- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG): Evaluating Current Valuation and Market Prospects in the Cloud Monitoring Sector

Datadog (DDOG) continues to draw attention from investors, especially as recent performance numbers signal interesting trends for the company. Its year-to-date gains and wider market moves provide context for anyone watching the cloud monitoring sector.

See our latest analysis for Datadog.

Datadog’s share price has gained strong momentum lately, with a recent 17.1% return over the last 90 days setting it apart from many tech peers. While there were some short-term dips this month, the stock’s robust three-year total shareholder return of 114.17% and year-to-date price return of 11.4% point to ongoing confidence in its growth story, even as near-term volatility reminds investors to stay watchful.

If you’re keeping an eye on cloud innovators like Datadog, you can spot more tech movers and fresh opportunities with our curated list: See the full list for free.

The key question for investors now is whether Datadog’s recent gains leave more room for upside, or if the stock’s forward momentum already reflects all the positive future expectations. Are we looking at a buying opportunity, or has the market already priced in its growth potential?

Most Popular Narrative: 24.5% Undervalued

Compared to Datadog’s last close at $160.01, the most popular narrative assigns a fair value of $211.97. This suggests strong potential for upside. This valuation reflects expectations that future earnings and platform expansion can outpace recent volatility and market skepticism.

Ongoing product innovation (for example, autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance. This is providing cross-selling opportunities and driving higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins.

Curious which assumptions are powering this bullish stance? The narrative’s core rests on a unique mix of rising margins and future profit multiples that defy typical software sector trends. Find out what surprising numbers could justify this aggressive fair value.

Result: Fair Value of $211.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major customers cutting spending or fiercer competition from new platform entrants could quickly challenge Datadog’s optimistic growth outlook.

Find out about the key risks to this Datadog narrative.

Another View: Valuation by Sales Ratio

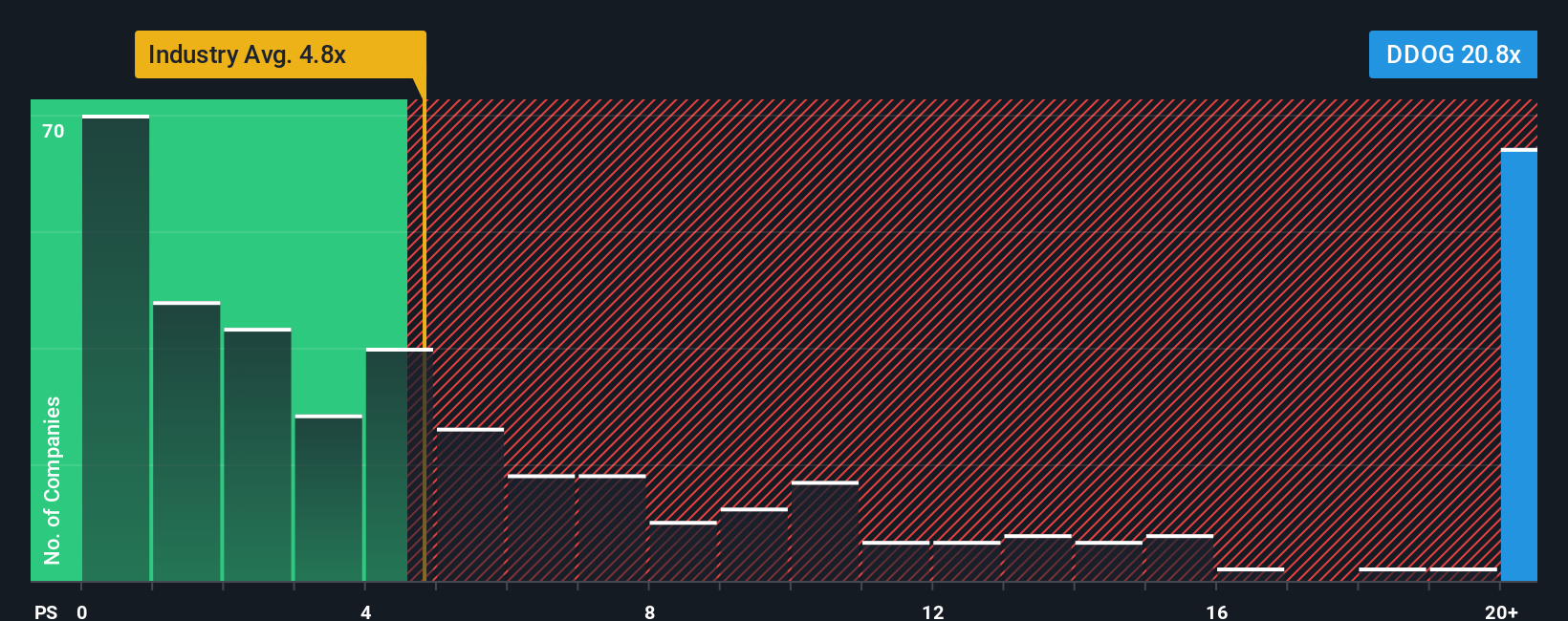

Taking a look from a price-to-sales perspective, Datadog comes out as expensive. Its ratio stands at 17.5 times sales, much higher than the peer average of 7.2 times and the industry’s 4.9 times. That is well above the fair ratio of 15.5 times that the market might ultimately target. Does this premium signal lasting quality, or possible over-exuberance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If the current analysis doesn’t match your take or you want to test your own assumptions, you can dive into the data and shape your own view in just a few minutes. Do it your way.

A great starting point for your Datadog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and give yourself the edge by seeking out fresh investment angles before the crowd. Don’t miss out on opportunities only found through creative stock hunting. Incredible growth stories and solid value plays await just beyond the obvious choices.

- Accelerate your hunt for tomorrow’s winners with these 914 undervalued stocks based on cash flows, which signals exceptional value potential hidden in plain sight.

- Tap into growth at the intersection of healthcare and technology by reviewing these 30 healthcare AI stocks, helping shape next-generation medical breakthroughs.

- Plug into the future of finance by considering these 81 cryptocurrency and blockchain stocks, shaping secure payment systems and decentralized innovation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.

Nedbank please contact me,l need guidance step by step, please