- United States

- /

- Software

- /

- NasdaqGS:CYBR

Assessing CyberArk Software (CYBR) Valuation as Investor Momentum Pauses

Reviewed by Simply Wall St

See our latest analysis for CyberArk Software.

CyberArk’s momentum has cooled a bit recently, but its bigger picture remains bright. Despite a modest dip in the 1-day and 30-day share price returns, the stock’s year-to-date gain of 41.71% and outstanding one-year total shareholder return of 50.10% show investors are rewarding its growth. Long-term holders have seen substantial value created, with total shareholder returns of 210% over three years and 326% over five years.

If you’re watching how tech leaders like CyberArk perform, this could be the perfect time to discover See the full list for free.

That leaves investors with a key question: Is CyberArk now attractively valued given its recent pause, or is the market already factoring in all of its anticipated future growth?

Most Popular Narrative: 2% Undervalued

CyberArk’s most-followed valuation narrative sets a fair value at $485.47, marginally above the last close of $475.67. This slight premium suggests that the growth story may not be fully reflected in the share price yet, depending on whether you subscribe to the narrative’s bold projections.

The evolving machine identity market, coupled with CyberArk’s focus on AI-driven identity security through its machine identity capabilities and Secrets Management, is expected to drive significant revenue growth as organizations seek integrated solutions to manage increasingly complex identity security needs. CyberArk's unified identity security platform, which includes privileged access management and workforce security, is expected to drive higher average deal sizes, revenue growth, and improved net margins as customers increasingly consolidate their identity security solutions with trusted vendors.

What powers this razor-thin valuation edge? The most popular narrative is betting on rapid-fire revenue acceleration, a profitability turnaround, and premium profit multiples typical of only the hottest tech stocks. Just what kind of earnings leap and margin expansion fuel this fair value? Click through to see the exact assumptions that could change how you look at CyberArk today.

Result: Fair Value of $485.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential challenges integrating recent acquisitions and the unpredictability of evolving cybersecurity threats. Both of these factors could affect CyberArk’s growth outlook.

Find out about the key risks to this CyberArk Software narrative.

Another View: Do High Sales Multiples Signal Risk?

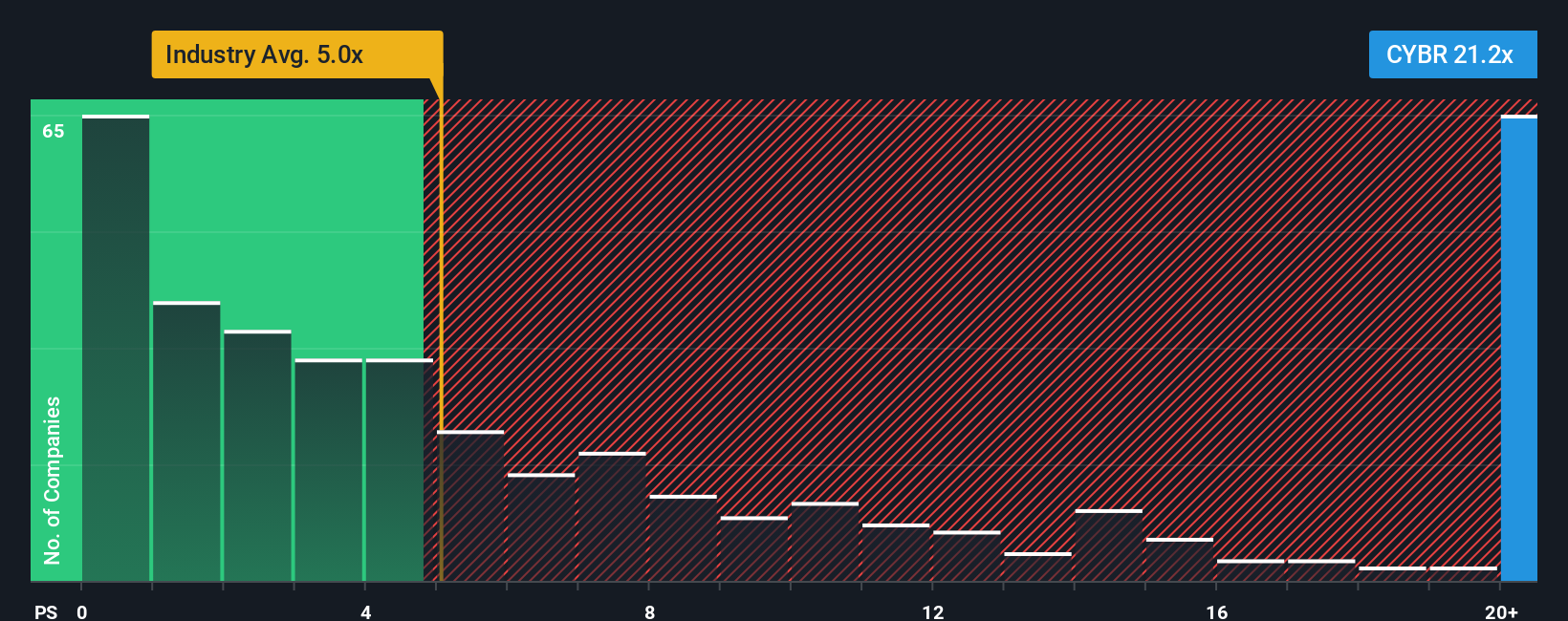

While the popular narrative points to CyberArk’s promising growth story, the company trades at a price-to-sales ratio of 18.4x, which is far higher than the US Software industry’s average of 4.7x and also exceeds its peer average of 8.7x. Compared to a fair ratio of 10x, this steep premium may signal valuation risk if future growth slows. Are investors paying too much for the story, or does long-term upside justify the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CyberArk Software Narrative

If you want a fresh perspective or think you see things differently, you can shape your own view in just a few minutes. Do it your way.

A great starting point for your CyberArk Software research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't miss your chance to get ahead. Simply Wall Street's screener makes it easier than ever to find stocks that fit your goals and open new possibilities.

- Target steady income by checking out these 15 dividend stocks with yields > 3% with yields above 3% and strong payout histories.

- Capture the potential of digital finance by reviewing these 81 cryptocurrency and blockchain stocks where companies lead progress in blockchain and cryptocurrency innovation.

- Uncover tomorrow’s game-changers among these 26 AI penny stocks harnessing artificial intelligence to disrupt multiple industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives