- United States

- /

- Software

- /

- NasdaqGS:DOCU

Is DocuSign’s (DOCU) Socure Partnership Transforming Digital Agreement Security and User Experience?

- On October 16, 2025, Socure announced a partnership with DocuSign to embed its comprehensive identity verification suite into DocuSign Identify, providing real-time risk-based authentication and fraud detection options for millions of DocuSign users worldwide.

- This collaboration allows organizations to streamline document workflows by combining advanced fraud detection and AI-powered risk tools, significantly reducing user friction compared to traditional authentication methods.

- We'll examine how DocuSign's integration of AI-driven identity verification with Socure may enhance its expanding agreement management platform.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

DocuSign Investment Narrative Recap

To be a DocuSign shareholder today, you need to believe that its push into AI-powered agreement management, strengthened by new partnerships like Socure, can drive adoption and upsell its existing customer base while fending off mounting competition. While this Socure integration could further differentiate DocuSign’s platform and attract enterprise clients, it does not materially address the biggest immediate challenge: the risk that the core eSignature market is maturing and revenue growth may continue slowing despite new product introductions.

Among recent announcements, the September roll-out of DocuSign's Intelligent Agreement Management (IAM) platform to federal clients stands out, expanding opportunities in regulated sectors but also highlighting the lengthy, uncertain path of turning international and enterprise expansion into significant, profitable revenue streams. Both the Socure partnership and IAM’s growing feature set support DocuSign's efforts to move beyond its traditional eSignature market, but execution risks and return timelines remain difficult to gauge for investors seeking upside from these catalysts.

Yet, investors should also be aware that as competitors leverage AI to attack DocuSign’s core market, the growing risk of pricing pressure and customer attrition...

Read the full narrative on DocuSign (it's free!)

DocuSign's narrative projects $3.8 billion in revenue and $359.8 million in earnings by 2028. This requires 7.3% yearly revenue growth and a $78.8 million increase in earnings from $281.0 million.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 37% upside to its current price.

Exploring Other Perspectives

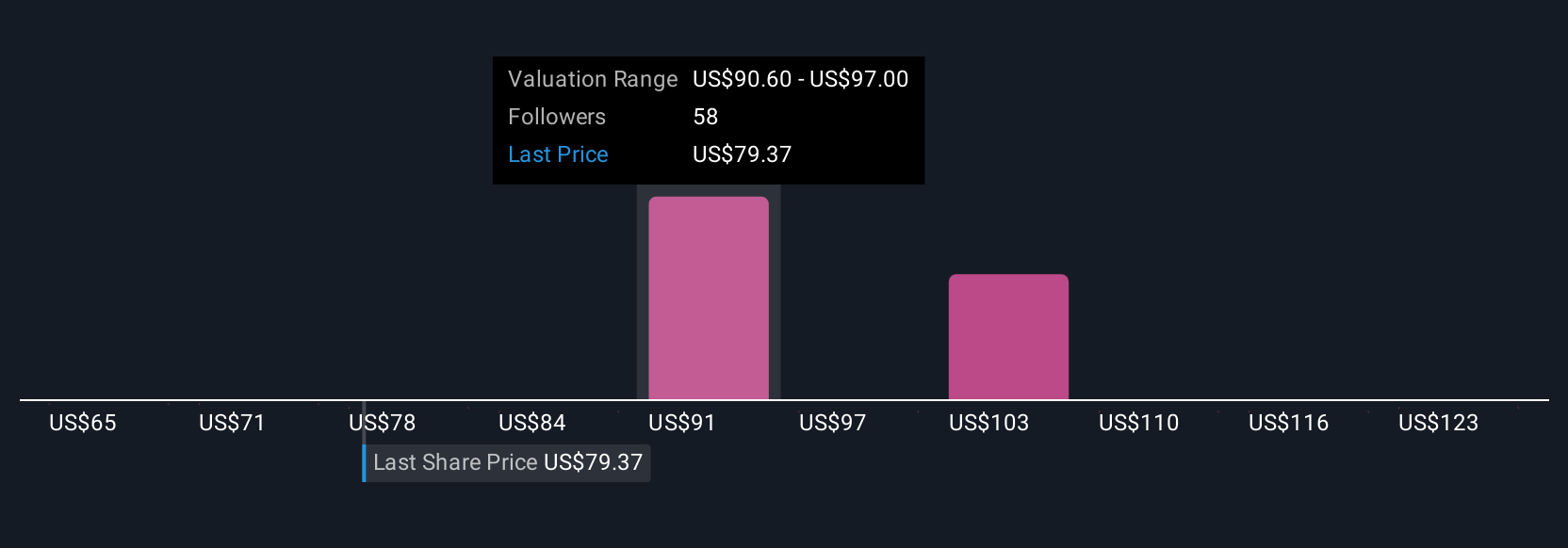

Six individual fair value estimates from the Simply Wall St Community range from US$77 to US$118 per share, reflecting broad disagreement on DocuSign’s outlook. With potential commoditization in the digital agreement space, these wide community perspectives highlight just how differently investors are weighing competitive pressures and future growth.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth as much as 74% more than the current price!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks