- United States

- /

- Software

- /

- NasdaqGS:CVLT

Commvault Systems (CVLT): Assessing Value After Earnings Miss, Revenue Milestones and Bold Product Launches

Reviewed by Simply Wall St

Investor attention around Commvault Systems (CVLT) has picked up after the company's quarterly earnings highlighted strong revenue growth and a leap to over $1 billion in recurring revenue. However, profit missed expectations, which sent shares sharply lower. At the same time, new product launches and a fresh enterprise partnership signal long-term ambitions.

See our latest analysis for Commvault Systems.

Despite Commvault's milestones and innovative product rollouts, the past month has been tough for shareholders, with a 27.1% decline in the share price and a year-to-date dip of 9.5%. Still, the company’s long-term story remains impressive. Commvault has delivered a 116% total shareholder return over three years and 216% over five, suggesting that momentum, though shaken in the short term, has been a tailwind for patient investors.

If the recent volatility has you eyeing what else the market offers, this is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares down sharply despite solid growth milestones, the key question now is whether Commvault's recent weakness signals an undervalued entry point or if the market has already accounted for its future upside.

Most Popular Narrative: 35.9% Undervalued

Commvault Systems' most widely followed narrative suggests the stock's fair value is $214.56, which stands well above the last close at $137.62. This significant gap has turned heads, as it points to a compelling upside story, driven by a blend of business momentum and future projections. Here is a key excerpt shaping that valuation:

Surging demand for enterprise data protection and recovery fueled by accelerating cyber threats, with Commvault's enhanced cyber resilience platform (including Cleanroom Recovery, Air Gap Protect, and the upcoming Satori Cyber acquisition) driving new customer adoption and increased wallet share. This is likely supporting sustained double-digit revenue and ARR growth.

Curious which trends and bold financial forecasts set the stage for such a bullish view? The narrative leans on future revenue jumps, widening margins, and a profit target that would make any software peer envious. Want to see what aggressive assumptions power this 35.9% upside claim? Unlock the numbers that could sway any investment thesis.

Result: Fair Value of $214.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing risks such as margin pressure from SaaS transitions and potential reliance on existing customer growth could challenge Commvault’s impressive outlook.

Find out about the key risks to this Commvault Systems narrative.

Another View: Is Commvault Actually Expensive?

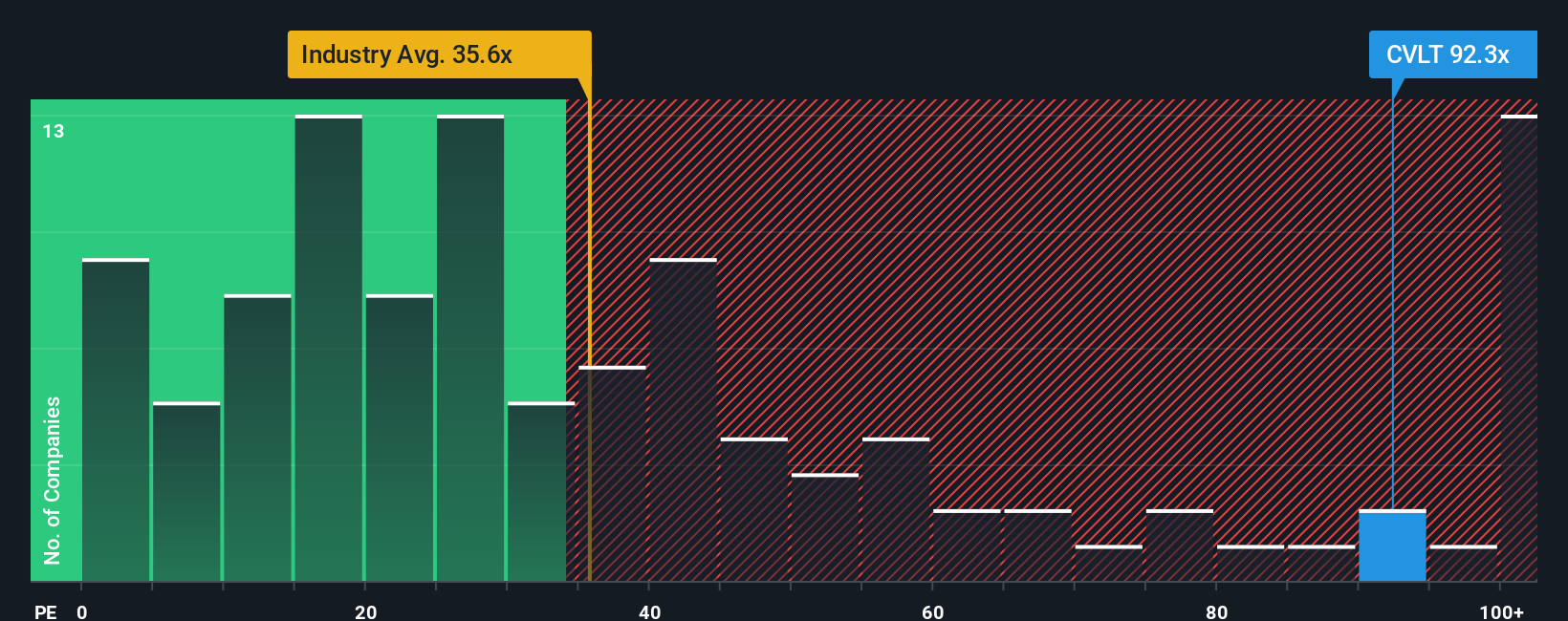

While some see plenty of upside, a look at the price-to-earnings ratio tells a different story. Commvault trades at 76.3x earnings, which is far above both its US software peers at 24x and the industry average of 34.8x. The fair ratio suggests 34.7x is a more reasonable benchmark. This means the current valuation leaves little room for error or disappointment. Does this raise the risk of a pullback if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you have your own perspective or want to dig into the facts directly, you can assemble your unique narrative in just a few short minutes. So why not Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by searching out unique opportunities, and the Simply Wall Street Screener gives you an edge. Miss this, and you could miss big winners in sectors just heating up.

- Boost your returns with steady income. Scan these 24 dividend stocks with yields > 3% featuring strong yields and reliable payers competing for your portfolio’s attention.

- Ride the wave of technological innovation. Unlock potential with these 26 AI penny stocks as artificial intelligence reshapes entire industries and creates new winners.

- Seize the early advantage in tomorrow’s breakthroughs. Zero in on these 28 quantum computing stocks as quantum computing moves from lab to real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives