- United States

- /

- Software

- /

- NasdaqGS:DOCU

Returns Are Gaining Momentum At DocuSign (NASDAQ:DOCU)

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at DocuSign (NASDAQ:DOCU) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on DocuSign is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.064 = US$137m ÷ (US$3.8b - US$1.6b) (Based on the trailing twelve months to July 2024).

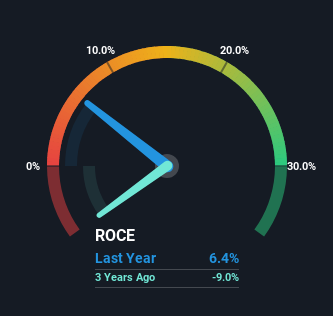

So, DocuSign has an ROCE of 6.4%. In absolute terms, that's a low return and it also under-performs the Software industry average of 9.1%.

View our latest analysis for DocuSign

Above you can see how the current ROCE for DocuSign compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for DocuSign .

What The Trend Of ROCE Can Tell Us

DocuSign has recently broken into profitability so their prior investments seem to be paying off. The company was generating losses five years ago, but now it's earning 6.4% which is a sight for sore eyes. In addition to that, DocuSign is employing 81% more capital than previously which is expected of a company that's trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 43% of its operations, which isn't ideal. And with current liabilities at those levels, that's pretty high.

In Conclusion...

Long story short, we're delighted to see that DocuSign's reinvestment activities have paid off and the company is now profitable. Investors may not be impressed by the favorable underlying trends yet because over the last five years the stock has only returned 6.4% to shareholders. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

On a final note, we've found 1 warning sign for DocuSign that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Great dividend but share numbers have increased 100% in last 12 months!!

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.