- United States

- /

- IT

- /

- NasdaqGM:GDS

GDS Holdings (NasdaqGM:GDS): Revisiting Valuation After C-REIT IPO and Raymond James Strong Buy Rating

Reviewed by Kshitija Bhandaru

Raymond James just doubled down on its confidence in GDS Holdings (NasdaqGM:GDS), underscoring strong growth prospects as the company rides the wave of AI adoption and seizes new opportunities in China’s data center market.

See our latest analysis for GDS Holdings.

With momentum building on the back of the recent C-REIT IPO and investor optimism around AI-driven growth, GDS Holdings’ 1-year total shareholder return sits at just under 1%, while longer-term performance remains mixed. Recent news and industry events have helped keep the share price resilient, indicating that the market’s perception of GDS’s future potential is strengthening.

If the data center surge has piqued your interest, now is the perfect time to discover other innovative tech and AI stocks using our See the full list for free..

This raises the key question for investors: is GDS Holdings trading below its true potential given recent momentum, or is the stock’s future growth already factored into its current price?

Most Popular Narrative: 12.8% Undervalued

With GDS Holdings trading at $41.35 versus the most popular narrative's fair value estimate of $47.44, analysts are positioning the company as having further room to run. Their attention is on major structural changes that could reshape the growth story over the next few years.

The successful implementation of China's first data center ABS and C-REIT IPOs has pioneered a pathway for GDS to repeatedly recycle capital at cap rates (and multiples) well above the company's own market valuation. This allows the company to fund new growth, improve leverage, and enhance ROIC, supporting stronger net earnings over time.

Curious how this narrative justifies a powerful upside? There are bold growth forecasts and ambitious margin improvements embedded here, unlocking a premium future earnings multiple. Want to know the hard metrics fueling this view? Dive in to uncover the high-conviction numbers driving the valuation gap.

Result: Fair Value of $47.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and high leverage at GDS could quickly shift sentiment if market conditions or capital access change unexpectedly.

Find out about the key risks to this GDS Holdings narrative.

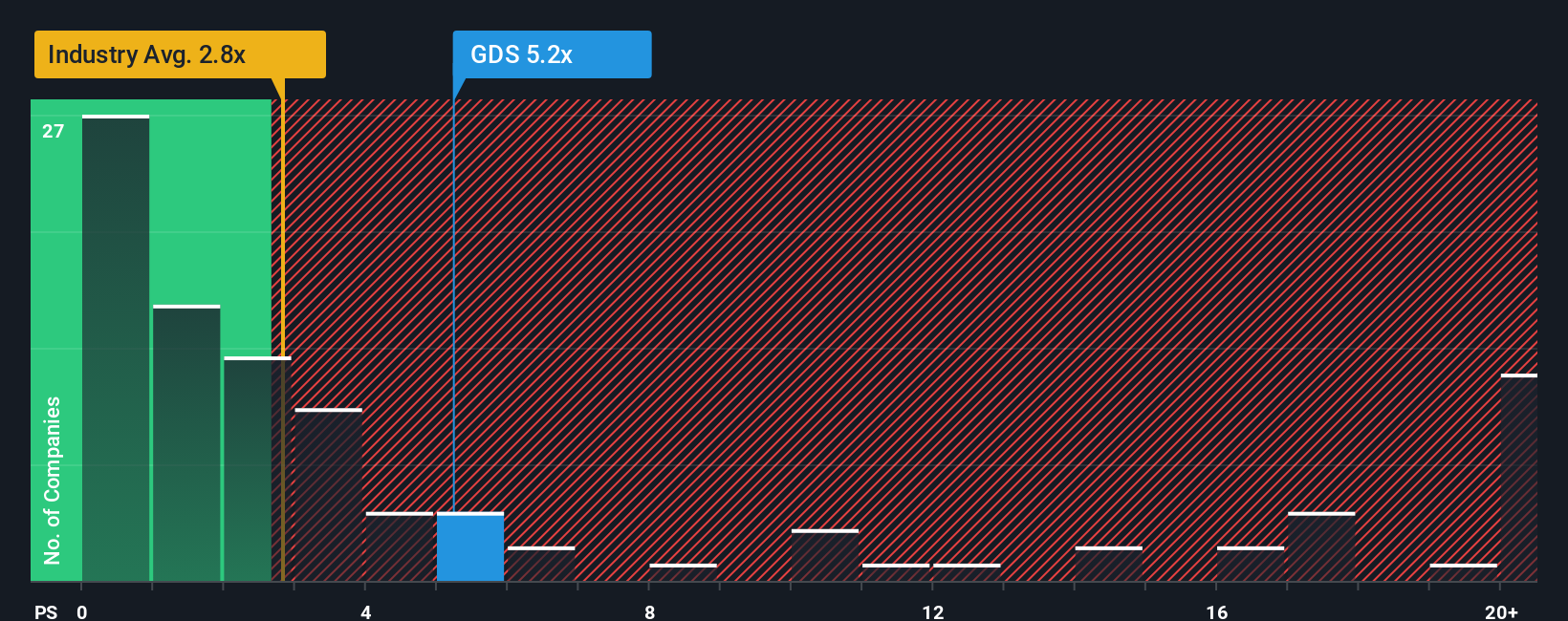

Another View: How Does GDS Stack Up on Sales Ratios?

Looking at the price-to-sales ratio gives a fresh perspective. GDS trades at 5.4x sales, higher than both its peer average (3.6x) and the broader US IT industry (2.3x). The market's fair ratio is closer to 3.3x, which suggests the stock may be richly valued. Does this premium signal confidence or extra risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GDS Holdings Narrative

If you want to dig into the numbers yourself or have a different viewpoint, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your GDS Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next opportunity to pass you by. Act now to uncover stocks that could fuel your portfolio’s growth and help you stay ahead of the trends.

- Tap into companies with high yields and secure your income by reviewing these 19 dividend stocks with yields > 3% offering sustainable returns above 3%.

- Target future disruptors by scanning these 26 quantum computing stocks that are pioneering breakthroughs in quantum computing and next-generation technology.

- Boost your returns by sorting through these 910 undervalued stocks based on cash flows poised for strong upside based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives