- United States

- /

- Software

- /

- NasdaqGS:GEN

How Investors May Respond To Gen Digital (GEN) Beating Estimates and Launching a Quarterly Dividend

Reviewed by Sasha Jovanovic

- Gen Digital recently reported quarterly earnings and revenue that exceeded expectations, and introduced a new quarterly dividend to shareholders.

- This combination of stronger financial results and a new dividend announcement has drawn renewed institutional investor interest in Gen Digital.

- We’ll explore how the initiation of a quarterly dividend strengthens Gen Digital's investment narrative and potential future returns for shareholders.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Gen Digital Investment Narrative Recap

To be a shareholder in Gen Digital, you have to believe in the ongoing relevance and durability of consumer cybersecurity and identity protection, despite rising competition and evolving digital security trends. While stronger-than-expected earnings and a new dividend support near-term sentiment, the key catalyst remains sustained product and platform innovation, and the largest risk continues to be the company’s dependence on legacy brands in a market rapidly shifting toward integrated or embedded solutions; the recent results and dividend do not appear to materially change these critical factors.

The newly introduced quarterly dividend of US$0.125 per share, first announced in August 2025, stands out as the most relevant recent announcement. This move signals to the market an increased focus on returning capital to shareholders, aligning with broader investor interest in sustainable shareholder payouts, but does not directly address the risk of brand or business model obsolescence in the evolving cybersecurity sector.

However, investors should also consider the potential downside if Gen Digital’s reliance on its legacy brands and subscription model is challenged by...

Read the full narrative on Gen Digital (it's free!)

Gen Digital's outlook anticipates $5.3 billion in revenue and $1.2 billion in earnings by 2028. Achieving this would require 7.7% annual revenue growth and an earnings increase of approximately $603 million from current earnings of $597 million.

Uncover how Gen Digital's forecasts yield a $33.34 fair value, a 26% upside to its current price.

Exploring Other Perspectives

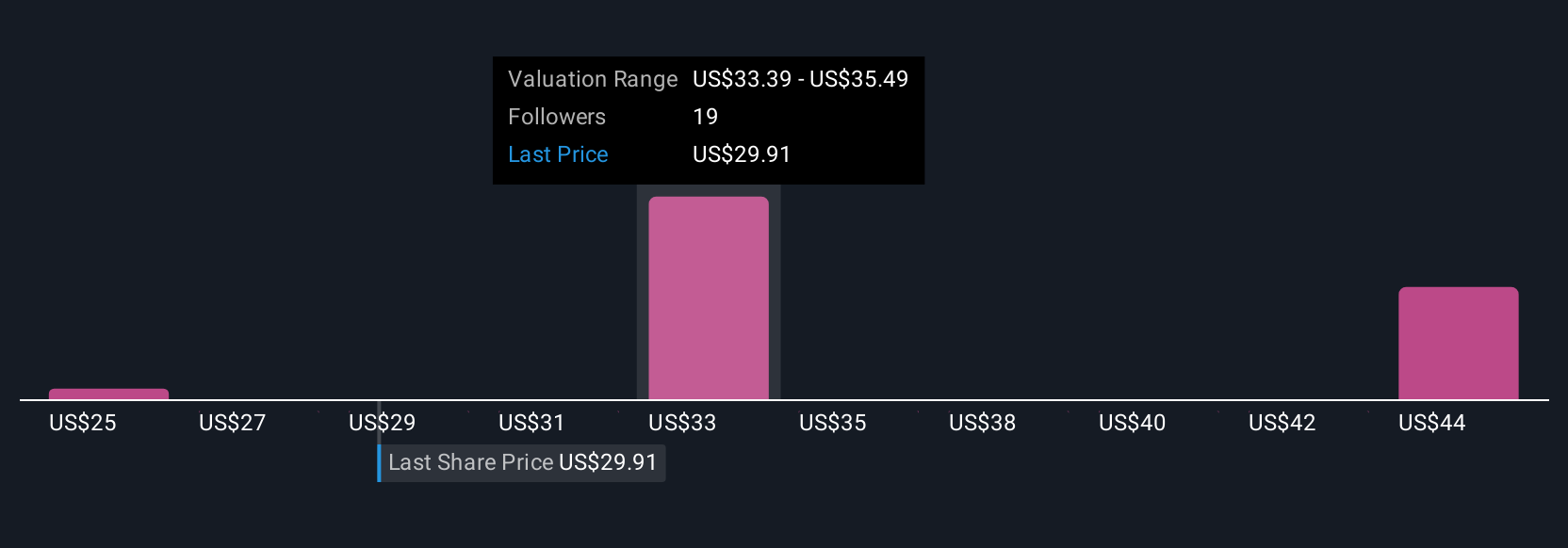

Community members on Simply Wall St estimate Gen Digital’s fair value between US$25 and US$45.02, based on seven different analyses. As expectations of recurring revenue models evolve, your view on the company’s future growth and market positioning may differ, track several viewpoints for a balanced perspective.

Explore 7 other fair value estimates on Gen Digital - why the stock might be worth as much as 71% more than the current price!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026