- United States

- /

- IT

- /

- NasdaqGS:DOX

Does Amdocs Offer Strong Value After Recent Share Price Recovery in 2025?

Reviewed by Bailey Pemberton

If you are considering whether to hold, buy, or sell Amdocs stock, you are not alone. The company’s performance has been attracting attention from smart investors trying to see through recent market shifts. Over the last week, Amdocs gained 1.1%, recovering some ground after a softer stretch in which the stock slipped 2.7% over the past month and is still slightly down for the year. Looking at a longer time frame, the past five years have brought a robust 54.4% return, underscoring this stock’s ability to deliver long-term value even through periods of turbulence.

Much of what is moving Amdocs today is influenced by broader shifts in the tech sector, especially as digital transformation continues to reshape how companies invest in services and infrastructure. Increased demand for telecom technology and business software has pointed a spotlight at players like Amdocs, while changes in risk appetite across the market have added to the ups and downs in the share price.

But what about the underlying value? Here is something to pay close attention to: according to our scoring model, Amdocs is undervalued in all 6 out of 6 key valuation checks. That results in a value score of 6, which is an impressive clean sweep no matter how you view it.

Let’s break down how Amdocs measures up across the major valuation approaches, then explore if there is an even better way to interpret what the numbers really mean.

Why Amdocs is lagging behind its peers

Approach 1: Amdocs Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This method helps investors look past short-term swings and focus on what the business could earn over time.

For Amdocs, the current Free Cash Flow sits at $613.5 Million. Analyst forecasts provide detailed projections up to five years, with an estimated Free Cash Flow of $972.6 Million by 2030. Beyond those years, projections are extrapolated based on historical trends. This gradual increase in cash flows highlights expectations of steady growth in the company’s core business over the next decade.

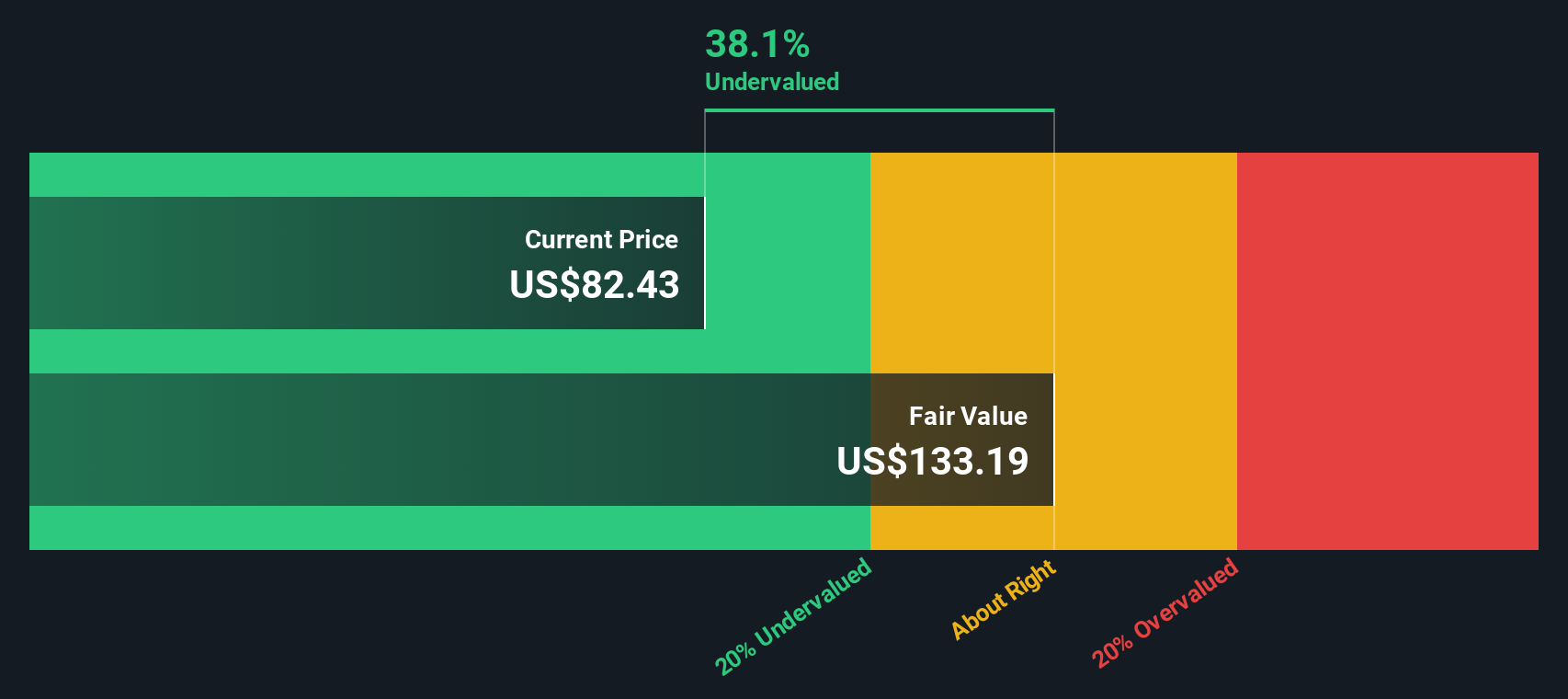

Based on this model, the estimated fair value per share for Amdocs is $132.52. Importantly, this valuation indicates the stock is trading at a 38.0% discount to its estimated intrinsic value, meaning it is 38.0% undervalued according to the DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amdocs is undervalued by 38.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Amdocs Price vs Earnings (P/E Ratio Analysis)

For companies that are consistently profitable like Amdocs, the Price-to-Earnings (P/E) ratio is often the go-to valuation measure. This ratio helps investors gauge how much they are paying for each dollar of a company's earnings, making it a sensible barometer for established businesses with steady profits. An appropriate P/E ratio can be influenced by a company’s future growth expectations and the perceived risk associated with its operations. Higher growth or lower risk typically justifies a higher ratio.

