- United States

- /

- Software

- /

- NasdaqGS:FROG

Here's Why Shareholders Will Not Be Complaining About JFrog Ltd.'s (NASDAQ:FROG) CEO Pay Packet

Key Insights

- JFrog's Annual General Meeting to take place on 20th of May

- CEO Shlomi Haim's total compensation includes salary of US$575.0k

- The total compensation is similar to the average for the industry

- JFrog's EPS grew by 18% over the past three years while total shareholder return over the past three years was 128%

It would be hard to discount the role that CEO Shlomi Haim has played in delivering the impressive results at JFrog Ltd. (NASDAQ:FROG) recently. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 20th of May. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for JFrog

How Does Total Compensation For Shlomi Haim Compare With Other Companies In The Industry?

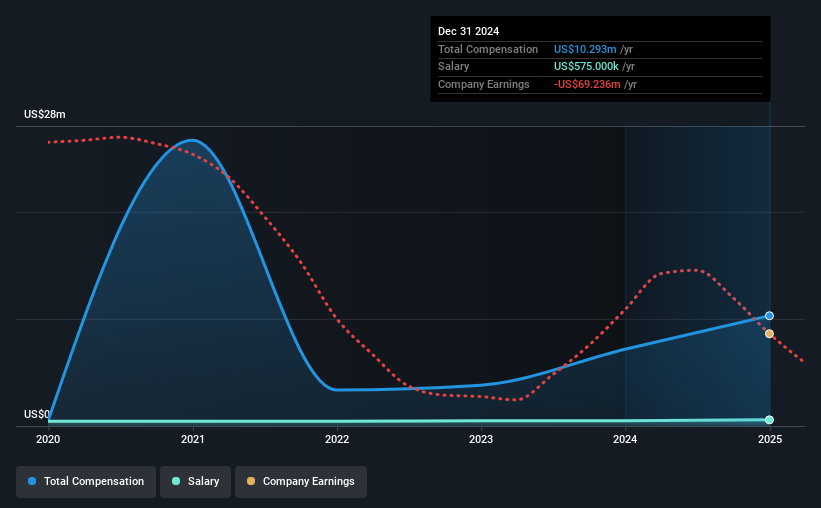

Our data indicates that JFrog Ltd. has a market capitalization of US$4.5b, and total annual CEO compensation was reported as US$10m for the year to December 2024. That's a notable increase of 44% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$575k.

On examining similar-sized companies in the American Software industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$10m. From this we gather that Shlomi Haim is paid around the median for CEOs in the industry. What's more, Shlomi Haim holds US$178m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Talking in terms of the industry, salary represented approximately 11% of total compensation out of all the companies we analyzed, while other remuneration made up 89% of the pie. JFrog pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at JFrog Ltd.'s Growth Numbers

JFrog Ltd. has seen its earnings per share (EPS) increase by 18% a year over the past three years. In the last year, its revenue is up 22%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has JFrog Ltd. Been A Good Investment?

Most shareholders would probably be pleased with JFrog Ltd. for providing a total return of 128% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for JFrog that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FROG

JFrog

Provides software supply chain platform in the United States, Israel, India, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Why did Novo Nordisk flop?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks