- United States

- /

- IT

- /

- NasdaqGM:GDS

Imagine Holding GDS Holdings (NASDAQ:GDS) Shares While The Price Zoomed 345% Higher

For us, stock picking is in large part the hunt for the truly magnificent stocks. But when you hold the right stock for the right time period, the rewards can be truly huge. Take, for example, the GDS Holdings Limited (NASDAQ:GDS) share price, which skyrocketed 345% over three years. Also pleasing for shareholders was the 19% gain in the last three months. But this could be related to the strong market, which is up 13% in the last three months.

View our latest analysis for GDS Holdings

Because GDS Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years GDS Holdings saw its revenue grow at 41% per year. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 64% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like GDS Holdings can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

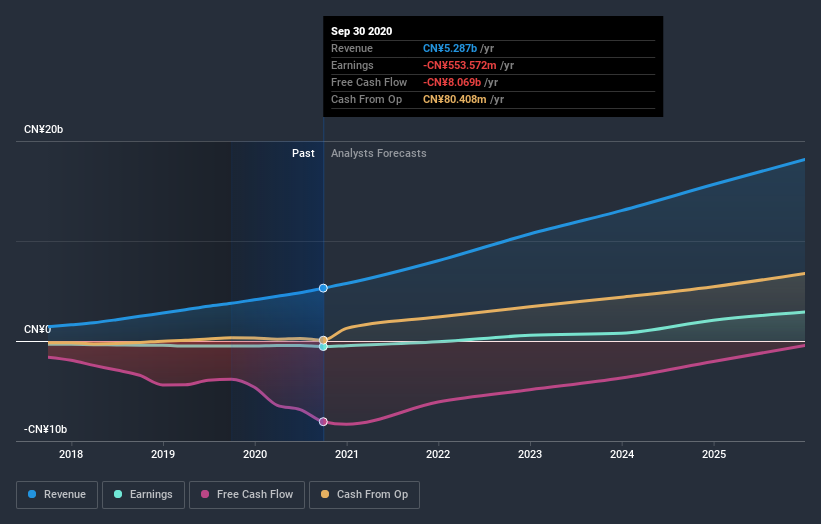

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

GDS Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling GDS Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Pleasingly, GDS Holdings' total shareholder return last year was 100%. That gain actually surpasses the 64% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting GDS Holdings on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with GDS Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

Of course GDS Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading GDS Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives