- United States

- /

- Software

- /

- NasdaqGS:EVCM

Returns At EverCommerce (NASDAQ:EVCM) Are On The Way Up

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, EverCommerce (NASDAQ:EVCM) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on EverCommerce is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.019 = US$25m ÷ (US$1.5b - US$117m) (Based on the trailing twelve months to June 2024).

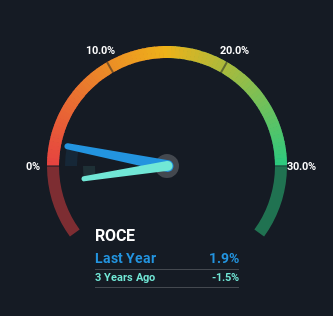

Thus, EverCommerce has an ROCE of 1.9%. In absolute terms, that's a low return and it also under-performs the Software industry average of 9.1%.

Check out our latest analysis for EverCommerce

Above you can see how the current ROCE for EverCommerce compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for EverCommerce .

So How Is EverCommerce's ROCE Trending?

The fact that EverCommerce is now generating some pre-tax profits from its prior investments is very encouraging. About four years ago the company was generating losses but things have turned around because it's now earning 1.9% on its capital. Not only that, but the company is utilizing 28% more capital than before, but that's to be expected from a company trying to break into profitability. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

What We Can Learn From EverCommerce's ROCE

Long story short, we're delighted to see that EverCommerce's reinvestment activities have paid off and the company is now profitable. Astute investors may have an opportunity here because the stock has declined 46% in the last three years. So researching this company further and determining whether or not these trends will continue seems justified.

Before jumping to any conclusions though, we need to know what value we're getting for the current share price. That's where you can check out our FREE intrinsic value estimation for EVCM that compares the share price and estimated value.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if EverCommerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EVCM

EverCommerce

Provides integrated software-as-a-service solutions for service-based small and medium-sized businesses in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks