- United States

- /

- Software

- /

- NasdaqGS:FTNT

Is Fortinet Delivering Value After Its Recent Stock Slide and Cloud Security Investments?

Reviewed by Bailey Pemberton

- Wondering whether Fortinet stock is delivering genuine value or simply riding the latest wave? If you have been keeping an eye on the cybersecurity sector, you are not alone in asking whether the current price is really a bargain.

- While Fortinet’s stock is down 3.7% over the past week and has fallen 8.0% in the last month, its performance this year has been a bit rocky, dropping 17.6% year-to-date and 17.0% over the past twelve months. Even so, the stock’s 46.3% gain over three years and a hefty 225.5% five-year return show it has long-term growth appeal.

- Recent headlines have zeroed in on Fortinet’s expansion efforts, with the company investing in new cloud security products and making strategic acquisitions to broaden its reach. This news has fueled debate: some see a business gearing up for another growth leg, while others are cautious about execution risks and a more competitive landscape.

- Fortinet currently carries a valuation score of 3 out of 6, suggesting there's room for debate about whether it is undervalued or overvalued. Let’s break down what this means through different valuation approaches. Stick around, because there is a better way to truly understand Fortinet’s fair value that we will get to by the end of the article.

Find out why Fortinet's -17.0% return over the last year is lagging behind its peers.

Approach 1: Fortinet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by forecasting its future cash flows and then discounting those sums back to today's dollars. This helps investors decide what a company is truly worth, rather than just relying on the current market price.

For Fortinet, analysts estimate that the company's latest twelve months' Free Cash Flow stands at $2.10 billion, with projections showing this growing steadily over the next decade. By 2029, Free Cash Flow is expected to reach approximately $3.59 billion, with further growth extrapolated based on typical industry trends. While the first five years of these figures rely on analyst input, the longer-term projections are calculated using moderate growth assumptions.

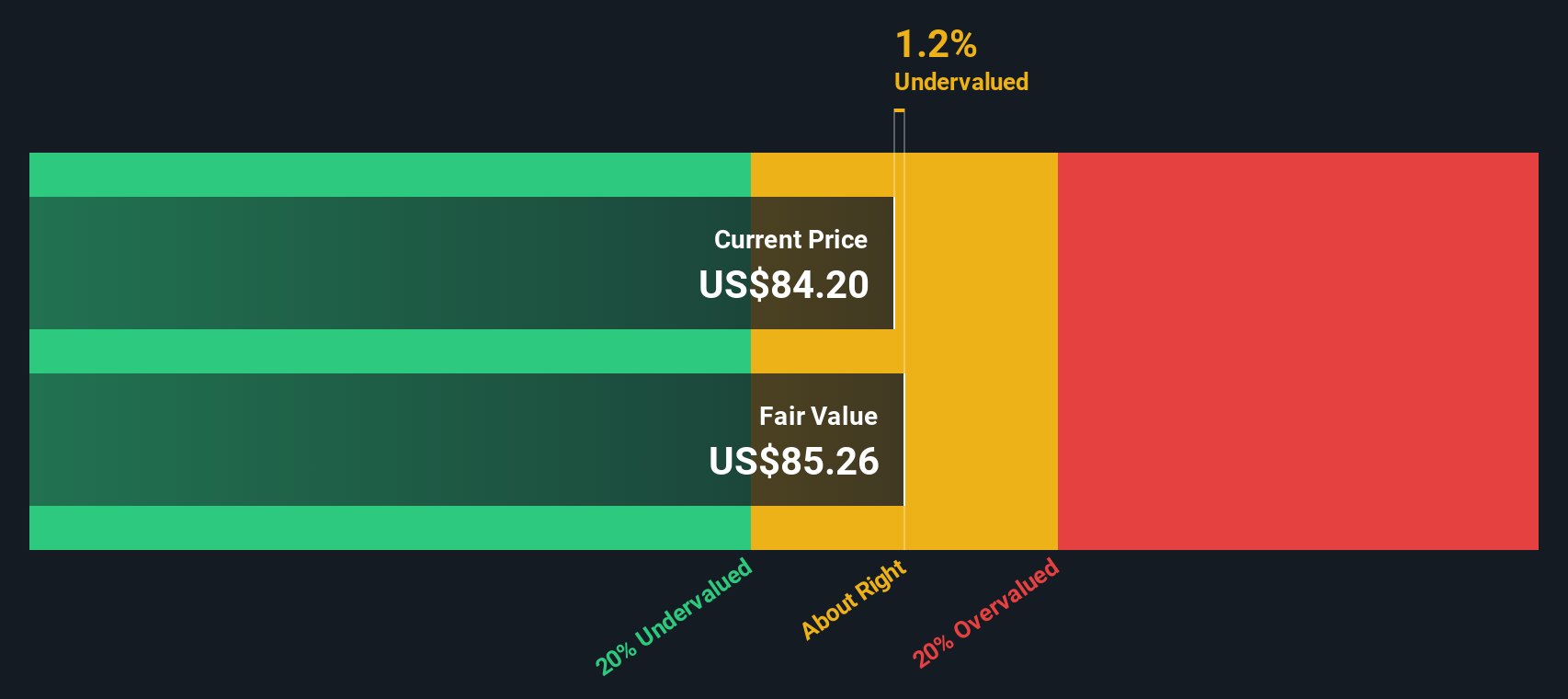

Based on this DCF approach, Fortinet's estimated fair value is $88.59 per share. With the current price trading about 11.9% below this intrinsic value, the model suggests that Fortinet stock is undervalued and may warrant further consideration.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fortinet is undervalued by 11.9%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Fortinet Price vs Earnings

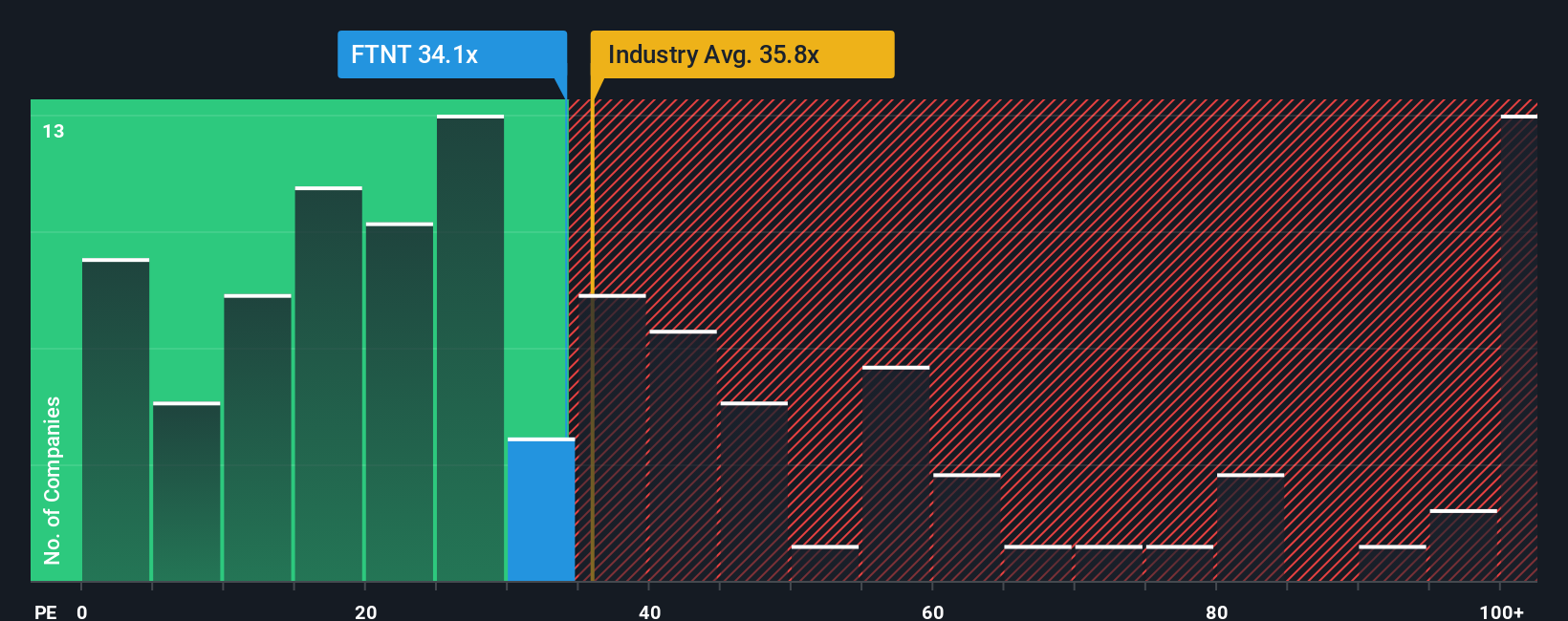

Price-to-Earnings (PE) is the preferred valuation multiple for profitable companies like Fortinet, as it directly measures how much investors are willing to pay today for every $1 of current earnings. A company’s fair or “normal” PE ratio often depends on its growth outlook and risk profile. Companies with high expected growth or lower risk usually trade at higher PE ratios, while slower-growing or riskier businesses tend to have lower multiples.

Currently, Fortinet trades at a PE ratio of 31x. This is slightly above the average for the Software industry, which sits at 29x, but well below the average of its peers at 64x. While comparing to industry or peer averages provides quick context, it can sometimes overlook company-specific factors that impact what a fair PE should be.

Simply Wall St’s “Fair Ratio” helps bridge this gap. This proprietary metric estimates what would be a reasonable multiple for Fortinet by accounting for its earnings growth, typical industry behavior, profit margins, company size, and unique risks. Fortinet’s Fair Ratio is calculated at 36x, which is a more tailored benchmark than a simple industry or peer comparison.

Since Fortinet’s current PE of 31x is moderately below the Fair Ratio of 36x, this analysis suggests the stock is undervalued on this metric and could present an attractive opportunity for long-term investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortinet Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story for a company, where you can lay out how you see its future by combining your expectations for revenue, margins, and risks with your own estimate of fair value.

Narratives let you connect the dots from the company’s business story through to clear financial forecasts, making your investment decision more logical and less reliant on guesswork or consensus targets. On Simply Wall St’s Community page, millions of investors already use Narratives as an easy and accessible tool to track their thinking and share perspectives.

With Narratives, you can see in real time how your assumptions compare to others’, and decide when to buy or sell by checking if your Fair Value is above or below the current market price. Best of all, Narratives update dynamically when major news or earnings releases happen, helping you stay up-to-date and make smarter calls.

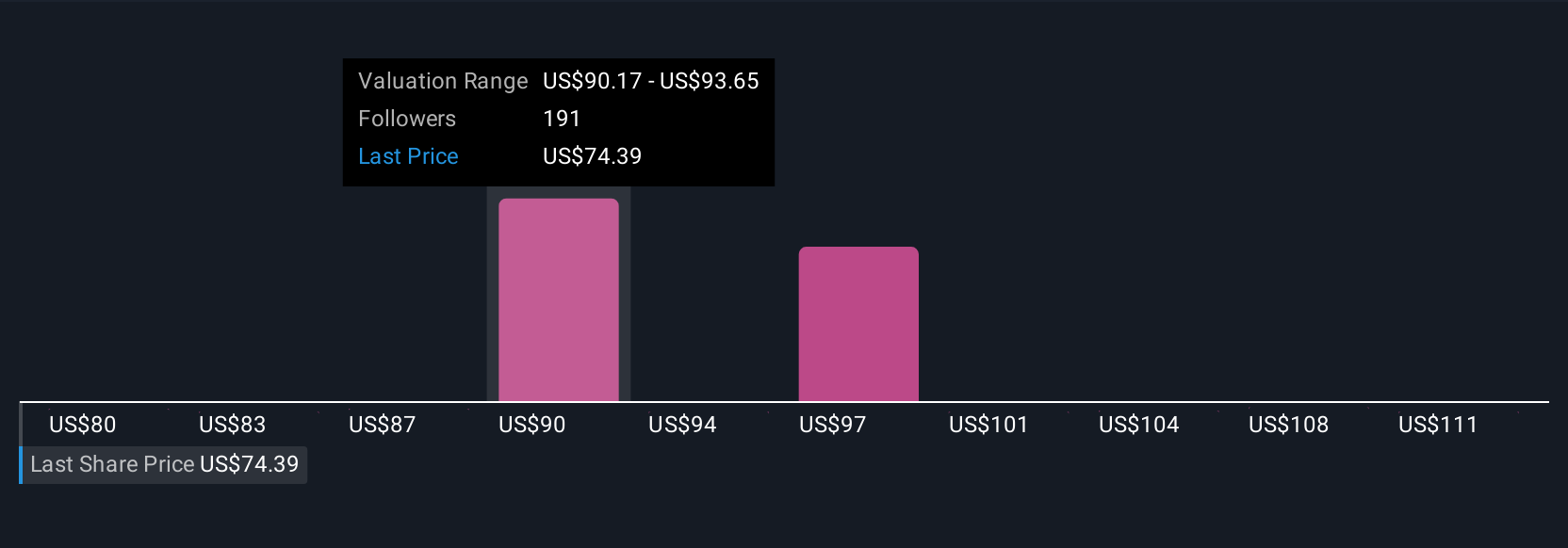

For example, one investor sees Fortinet’s profitability and organic growth as reasons to assign a fair value of $99.03 per share, while another expects slower growth and sets fair value at $87.45. Narratives reveal these differing outlooks, empowering you to shape your own story and your next move based on what matters most to you.

Do you think there's more to the story for Fortinet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives