- United States

- /

- Software

- /

- NasdaqGS:DDOG

Is Datadog (DDOG) Now Attractive After Recent Share Price Pullback?

- If you are wondering whether Datadog's current share price lines up with its underlying worth, you are not alone. This article focuses squarely on what the numbers suggest about value.

- Datadog recently closed at US$125.49, with a 7 day return of a 6.2% decline, a 30 day return of a 14.0% decline, and a year to date return of a 6.2% decline, while the 1 year return sits at a 10.6% decline. The 3 year and 5 year returns are 78.1% and 25.7% respectively.

- Recent coverage of Datadog has highlighted it as a key player in observability and cloud monitoring, which keeps it on many investors' watchlists. This context helps frame why the share price has seen both pullbacks in the short term and stronger performance over the multi year period.

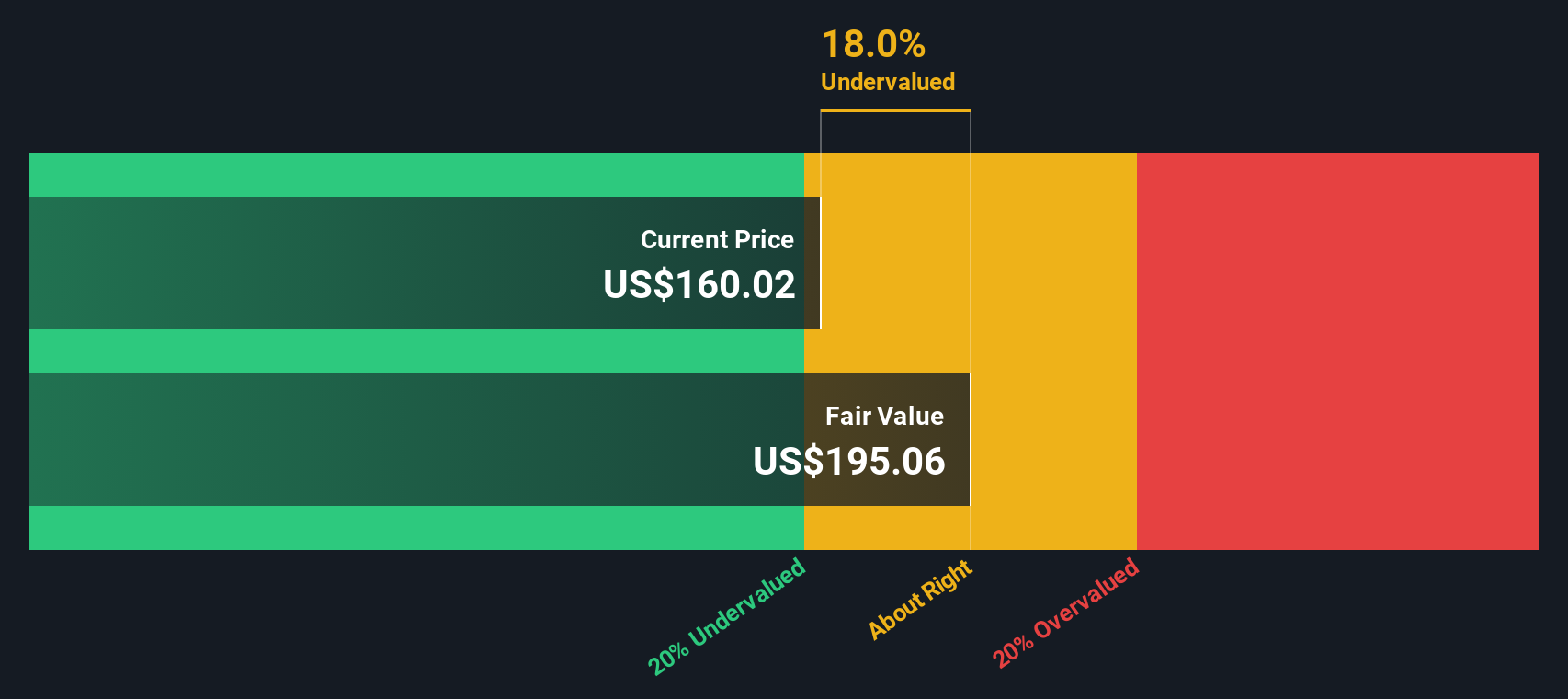

- On our valuation framework, Datadog has a value score of 3/6, meaning it screens as undervalued on half of the checks we use. Next we will walk through those valuation methods before rounding out with a broader way to think about what the stock might be worth.

Find out why Datadog's -10.6% return over the last year is lagging behind its peers.

Approach 1: Datadog Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows and discounts them back to today using a required rate of return, to arrive at an estimate of what the business might be worth now.

For Datadog, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections. The latest twelve month Free Cash Flow is about $874.3 million. Analyst inputs and extrapolated estimates point to Free Cash Flow reaching around $4.0b by 2030, with values between 2026 and 2035 projected and then discounted back to today by Simply Wall St.

Bringing all of those future cash flows into today’s terms results in an estimated intrinsic value of about $248.78 per share under this DCF model. Compared with the recent share price of $125.49, this implies the stock screens as about 49.6% undervalued on this specific set of assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Datadog is undervalued by 49.6%. Track this in your watchlist or portfolio, or discover 880 more undervalued stocks based on cash flows.

Approach 2: Datadog Price vs Sales

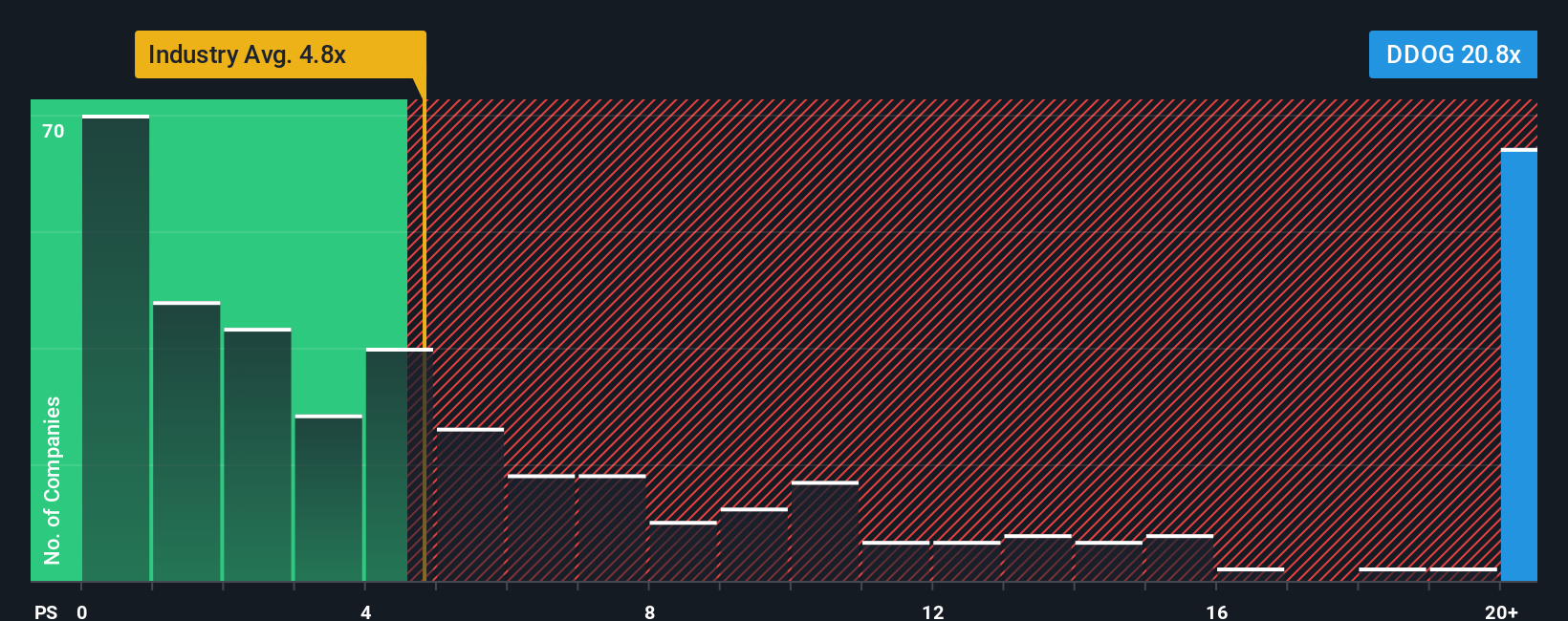

For companies that are focused on growth and may be reinvesting heavily, the P/S ratio is often a useful cross check because it compares what you are paying to the revenue the business is already generating. It avoids some of the noise that can sit in earnings for high growth software names.

In general, higher expected growth and lower perceived risk can support a higher “normal” P/S ratio, while slower growth or higher risk tends to justify a lower one. Datadog currently trades on a P/S of 13.70x. That sits above the Software industry average of 4.95x and above the peer group average of 9.73x.

Simply Wall St’s Fair Ratio for Datadog is 12.51x. This is its proprietary estimate of what the P/S multiple might be given factors such as Datadog’s growth profile, industry, profit margins, market cap and risk characteristics. This Fair Ratio can be more informative than a simple peer or industry comparison because it adjusts for those company specific inputs rather than using broad group averages. Set against the current P/S of 13.70x, Datadog screens as overvalued on this metric.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Datadog Narrative

Earlier we mentioned that there is an even better way to think about valuation. On Simply Wall St you can use Narratives, which are short, clear stories that link your view of Datadog’s business to specific forecasts for revenue, earnings and margins. These are then converted into a fair value, which you can compare to the current share price to see if it looks high or low. Everything is kept updated automatically as new news or earnings arrive, all within the Community page where millions of investors share their views. For example, one Datadog Narrative might assume the higher analyst fair value of about US$208.49 and lean on the more optimistic earnings expectations, while another might sit closer to the lower analyst price target of US$105 and use the more cautious earnings estimate of US$145.8m by 2028. This gives you a clear sense of how different stories about the same company lead to different fair values and potential decisions.

Do you think there's more to the story for Datadog? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web