- United States

- /

- Software

- /

- NasdaqGS:FROG

JFrog (FROG) Valuation in Focus After GitHub Tech Partner of the Year Award and AI Integration Highlights

Reviewed by Simply Wall St

JFrog (FROG) has just been named GitHub’s 2025 Tech Partner of the Year, a recognition that highlights their ongoing collaboration and deepening integrations. The focus on joint solutions and AI-powered features could attract fresh investor attention.

See our latest analysis for JFrog.

Shares of JFrog have enjoyed strong momentum this year, with a 57.26% year-to-date share price return and an impressive 64.39% total shareholder return over the past twelve months. News of fresh AI integrations and the prestigious GitHub award have amplified enthusiasm. This has cemented the company's growth narrative, even as short-term dips hint at shifting risk appetite. Looking further back, the stock has doubled investors’ money over three years, though it is still working to recover from early post-IPO losses.

If you’re interested in what’s driving growth across the tech landscape, now is the perfect moment to check out the latest opportunities with our See the full list for free.

But after this surge and a high analyst consensus, is JFrog still undervalued with more room to run? Or have recent achievements already been factored into the current share price, leaving little room for upside?

Most Popular Narrative: 14.5% Undervalued

With JFrog closing at $48.28 and the most widely followed narrative setting fair value at $56.44, expectations remain strong as the gap continues to favor the bulls. Here is a direct window into the logic propelling this optimistic outlook.

Accelerating adoption of AI and machine learning across enterprises is driving increased demand for trusted, scalable artifact and AI model management; JFrog's position as the system of record for binaries and rapid traction as a model registry (including strategic wins with NVIDIA and AI industry leaders) supports strong expansion in data consumption, customer commitments, and revenue growth.

Want to peek behind the numbers? Discover which ambitious growth targets and bold profit margin assumptions are fueling such a premium. Analysts are betting big on JFrog’s evolution. The details may surprise you.

Result: Fair Value of $56.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in security and increased reliance on large enterprise contracts could dampen near-term growth and introduce added earnings volatility for JFrog.

Find out about the key risks to this JFrog narrative.

Another View: Value Signals Flashed By Sales Ratio

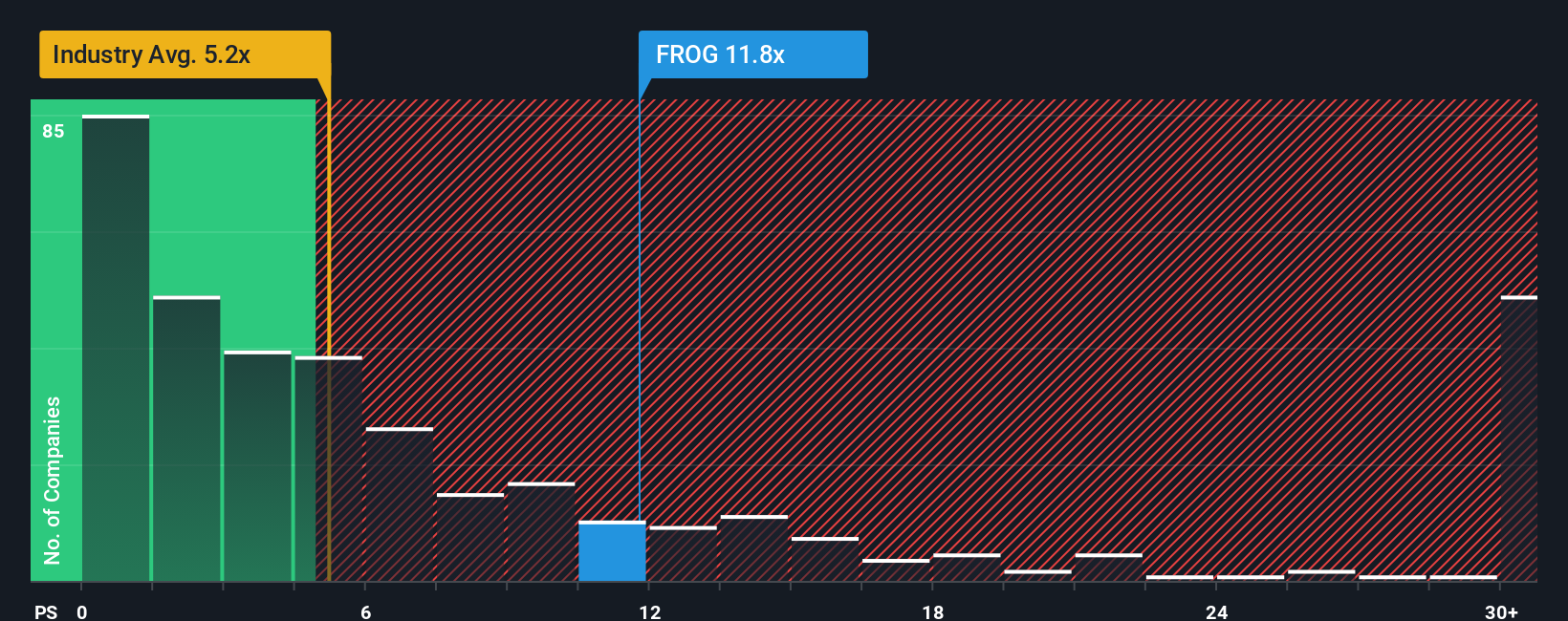

While the growth story fuels optimism, JFrog is trading at a price-to-sales ratio of 11.9x, which is significantly above the US Software industry average of 5.4x and also higher than the peer group average of 7.1x. In simple terms, investors are paying a notable premium for JFrog relative to both the industry and its closest competitors. Notably, our fair ratio stands at 7x, suggesting the market could be overestimating JFrog’s current potential if multiples revert. Does this premium open up valuation risk or signal unique opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JFrog Narrative

If you see the story differently or want to dive into the numbers firsthand, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your financial future by acting on promising trends across the market. Unleash new opportunities with these unique stock picks that could set your portfolio apart:

- Capitalize on the Artificial Intelligence boom by scanning these 26 AI penny stocks, which is setting new standards for innovation and machine learning adoption worldwide.

- Boost your income potential by targeting these 21 dividend stocks with yields > 3%, offering reliable yields greater than 3% and robust financial health.

- Seize the next wave in digital finance by analyzing these 81 cryptocurrency and blockchain stocks, tapping into blockchain, cryptocurrency, and decentralized tech opportunities before everyone else.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FROG

JFrog

Provides software supply chain platform in the United States, Israel, India, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives