- United States

- /

- IT

- /

- NasdaqGS:CRWV

Is CoreWeave’s Recent Cloud Expansion Fueling an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether CoreWeave stock is a bargain or a bubble? You are not alone, and getting valuation right can make all the difference for your portfolio.

- The stock has been on a tear, returning 15.1% in the last week and 249.8% year-to-date. This highlights both strong investor conviction and growing curiosity about what is driving the surge.

- Recently, CoreWeave made headlines with aggressive expansion moves and partnerships in the cloud computing space. These developments have fueled excitement around its growth potential, added momentum to the share price, and drawn fresh attention from both institutional and individual investors.

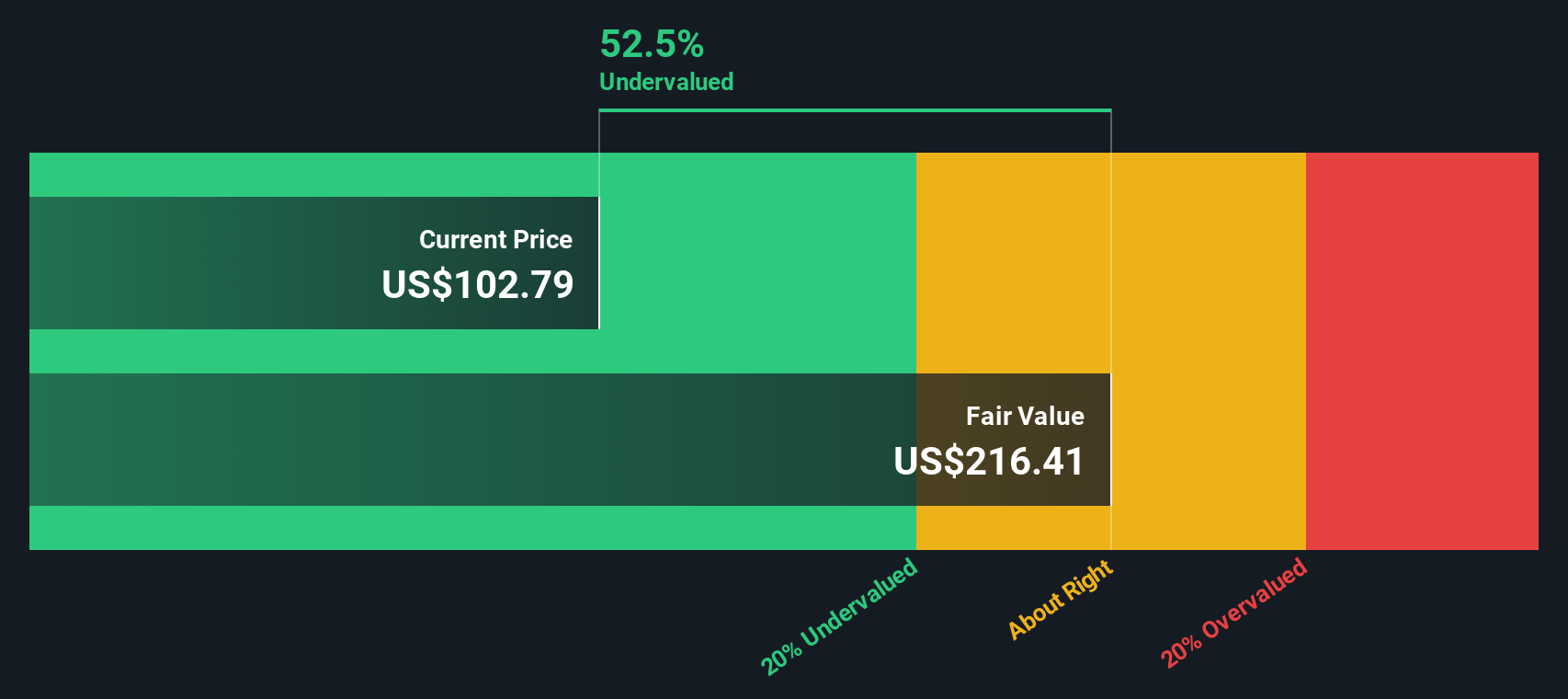

- Our current evaluation shows CoreWeave scores a 4 out of 6 on our undervaluation checks, which means there could still be significant value left to uncover. As always, there is more to valuation than just the numbers. Let’s break down the methods analysts use, and look deeper at what really matters most.

Approach 1: CoreWeave Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This approach helps investors judge how much a business’s future expected profits are worth today.

For CoreWeave, recent cash flows have been negative, with the latest twelve months Free Cash Flow (FCF) at about $-11,147 Million. Analysts expect free cash flow to improve remarkably over the coming decade. By 2029, projections put FCF at $5,658 Million, and by 2035, the model anticipates FCF to reach $27,914 Million. Most years are expected to see robust annual growth rates. Only the first five years are based on analyst forecasts, while the remainder rely on further extrapolations from Simply Wall St’s model.

The DCF analysis results in an estimated intrinsic value of $434.10 per share. Relative to the current market price, this suggests that CoreWeave stock is trading at a 67.8% discount to its calculated fair value. This implies that the stock is significantly undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CoreWeave is undervalued by 67.8%. Track this in your watchlist or portfolio, or discover 856 more undervalued stocks based on cash flows.

Approach 2: CoreWeave Price vs Sales

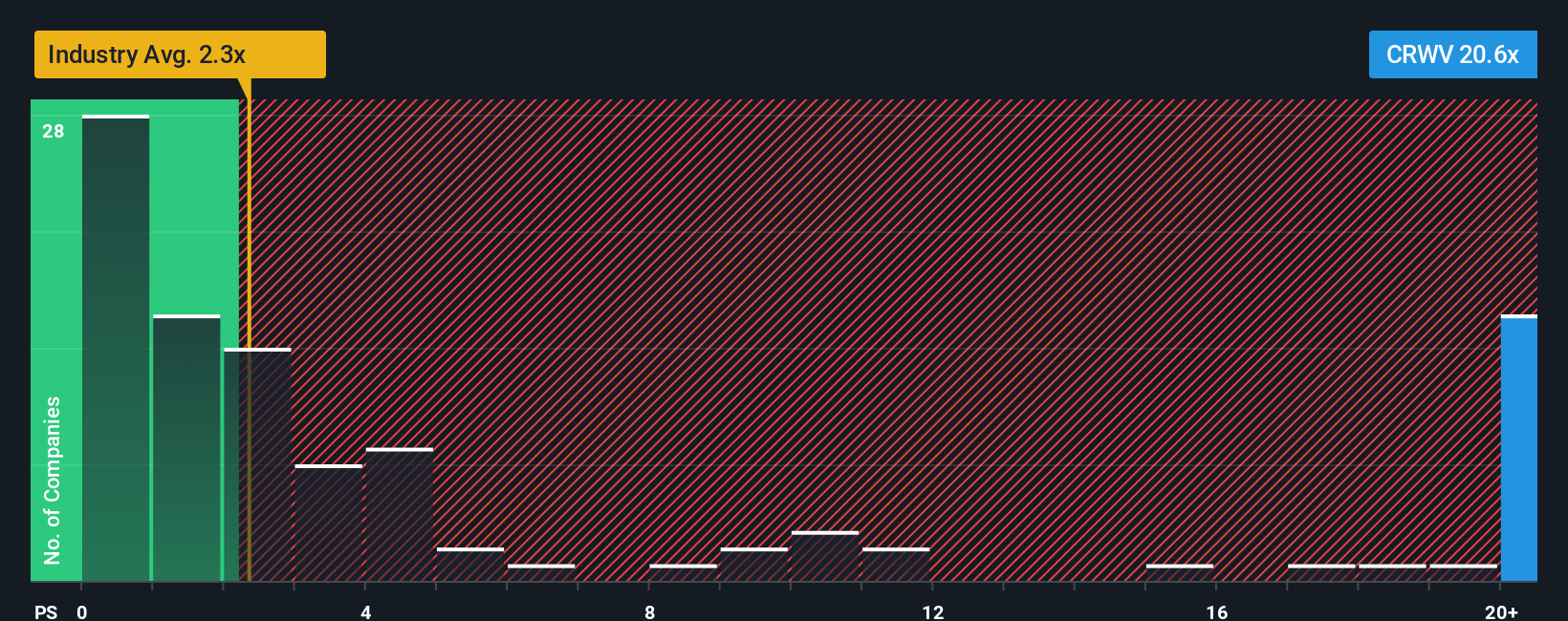

For many high-growth companies that are not yet profitable, the Price-to-Sales (PS) ratio is a practical and popular valuation metric. Since CoreWeave is still posting negative earnings, the PS ratio gives investors a useful way to compare the stock’s value to its current revenue without focusing on bottom-line profitability just yet.

A company’s "normal" or "fair" PS ratio often depends on its growth prospects and risk profile. High-growth companies can command higher PS ratios, while more stable, less risky businesses usually trade at lower multiples. Investors also weigh industry benchmarks and how peers are being valued.

CoreWeave currently trades at a PS ratio of 20.6x, which is just a bit lower than the peer average of 22.5x and sharply above the broader IT industry average of 2.8x. On first glance, this might seem expensive. However, Simply Wall St's Fair Ratio for CoreWeave is 46.5x, substantially higher than both its current multiple and the benchmarks. The Fair Ratio takes a tailored approach by weighing CoreWeave’s revenue growth, margins, market risks, company size, and industry context, making it more insightful than simple peer or sector comparisons.

Comparing CoreWeave’s actual PS ratio to its Fair Ratio, the stock looks significantly undervalued based on this method.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoreWeave Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful way to connect your personal take on a company with a financial forecast and a fair value estimate. Rather than just focusing on isolated numbers, Narratives allow you to combine your view of CoreWeave’s story, such as expected revenue, margins, or market position, with key financial assumptions to transparently see what you believe the stock is really worth.

Narratives are available right on Simply Wall St’s Community page, where millions of investors share and update their perspectives. You can easily create or view Narratives, which show how different fair value estimates compare to the actual share price. This helps guide buy or sell decisions based on what matters most to you. Best of all, Narratives stay up to date as new news or earnings reports are released, so your insights evolve with the market.

For example, when looking at CoreWeave, some investors in the Community believe the fair value could be as high as $650 per share. Others are more cautious, valuing it closer to $220. This perfectly illustrates how Narratives capture a range of real opinions and forecasts.

Do you think there's more to the story for CoreWeave? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives