- United States

- /

- Software

- /

- NasdaqGS:FRSH

The Bull Case For Freshworks (FRSH) Could Change Following Q3 2025 Earnings and Analyst Upgrades – Learn Why

Reviewed by Sasha Jovanovic

- Freshworks Inc. reported its third quarter 2025 earnings on November 5, following a period of rising consensus revenue and earnings estimates for 2025 and 2026.

- Brokerage sentiment remains positive with an "Outperform" consensus, driven by Freshworks’ ongoing enterprise customer growth and a consistent trend of surpassing analyst expectations.

- We'll explore how rising revenue estimates and strong analyst sentiment may influence Freshworks' investment outlook as Q3 results are unveiled.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Freshworks Investment Narrative Recap

To invest in Freshworks, shareholders need to believe in the long-term growth of its cloud-based enterprise solutions and the effective monetization of new AI-powered products. The recent uptick in consensus revenue and earnings estimates suggests optimism among analysts, but the short-term catalyst remains the company’s ability to accelerate enterprise customer wins and maintain outperformance. For now, news of stronger analyst sentiment and rising forecasts has not shifted the main risk: increasing competition in AI-driven SaaS. Among recent developments, the launch of Freshworks’ Freddy Agentic AI Platform stands out as directly relevant to the current investor focus. With over 5,000 paying customers for Freshworks' AI features and management expecting AI solutions to fuel future revenue growth, expanded monetization of the platform is expected to be a key driver, though pricing strategies and true incremental impact still carry uncertainty. Yet, in contrast to the growth story, investors should watch for concerning signals around rising competition from better-capitalized enterprise software peers and how this could...

Read the full narrative on Freshworks (it's free!)

Freshworks' outlook calls for $1.1 billion in revenue and $145.1 million in earnings by 2028. This requires a 12.3% annual revenue growth rate and a $200 million increase in earnings from current earnings of -$54.9 million.

Uncover how Freshworks' forecasts yield a $19.64 fair value, a 80% upside to its current price.

Exploring Other Perspectives

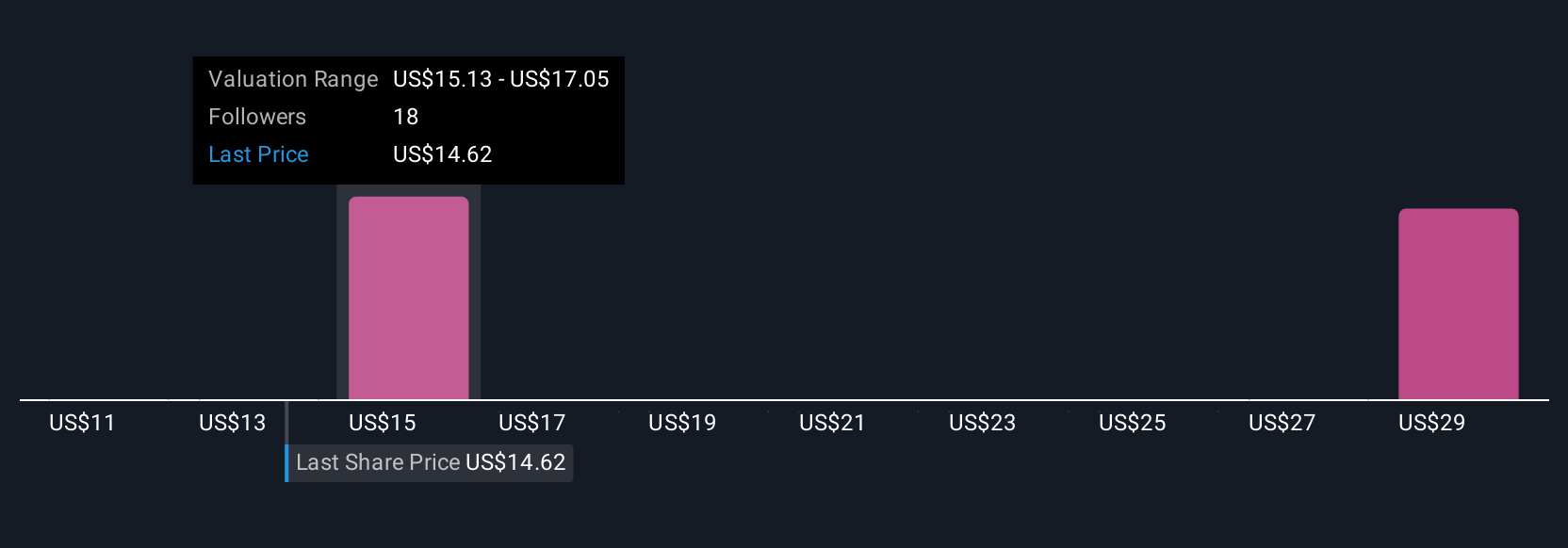

Four individual Simply Wall St Community members set fair value for Freshworks between US$15.12 and US$28.54 per share. With varied insights, you should weigh these perspectives against ongoing margin pressures and the broader debate about Freshworks' ability to scale profitably.

Explore 4 other fair value estimates on Freshworks - why the stock might be worth just $15.12!

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives