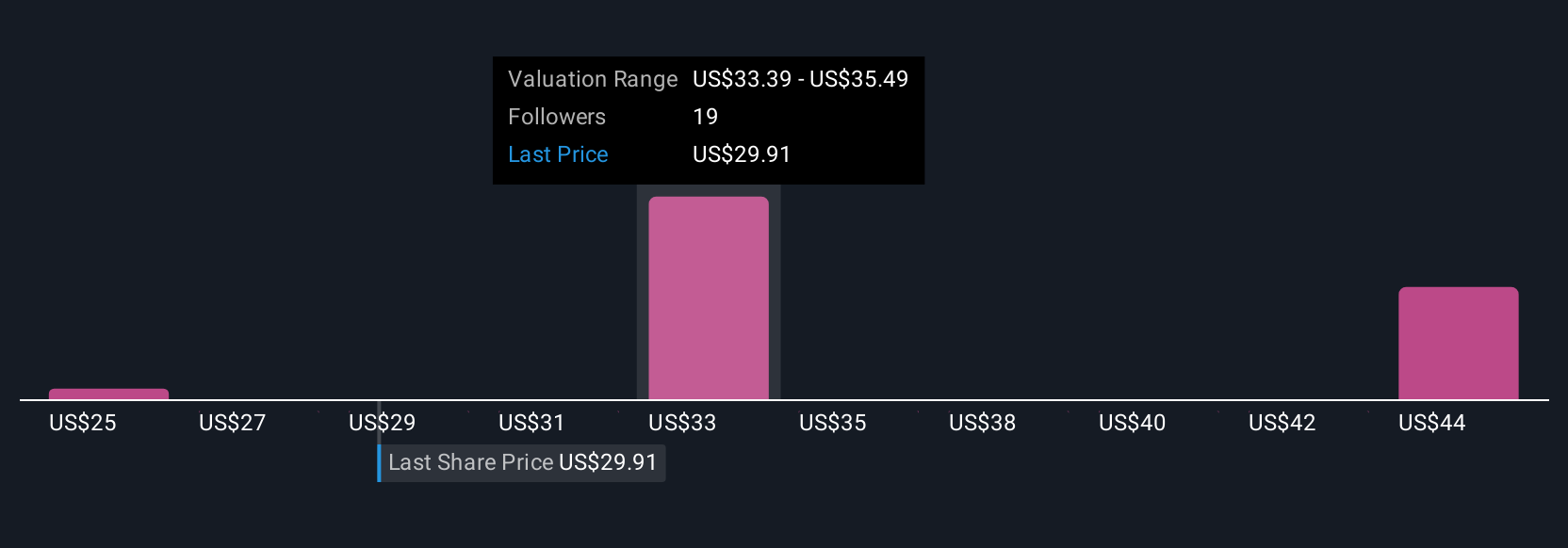

Uncover how Gen Digital's forecasts yield a $34.64 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$25 to US$46.07 per share, revealing a wide gap in expectations. Many see growth catalysts in Gen’s AI product rollouts, but risks from intensified competition and margin pressure may shape the company’s future much differently, so it’s worth considering more than one viewpoint.

Explore 5 other fair value estimates on Gen Digital - why the stock might be worth 15% less than the current price!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for individuals, families, and small businesses.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Sustained Silver at ~US$100/oz Drives Explosive Leverage and Re-Rating for PAAS

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.