- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance with a 2.4% increase over the last week and a remarkable 25% rise over the past year, while earnings are projected to grow by 15% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong revenue growth potential and innovative capabilities to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 61.26% | 20.47% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 55.24% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.66% | ★★★★★★ |

| Travere Therapeutics | 30.01% | 61.89% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Five9 (NasdaqGM:FIVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five9, Inc. provides intelligent cloud software solutions for contact centers globally, with a market capitalization of approximately $2.97 billion.

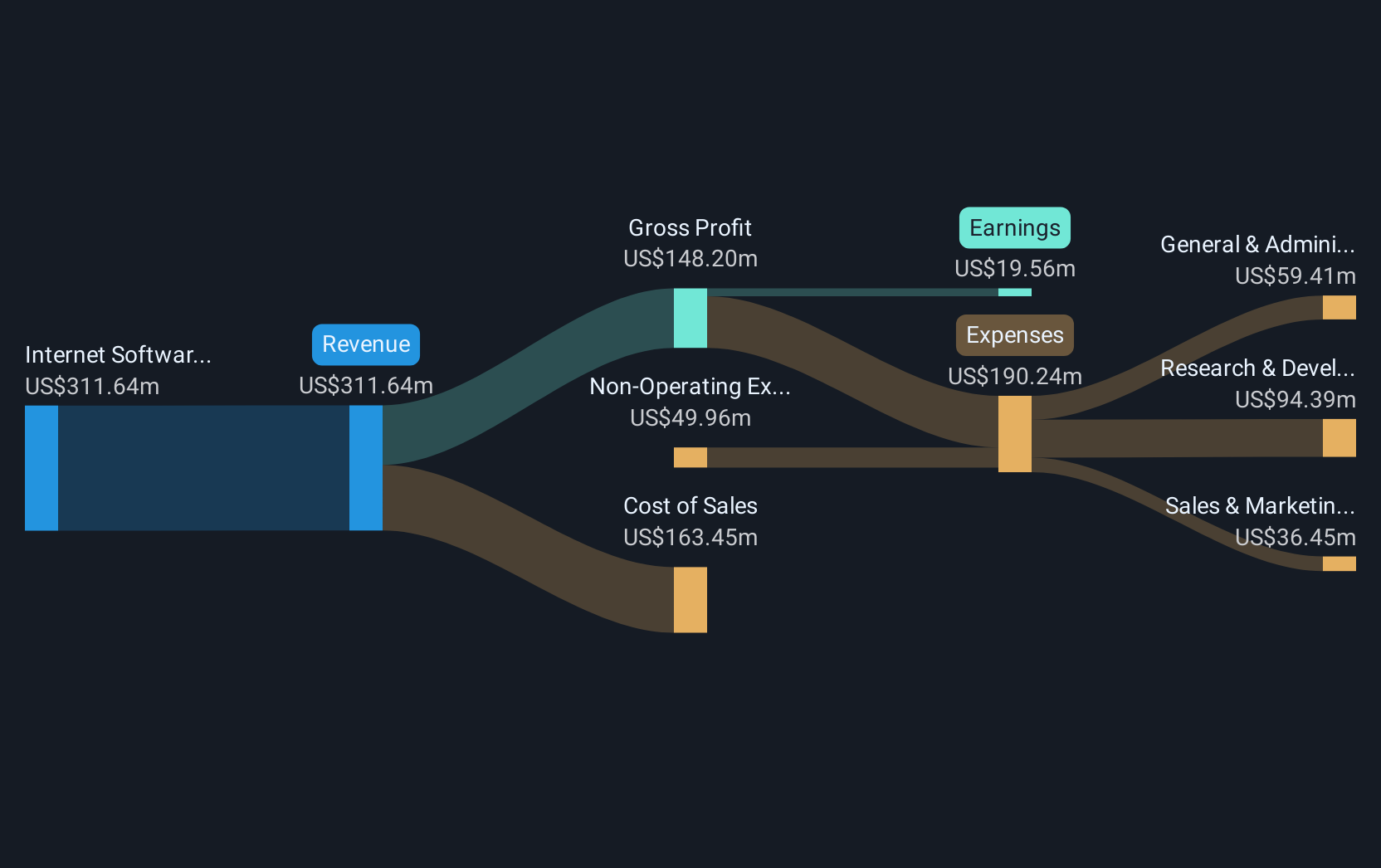

Operations: Five9, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $1 billion. The company focuses on delivering cloud-based solutions for contact centers across various regions including the United States and India.

Five9's strategic moves, including its recent integration with Microsoft Teams and enhanced security features, underscore its commitment to evolving in a competitive tech landscape. With an expected annual revenue growth of 9.7% outpacing the US market's 9%, and forecasted profitability within three years, Five9 is positioning itself robustly against industry norms. Notably, its R&D focus aligns with these ambitions; however, specific figures on R&D spending were not disclosed. The company's adaptability in integrating AI for better customer interaction management also highlights its proactive stance in leveraging technology for growth.

- Get an in-depth perspective on Five9's performance by reading our health report here.

Understand Five9's track record by examining our Past report.

Madrigal Pharmaceuticals (NasdaqGS:MDGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Madrigal Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to developing therapeutics for treating non-alcoholic steatohepatitis (NASH) in the United States, with a market cap of approximately $6.70 billion.

Operations: Madrigal focuses on developing treatments for non-alcoholic steatohepatitis (NASH) in the U.S., operating as a clinical-stage biopharmaceutical entity.

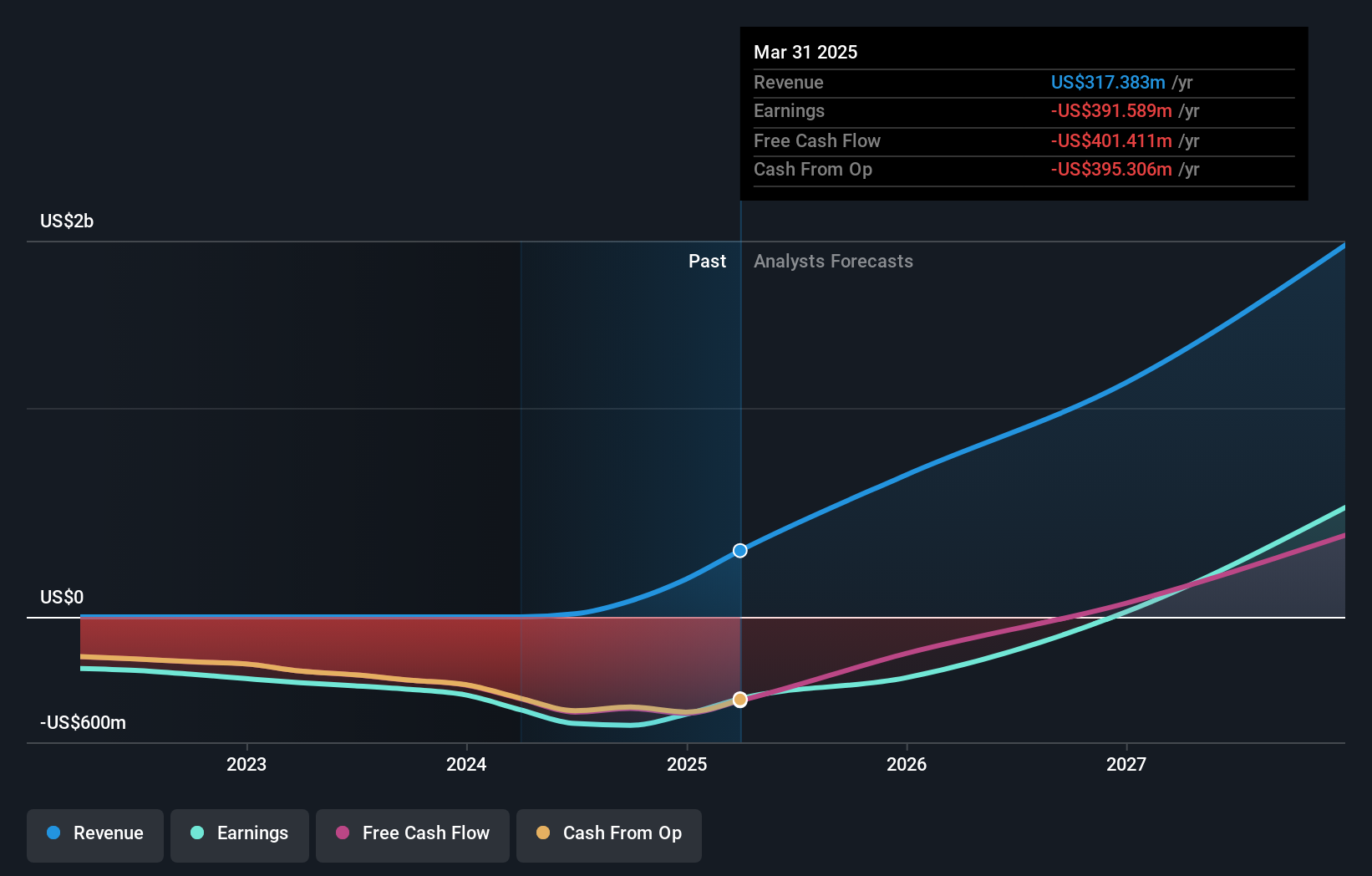

Madrigal Pharmaceuticals, spotlighted at multiple healthcare conferences, underscores its proactive engagement within the biotech sector. Despite a net loss of $106.96 million in Q3 2024, an increase from the previous year, the company is navigating through challenging financial waters with strategic shelf registration aimed at raising capital. Impressively, Madrigal's projected revenue growth stands at 45.2% annually, significantly outpacing the broader US market forecast of 9%. This robust revenue trajectory coupled with an anticipated shift to profitability within three years highlights its potential amidst current unprofitability challenges.

- Navigate through the intricacies of Madrigal Pharmaceuticals with our comprehensive health report here.

Evaluate Madrigal Pharmaceuticals' historical performance by accessing our past performance report.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. operates a specialized Internet of Things (IoT) cloud development platform serving both the People's Republic of China and international markets, with a market cap of approximately $1.13 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $280.97 million.

Tuya's recent advancements, including the introduction of a smart door lock compatible with Apple Wallet and Matter protocol, underscore its innovative strides in smart home technology. This product not only enhances user convenience through seamless integration and multiple unlocking methods but also emphasizes security with encrypted data protection. Showcasing at CES 2025, Tuya captured significant attention, reinforcing its role in pushing forward the global adoption of Matter-enabled devices. With over 200 Matter certifications across diverse product categories and a robust annual revenue growth forecast at 15.3%, Tuya is poised to make impactful contributions to the tech industry while navigating towards profitability with an anticipated earnings growth of 141.87% annually.

Taking Advantage

- Navigate through the entire inventory of 231 US High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

High growth potential and good value.

Market Insights

Community Narratives