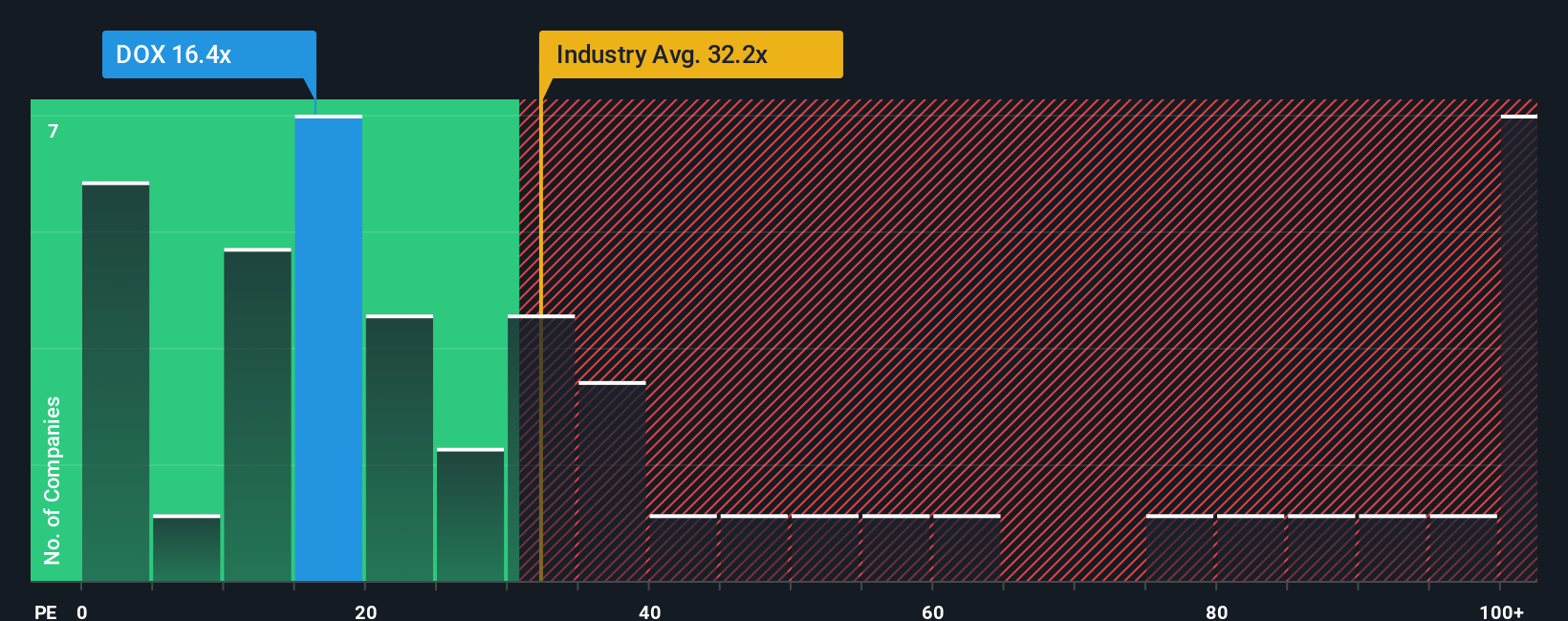

Currently, Amdocs trades at a P/E ratio of 16.31x. That is below both the average for peers in its sector, which sits at 18.45x, and the broader IT industry average of 32.73x. At first glance, this might point to undervaluation, but these comparisons only tell part of the story.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for Amdocs is calculated at 33.97x, taking into account not just basic price and earnings data, but also factors like Amdocs' projected growth, risk profile, profitability, position within the industry, and its overall size. Unlike simple peer or industry averages, the Fair Ratio tailors the expected multiple specifically to Amdocs’ unique characteristics, providing a more nuanced benchmark for valuation.

Comparing Amdocs' current P/E of 16.31x with its Fair Ratio of 33.97x, the stock appears clearly undervalued on this metric. The significant gap suggests that the market may be undervaluing Amdocs’ future earnings potential relative to its fundamentals and risk.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amdocs Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story, a combination of your reasoning and assumptions about where you think a company like Amdocs is headed, tied directly to the numbers behind your forecast.

Narratives enable you to connect the dots between a company’s business outlook, future revenue, earnings, margins, and what you believe to be its fair value. This approach makes it easier to translate your perspective into actionable insights, helping you make better investment decisions based on both qualitative and quantitative factors.

On Simply Wall St’s Community page, millions of investors are already using Narratives to compare their fair value to the current share price, making it clear when to buy, sell, or hold based on their own logic. These Narratives update automatically with new information, such as company news or results, so your view stays relevant and up to date.

For example, one investor might forecast Amdocs’ value at $104 per share based on expectations for strong cloud and AI-fueled growth, while another might set it much lower, citing risks like slow SaaS uptake or client concentration.

Do you think there's more to the story for Amdocs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOX

Amdocs

Through its subsidiaries, provides software and services to communications, entertainment, media, and other service providers worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion