- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): A Fresh Look at Valuation Following Recent Share Price Shifts

Reviewed by Simply Wall St

See our latest analysis for Five9.

Five9’s latest setback comes on the heels of a tough year for shareholders, with a 1-year total shareholder return down 52.5% and the share price losing momentum over the past quarter. While short bursts of optimism, such as the recent 1-day and 7-day bounce, hint that sentiment isn’t entirely gone, it will take more than a quick rally to shift the long-term trend.

If you’re keeping an eye out for companies in tech showing real growth and resilience, this is a perfect opportunity to explore the full range of See the full list for free..

But given such a steep drop and the company’s improving fundamentals, is Five9 now trading at a bargain, or are investors already factoring in the promise of future growth into the current share price?

Most Popular Narrative: 44.1% Undervalued

Five9’s most widely followed narrative indicates a fair value of $34.76, which stands well above the recent closing price of $19.44. This gap reflects optimism that recent profitability and ongoing AI-driven developments have the potential to re-rate shares higher.

Ongoing large customer wins and multi-year contract expansions that emphasize Five9 as a single, comprehensive CX platform for both core and AI solutions demonstrate sustained demand for scalable, cloud-native contact center offerings. This supports continued enterprise revenue growth and improved dollar-based net retention rates.

What fuels this big disconnect between narrative fair value and market price? The most closely watched assumptions behind this valuation center on the company’s expected profit margin expansion and a future earnings multiple that is more commonly seen in high-growth stories. Ready to find out what ambitious forecasts are driving these expectations? Get the full story inside the complete narrative.

Result: Fair Value of $34.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing executive transitions and intensifying competition across the industry could quickly disrupt Five9's momentum and threaten the bullish narrative that underpins today’s valuations.

Find out about the key risks to this Five9 narrative.

Another View: What Does the Market Multiple Signal?

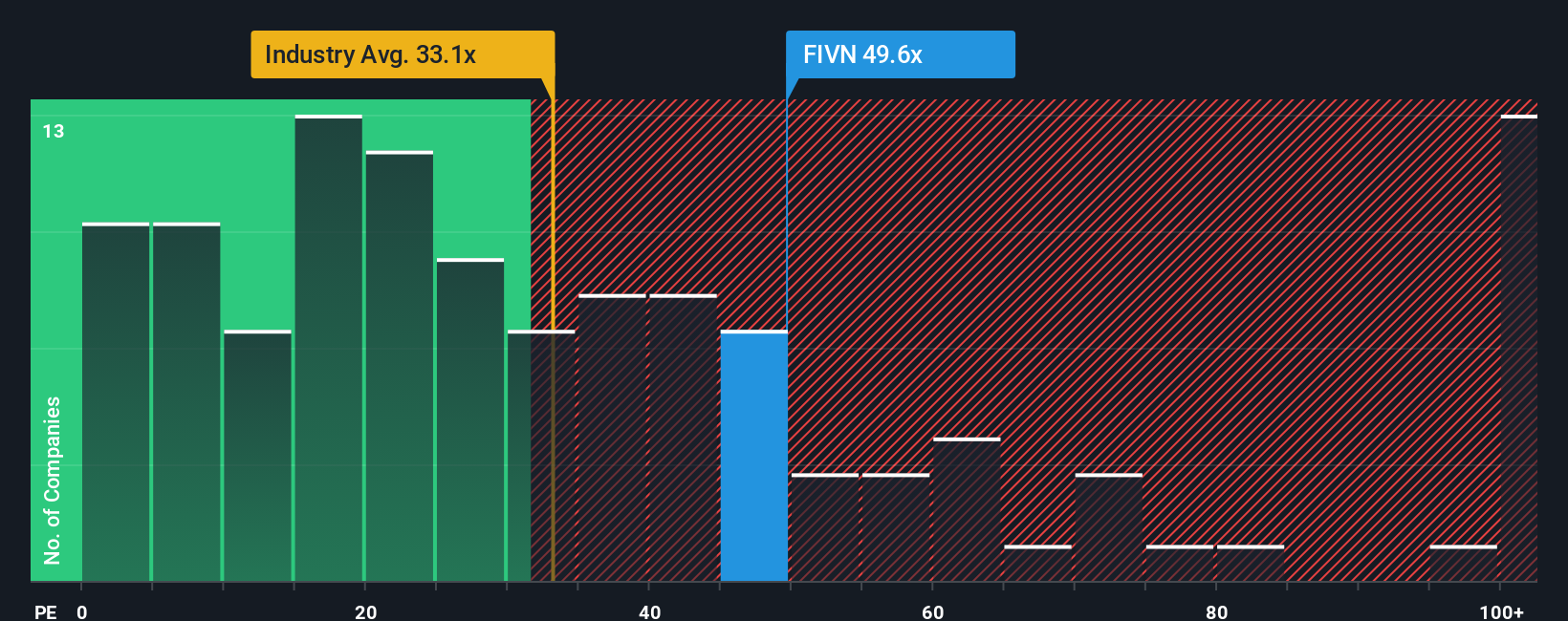

While the narrative and fair value estimates suggest Five9 is significantly undervalued, a look at the company’s price-to-earnings ratio tells a different story. Five9 trades at 48.6x earnings, which is much higher than the US software industry average of 29.8x, its peers at 33.8x, and the fair ratio of 40x. This kind of premium could mean investors are already pricing in high expectations, which increases the risk if future results fall short. How much faith can we place in these market-based signals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you think the story could go a different way or want to dig into the details yourself, you can build your own Five9 assessment in just a few minutes by using Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let market moves pass you by. Open the door to fresh investment ideas and take charge of your portfolio by checking out these handpicked opportunities today.

- Capture income potential with the highest-yielding picks by tapping into these 14 dividend stocks with yields > 3%, which offers robust dividends and financial stability.

- Ride the next wave in artificial intelligence as you scan these 26 AI penny stocks, targeting high-impact growth and innovation in the tech sector.

- Access rare gems with strong value upside when you view these 929 undervalued stocks based on cash flows, carefully selected for compelling valuations and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success