- United States

- /

- Software

- /

- NasdaqGS:CVLT

Commvault (CVLT) Valuation in Focus After Major AI-Powered Cloud Unity Platform Launch

Reviewed by Simply Wall St

Commvault Systems (CVLT) just unveiled its Commvault Cloud Unity platform, introducing major advances in AI-powered data security, cyber recovery, and identity resilience. These updates address persistent challenges brought by distributed data and hybrid cloud environments.

See our latest analysis for Commvault Systems.

Commvault’s string of AI-driven product launches, highlighted by the recent Cloud Unity platform and next-generation identity resilience tools, has attracted plenty of attention even as the stock’s momentum has cooled. After years of strong multi-year growth, the past month saw a 1-month share price return of -29.5%, while the one-year total shareholder return currently sits at -31.4%. However, its five-year total shareholder return of 144.9% reflects the company’s long-term innovation strength.

If you’re interested in spotting innovative software and tech names shaping the next wave of cloud security, don’t miss the opportunity to explore See the full list for free.

But with shares trading well below analyst price targets and long-term returns far outperforming recent declines, investors have to ask: Is Commvault undervalued now, or is the market already pricing in all future growth?

Most Popular Narrative: 38.2% Undervalued

Comparing the narrative’s $193.70 fair value estimate to Commvault’s last close at $119.76 reveals a significant gap. This highlights a valuation story shaped by bold growth expectations in both revenue and margin expansion, despite recent share price losses. This section uncovers a core catalyst behind that narrative, one that could redefine how investors view Commvault’s future potential.

“Surging demand for enterprise data protection and recovery fueled by accelerating cyber threats, with Commvault's enhanced cyber resilience platform (including Cleanroom Recovery, Air Gap Protect, and the upcoming Satori Cyber acquisition) driving new customer adoption and increased wallet share, likely supporting sustained double-digit revenue and ARR growth.”

Want to know why analysts believe Commvault’s future is tied to recurring revenue streams and ambitious margin goals? The projections behind this valuation rest squarely on a handful of aggressive, surprisingly optimistic forecasts that could rival some of the fastest growing tech peers. Find out what’s powering this narrative price target and why the debate on future profits is far from settled.

Result: Fair Value of $193.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract durations and margin pressures could inject more uncertainty into Commvault’s earnings outlook. This may challenge the current growth narrative.

Find out about the key risks to this Commvault Systems narrative.

Another View: Valuation Through Earnings Multiples

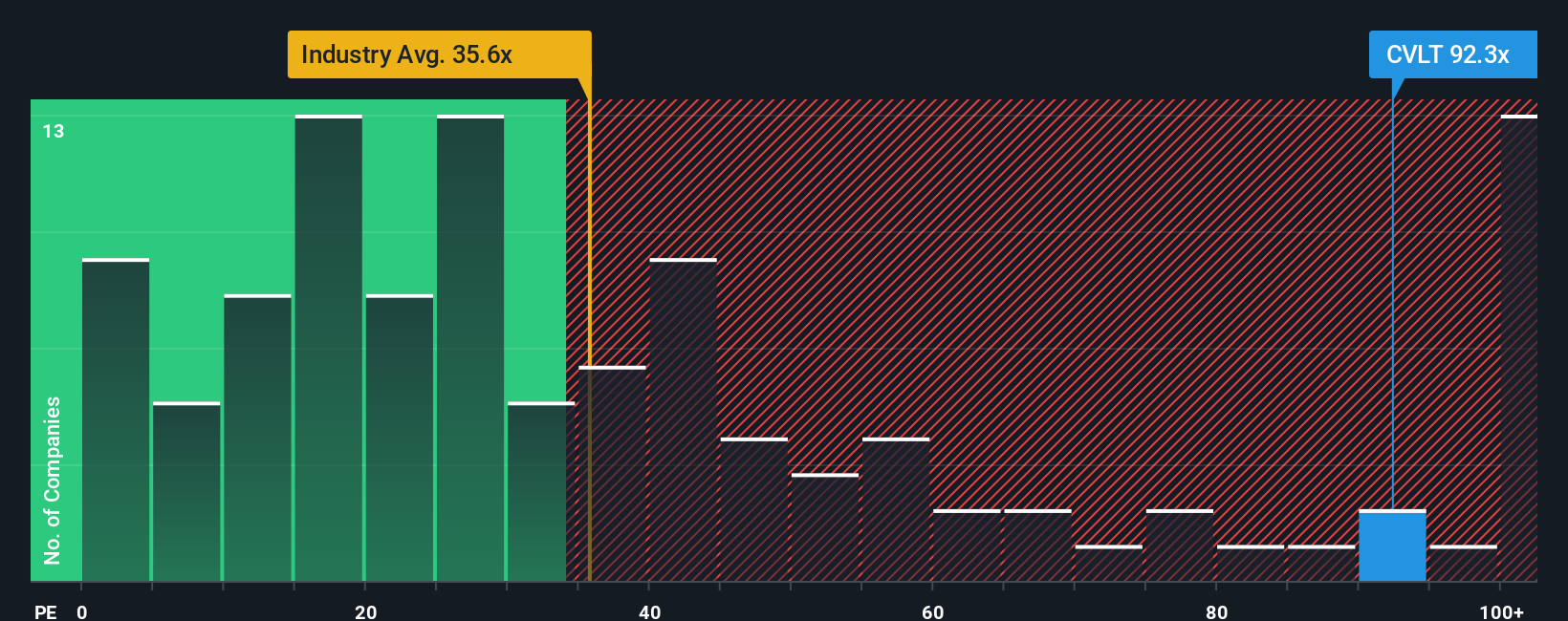

Looking beyond the fair value estimate, Commvault trades at a price-to-earnings ratio of 65.8x. This is significantly higher than both the US Software industry average of 28.8x and the peer average of 47.6x. The fair ratio, set at 34.2x, suggests the current valuation carries clear downside risk if the market shifts toward more typical multiples. Will investor optimism keep supporting this premium, or could future market movements trigger a reassessment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you see things differently or want to put your insights to work, you can quickly build your own narrative using our data tools in just a few minutes. Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit your search to Commvault. The Simply Wall Street Screener makes it simple to spot standout opportunities others are missing, whether you’re hunting for returns, growth, or sector trends.

- Target long-term potential and spot value gaps by checking out these 926 undervalued stocks based on cash flows for equities underpriced by the market.

- Tap into income streams that keep your portfolio resilient by reviewing these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Get ahead of the next tech evolution by pursuing breakthrough innovation when you browse these 26 AI penny stocks pushing boundaries in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives