- United States

- /

- IT

- /

- NasdaqGS:FSLY

Assessing Fastly (FSLY) Valuation After Solid Quarterly Results Spark Fresh Debate

Reviewed by Simply Wall St

Why Fastly’s latest quarter has investors talking

Investor interest in Fastly (FSLY) has picked up after solid quarterly results, which highlighted ongoing questions around customer retention, gross margins, and continuing operating losses, and sparked fresh debate about the company’s long term profit potential.

See our latest analysis for Fastly.

Fastly’s share price has pulled back to US$9.95 with a 1 day share price return of 5.51% decline and a 30 day share price return of 8.55% decline. However, the 90 day share price return of 20.90% and 1 year total shareholder return of 5.63% indicate momentum has improved recently despite a weak 5 year total shareholder return of 89.08% decline.

If Fastly’s recent swing has you reassessing opportunities, it could be a good moment to broaden your watchlist with high growth tech and AI stocks as a starting point.

With Fastly shares sitting at US$9.95, a value score of 2 and a net income loss of US$139.058 million on US$591.985 million of revenue, you have to ask: is this a mispriced turnaround, or is the market already baking in future growth?

Most Popular Narrative: 4.5% Undervalued

Fastly’s most followed narrative pegs fair value at US$10.42, slightly above the last close of US$9.95. This frames a modest valuation gap that hinges on specific growth and margin assumptions.

The acceleration of cloud migration and edge computing, combined with Fastly's increased product velocity (especially in Compute and adaptive observability analytics at the edge), expands the company's addressable market and underpins durable multi-year revenue growth.

Want to see what sits behind that confidence in future growth and margins? The narrative leans on steady revenue compounding, margin repair, and a premium future earnings multiple. Curious how those ingredients combine into that fair value target?

Result: Fair Value of $10.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture could shift quickly if pricing pressure in Fastly’s core CDN business deepens or if growth from newer security products loses momentum.

Find out about the key risks to this Fastly narrative.

Another View: DCF Sends A Different Signal

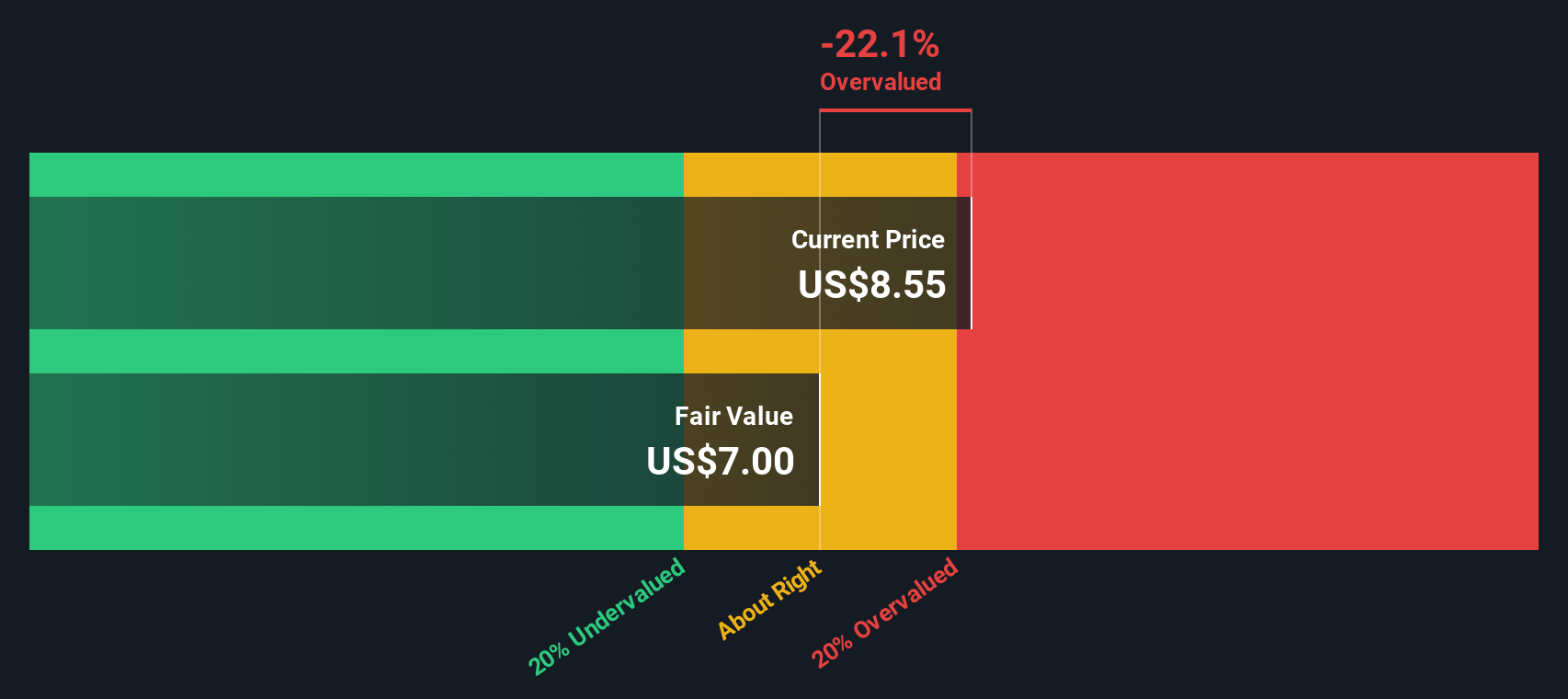

The narrative fair value of US$10.42 suggests a small undervaluation, but our DCF model indicates something different. At US$9.95, Fastly appears overvalued versus a DCF fair value of US$5.31, which indicates that the market is already assuming a much stronger future than the cash flow analysis supports.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fastly for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fastly Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Fastly story in just a few minutes with Do it your way.

A great starting point for your Fastly research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Want more investment ideas on your radar?

If Fastly has you thinking harder about risk, reward, and timing, do not stop here. Broaden your search and let data driven ideas sharpen your next move.

- Hunt for value by checking out these 877 undervalued stocks based on cash flows that the market may be pricing too cautiously based on their cash flow potential.

- Zero in on future focused themes with these 28 AI penny stocks that are tied to artificial intelligence trends you might want on your radar.

- Boost your income watchlist by reviewing these 11 dividend stocks with yields > 3% that could suit investors who prioritise regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026