- United States

- /

- Software

- /

- NasdaqGS:CVLT

Should Commvault Cloud Unity’s AI Integration Prompt a Fresh Look by CVLT Investors?

Reviewed by Sasha Jovanovic

- Earlier this month, Commvault introduced the Commvault Cloud Unity platform at SHIFT 2025, rolling out one of its most substantive product releases, which unifies AI-driven data security, cyber recovery, and identity resilience across cloud, SaaS, on-premises, and hybrid environments, with several features becoming available later this year and more to follow in 2026.

- This release marks a significant integration of advanced AI capabilities, such as synthetic cyber recovery and automated Active Directory threat detection, designed to address the growing complexity and risk exposure enterprises face as data environments expand and cyber threats increase.

- We'll examine how the integration of AI-enabled identity resilience in Commvault Cloud Unity could shape the company's investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Commvault Systems Investment Narrative Recap

For investors to consider Commvault Systems today, they need confidence in the company’s ability to lead a crowded data protection market with differentiated, AI-driven solutions. The recent Commvault Cloud Unity platform release is directionally positive, reinforcing potential for customer expansion and sustained growth, but does not immediately resolve margin pressure concerns tied to SaaS transition and recent acquisitions, which remain the primary short-term challenges for the stock.

Among recent announcements, the expansion of Commvault’s Identity Resilience portfolio, unveiled alongside Cloud Unity, stands out. This update directly addresses enterprise demand for more robust protection against surging identity-based threats and could encourage greater adoption across highly regulated sectors, supporting one of the company’s most important near-term growth catalysts.

On the other hand, investors should be aware that, despite progress on integration and innovation, the risk of ongoing margin compression remains as Commvault’s revenue mix...

Read the full narrative on Commvault Systems (it's free!)

Commvault Systems' outlook forecasts $1.5 billion in revenue and $173.1 million in earnings by 2028. This scenario assumes a 12.2% annual revenue growth rate and a $92 million increase in earnings from the current $81.1 million.

Uncover how Commvault Systems' forecasts yield a $194.70 fair value, a 55% upside to its current price.

Exploring Other Perspectives

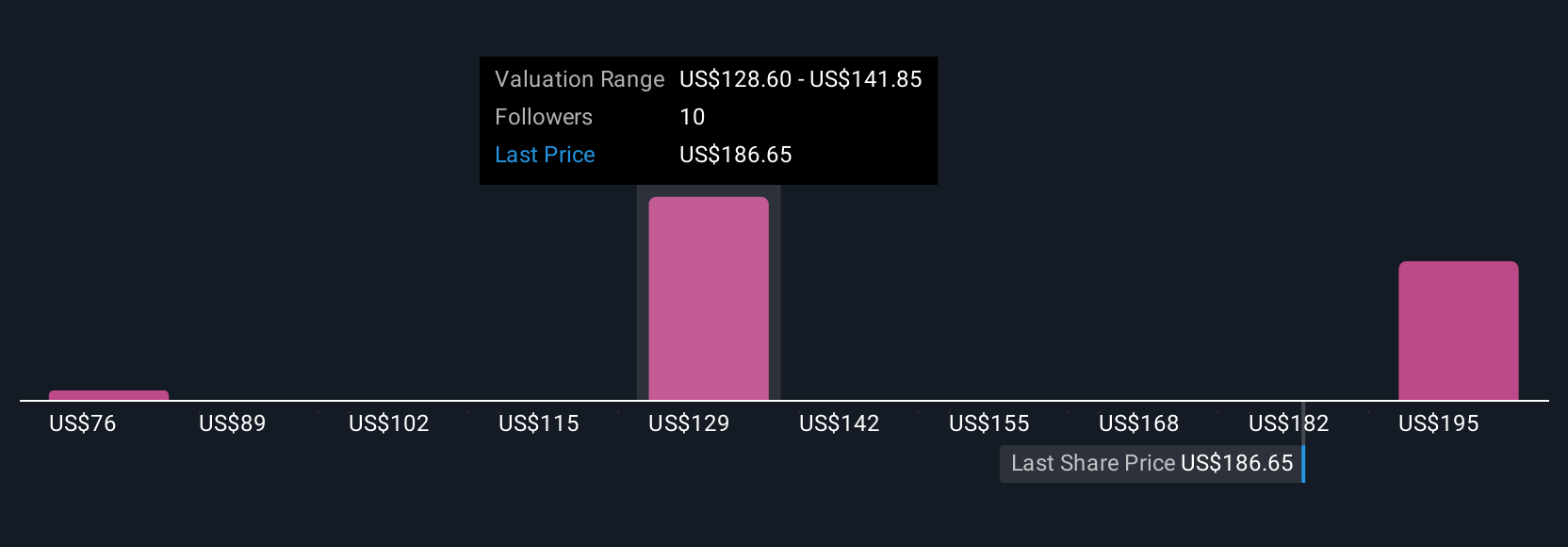

Four Simply Wall St Community members estimate Commvault’s fair value between US$75.61 and US$207.79 per share. While many expect AI-driven portfolio growth, close attention to the margin profile may affect future returns.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth 40% less than the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion