- United States

- /

- IT

- /

- NasdaqGM:GDS

Exploring High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

The United States market is experiencing a positive trend, with major indices like the S&P 500 and Dow Jones Industrial Average posting significant weekly gains, buoyed by investor optimism following tariff reductions between the U.S. and China. In this environment of renewed enthusiasm for tech stocks, identifying high-growth opportunities involves looking at companies that are well-positioned to capitalize on technological advancements and market demands while navigating potential economic challenges.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.28% | 37.43% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Travere Therapeutics | 25.75% | 64.53% | ★★★★★★ |

| Blueprint Medicines | 21.36% | 61.45% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

GDS Holdings (NasdaqGM:GDS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GDS Holdings Limited, along with its subsidiaries, specializes in the development and operation of data centers across the People's Republic of China, with a market capitalization of approximately $5.14 billion.

Operations: The company focuses on the design, build-out, and operation of data centers in China, generating revenue primarily from these activities. With a revenue of CN¥10.32 billion from this segment, it plays a significant role in the data center market within the region.

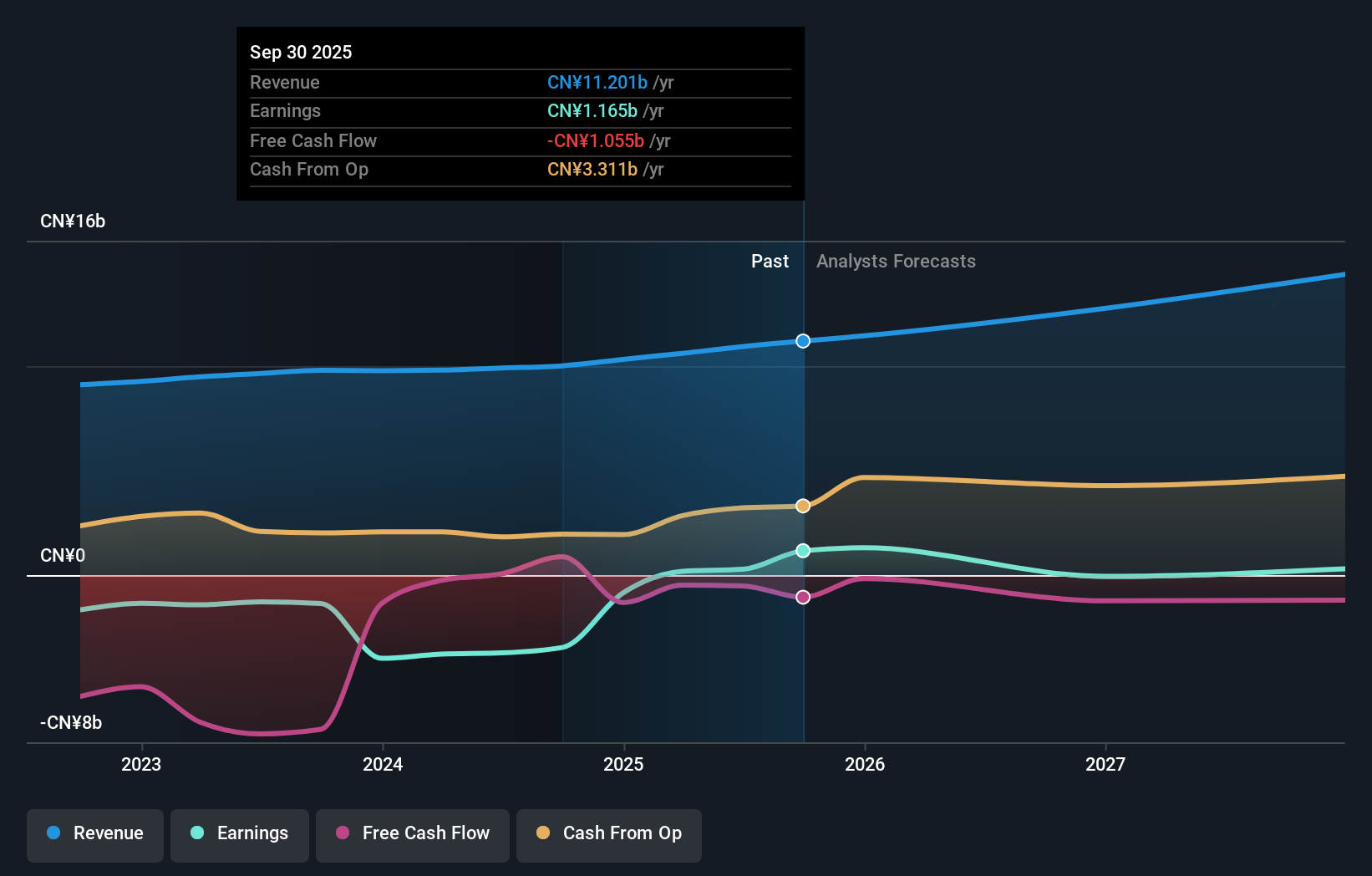

GDS Holdings, a player in the tech sector, is navigating its path towards profitability with an expected profit growth outpacing the market average. Despite current unprofitability, its revenue growth forecast at 12.2% annually surpasses the US market prediction of 8.5%. The firm's significant turnaround in net income from a substantial loss to a profit as reported in their latest quarterly earnings highlights robust year-over-year improvement. However, challenges persist with a low forecasted Return on Equity at 2.2% and ongoing cash flow concerns. GDS's commitment to scaling operations is evident from their forward-looking revenue guidance projecting up to 12.3% increase year-on-year, positioning them as a noteworthy contender in the evolving tech landscape.

- Unlock comprehensive insights into our analysis of GDS Holdings stock in this health report.

Explore historical data to track GDS Holdings' performance over time in our Past section.

Exelixis (NasdaqGS:EXEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exelixis, Inc. is an oncology-focused company dedicated to discovering, developing, and commercializing new medicines for challenging cancer treatments in the United States, with a market cap of $12.18 billion.

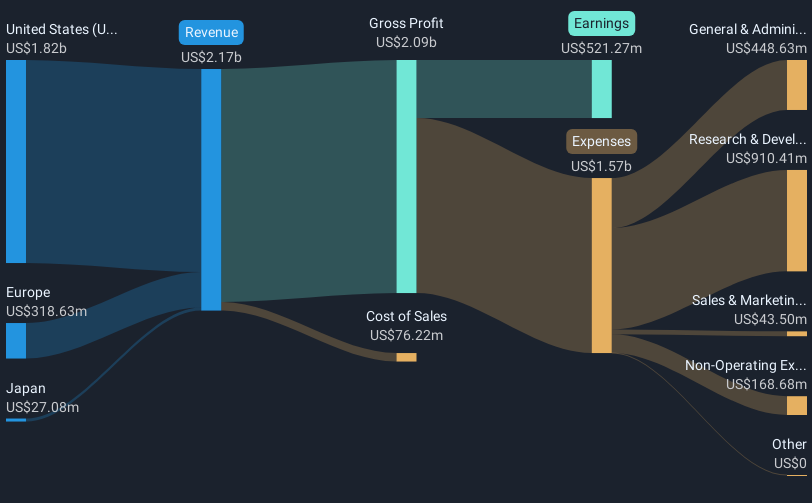

Operations: Exelixis generates revenue primarily from its focus on discovering, developing, and commercializing medicines for difficult-to-treat cancers, with reported revenue of $2.17 billion.

Exelixis, a trailblazer in biotechnology, has demonstrated robust financial and operational progress. In the first quarter of 2025, it reported a significant revenue increase to $555.45 million from $425.23 million year-over-year and a surge in net income to $159.62 million from $37.32 million, reflecting an earnings growth of nearly 328%. This performance is bolstered by its innovative R&D efforts, notably with the recent FDA approval of CABOMETYX for complex neuroendocrine tumors and the advancement of XB628 into clinical trials, highlighting its commitment to addressing unmet medical needs in oncology. The company's upward revision of its 2025 revenue forecast to between $2.25 billion and $2.35 billion underscores confidence in sustained growth driven by both existing products and promising pipeline developments.

- Navigate through the intricacies of Exelixis with our comprehensive health report here.

Assess Exelixis' past performance with our detailed historical performance reports.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of $108.15 billion.

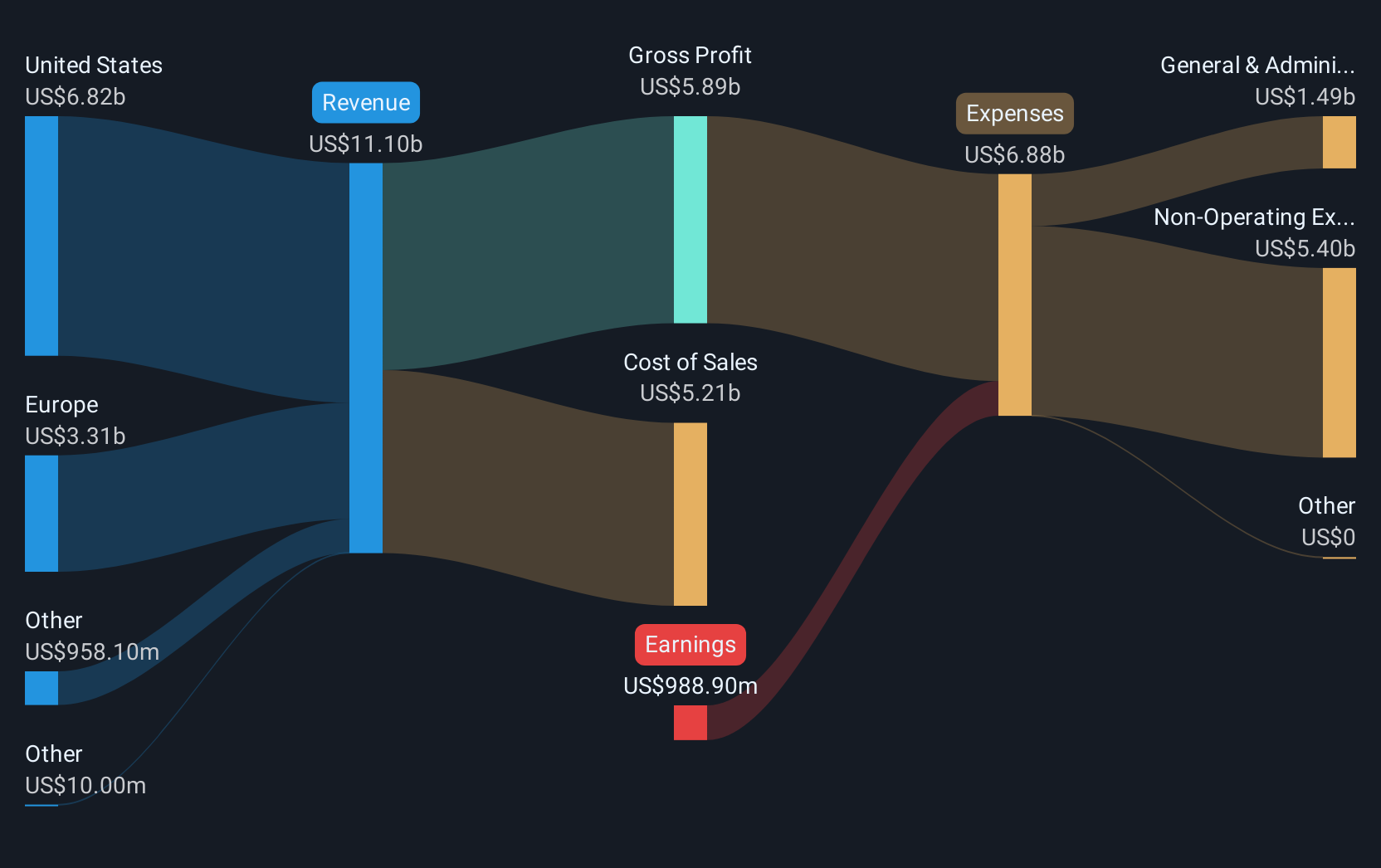

Operations: Vertex Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, which reported $11.10 billion. The company focuses on developing therapies for cystic fibrosis.

Vertex Pharmaceuticals, despite its current unprofitability, is poised for significant growth with forecasted revenue and earnings increases of 9.6% and 31.06% per year respectively. The company's strategic focus on R&D is evident from its investment trends, aligning with industry shifts towards advanced therapeutic modalities like CRISPR technology in genome editing. Recent adjustments to their 2025 revenue guidance suggest confidence in their operational trajectory amidst challenges such as a substantial impairment charge related to the discontinuation of the VX-264 program. This backdrop of innovation coupled with regulatory advancements positions Vertex distinctively within the biotech landscape, especially as it navigates recent legal complexities surrounding its genome editing therapies.

- Dive into the specifics of Vertex Pharmaceuticals here with our thorough health report.

Gain insights into Vertex Pharmaceuticals' past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 233 companies within our US High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Low risk with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion