- United States

- /

- Software

- /

- NasdaqGS:CVLT

Is Commvault’s (CVLT) New Cybersecurity Appointment a Signal of Evolving Board Strategy?

Reviewed by Sasha Jovanovic

- On October 17, 2025, Commvault Systems appointed cybersecurity veteran Geoff Haydon to its board of directors and Audit Committee following the recent resignation of board member Allison Pickens, whose departure was unrelated to any disagreements.

- Haydon’s background leading global cybersecurity and technology enterprises underscores Commvault’s increased focus on strengthening its cyber resilience capabilities and board expertise.

- We'll examine how Haydon’s board appointment may influence Commvault’s long-term growth narrative and efforts in cyber resilience leadership.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Commvault Systems Investment Narrative Recap

To own Commvault Systems shares today, you need to believe in the long-term necessity of advanced cyber resilience and data protection, driven by escalating cyber threats and tightening compliance standards. The appointment of Geoff Haydon to the board underscores this narrative, but is unlikely to have a material near-term impact on the key catalyst, sustained double-digit growth in subscription revenue, or address the biggest risk, ongoing margin pressure as SaaS becomes a larger part of the business.

Of the recent announcements, the integration partnership with BeyondTrust is particularly relevant, reinforcing Commvault’s emphasis on enterprise security and its positioning to meet rising demand for compliant data management, an important support for recurring revenue growth via the SaaS model. This move directly aligns with one of the company’s most important value drivers, although it does not resolve margin compression risks as Commvault pivots away from traditional licensing.

Yet, in contrast, the risk that expanding SaaS revenue could further dilute margins is information investors should be aware of if...

Read the full narrative on Commvault Systems (it's free!)

Commvault Systems is projected to achieve $1.5 billion in revenue and $173.1 million in earnings by 2028. This outlook is based on an anticipated annual revenue growth rate of 12.2% and an earnings increase of $92 million from the current $81.1 million.

Uncover how Commvault Systems' forecasts yield a $214.56 fair value, a 26% upside to its current price.

Exploring Other Perspectives

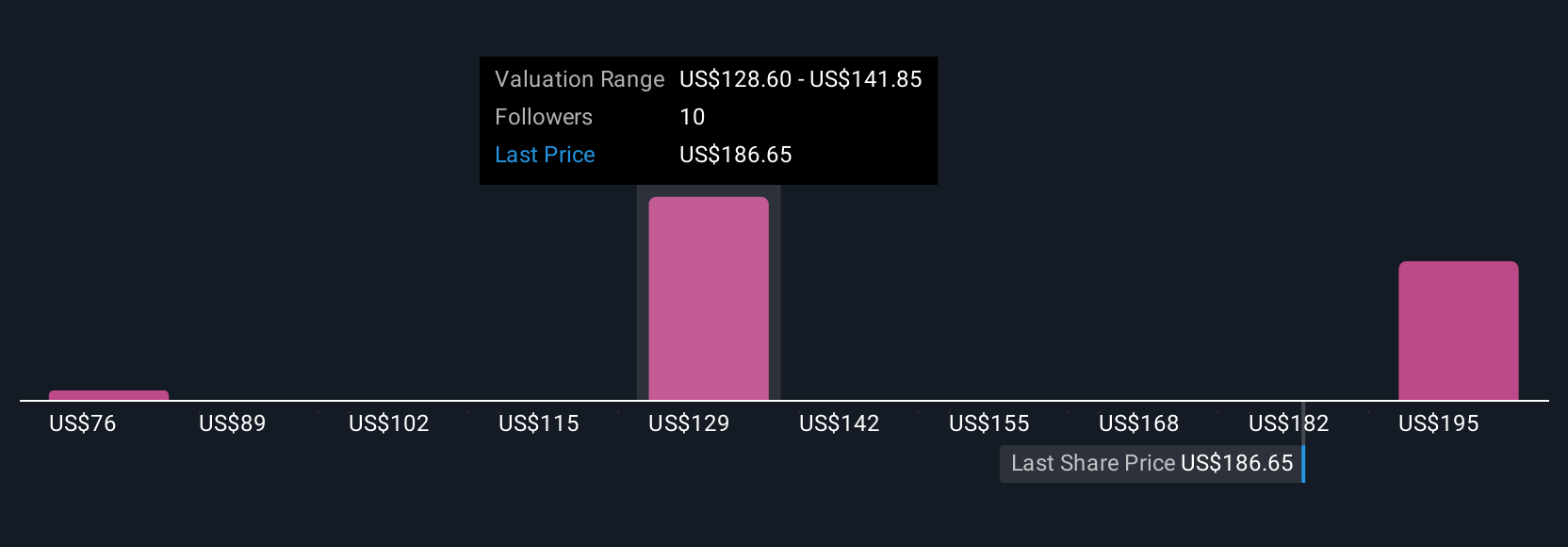

Four individual fair value estimates from the Simply Wall St Community for Commvault range widely from US$75.61 to US$214.56 per share. With margin compression an ongoing concern, these perspectives highlight how differently investors view Commvault’s path in the fast-changing cyber resilience sector.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth as much as 26% more than the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives