- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (NasdaqGS:DOCU) Partners With Guidewire To Enhance Insurer Efficiency Globally

Reviewed by Simply Wall St

DocuSign (NasdaqGS:DOCU) experienced a 3% decline last week, during a period marked by the launch of an integrated solution within Guidewire's PolicyCenter and ClaimCenter platforms. This integration was designed to enhance workflows for property and casualty insurers, potentially bolstering operational efficiency. While this development was noteworthy, broader market factors, such as rising geopolitical tensions between Israel and Iran and anticipation around the Federal Reserve's interest rate decision, contributed to market volatility. Major indices like the Nasdaq Composite saw modest gains, emphasizing external factors' influence over DocuSign's performance amid these prevailing uncertainties.

Find companies with promising cash flow potential yet trading below their fair value.

The recent integration of DocuSign's solutions within Guidewire's platforms has the potential to enhance the company's growth strategy by streamlining operations for property and casualty insurers. This development could support the company's broader expansion efforts, particularly in its Intelligent Agreement Management (IAM) initiative. As DocuSign focuses on SMB, mid-market, and international segments, these enhancements might bolster revenue growth despite facing AI and economic uncertainties.

Over the past year, DocuSign achieved a total return of 46.77%, reflecting a robust performance compared to the growth of the broader US Software industry. However, during the past week, the company's shares dipped by 3% amid prevailing market volatility driven by external geopolitical and economic factors. This short-term movement contrasts with the longer-term appreciation observed over the previous year.

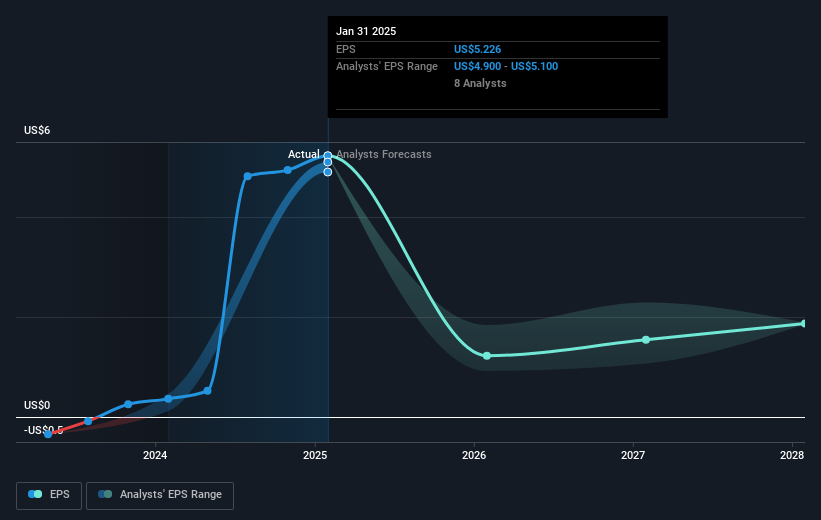

Analysts anticipate that DocuSign's revenue and earnings projections might be influenced by both the integration within Guidewire's platforms and ongoing efficiency improvements. These projections include a 7.4% annual revenue growth forecast over the next three years, though profit margins are expected to decline from 35.9% to 8.9%. The current share price of US$81.65 suggests a potential upside when compared to the consensus price target of US$88.63. This indicates that despite recent fluctuations, analysts believe there remains room for appreciation in DocuSign's share value.

Take a closer look at DocuSign's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives