- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): Valuation in Focus After Landmark $14.2 Billion Meta Platforms Deal

Reviewed by Kshitija Bhandaru

CoreWeave, Inc. has drawn fresh attention from investors after announcing a $14.2 billion agreement with Meta Platforms to provide cloud computing capacity through 2031, with an option for further expansion.

This long-term deal not only strengthens CoreWeave’s position as a major supplier of AI infrastructure, but also broadens its client base beyond previous partnerships. The move highlights increasing demand for scalable and advanced cloud resources as AI adoption grows.

See our latest analysis for CoreWeave.

The Meta announcement sent CoreWeave’s share price soaring by double digits, capping a standout month for the stock. That momentum follows a string of record-breaking, multi-billion-dollar deals, including an expanded $6.5 billion partnership with OpenAI, which have helped CoreWeave outpace peers and reinforce investor confidence in its growth story. After a rollercoaster summer, the stock’s YTD share price return now sits at 2.45%, reflecting renewed optimism around its expanding role in AI infrastructure and future contract pipeline.

If you want to uncover other emerging names powering the next era of artificial intelligence, explore the landscape using our See the full list for free..

Yet with shares already surging on big-ticket deals and optimism running high, investors must ask: is CoreWeave undervalued in light of its rapid pipeline growth, or is all the blue-sky potential already priced in?

Price-to-Sales of 20.3x: Is it justified?

CoreWeave trades at a price-to-sales ratio of 20.3x, putting it at a premium versus the broader US IT sector average of 2.4x. This signals that the market has sky-high growth expectations for the company, particularly given the surge in cloud infrastructure demand.

The price-to-sales multiple reflects how much investors are willing to pay for every dollar of CoreWeave’s revenue. For a high-growth, still-unprofitable company like CoreWeave, this multiple serves as a key yardstick for the valuation of future earnings potential, since profits are not yet being realized on the bottom line. The current level highlights market enthusiasm for CoreWeave's strategic partnerships and scale as an AI infrastructure provider.

Compared to other industry players, CoreWeave’s premium valuation is hard to ignore. While peers command far lower price-to-sales ratios, CoreWeave’s stands out as aggressive. However, regression analysis suggests that the price could move even higher, as the estimated fair price-to-sales ratio is 47.8x. If investor sentiment shifts, the valuation multiple may have significant room to run.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 20.3x (UNDERVALUED)

However, CoreWeave’s high valuation leaves little margin for error if revenue growth stalls or if competition in AI infrastructure intensifies unexpectedly.

Find out about the key risks to this CoreWeave narrative.

Another View: Our DCF Model Weighs In

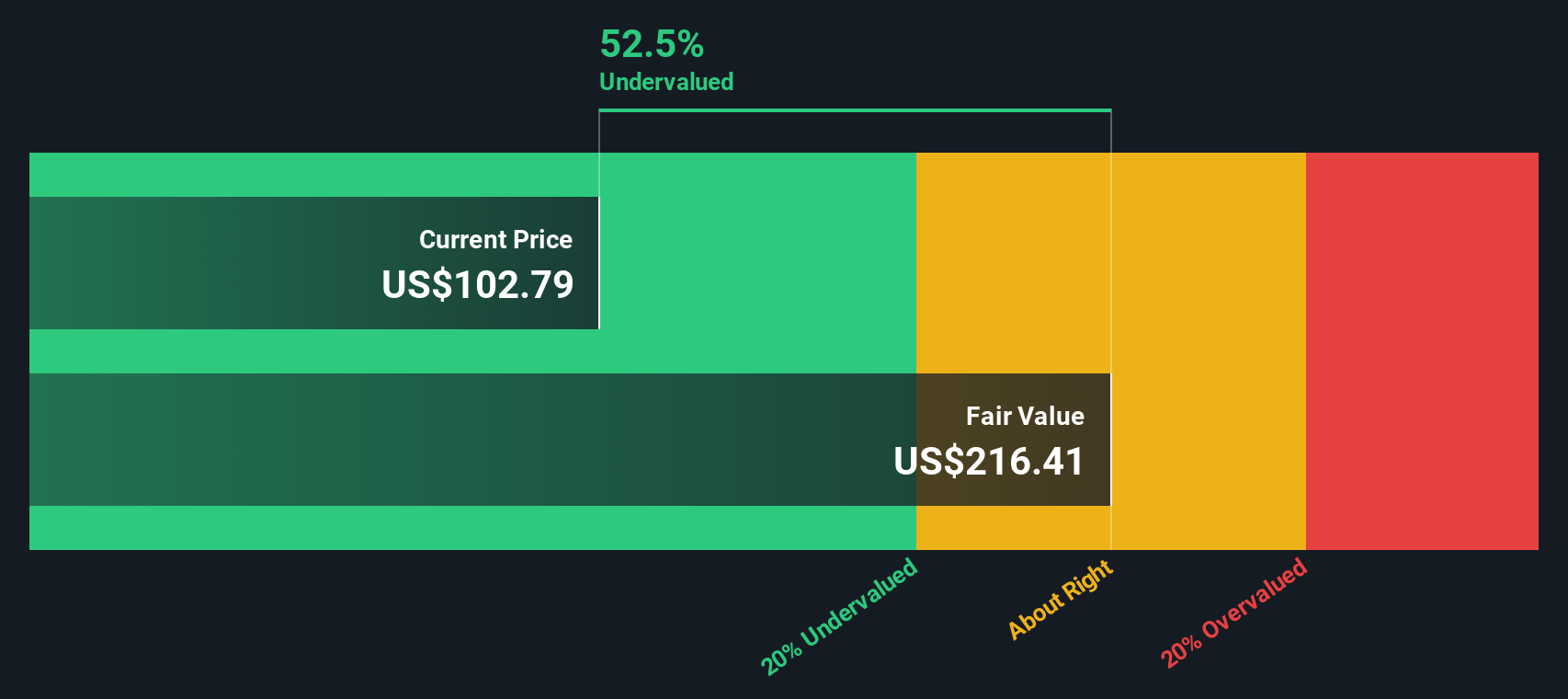

Looking at CoreWeave through the lens of the Simply Wall St DCF model offers a different angle on its valuation. Based on future cash flow projections, the DCF result suggests the company is currently trading 32.8% below its estimated fair value. This indicates potential undervaluation compared to the current market price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

Of course, if you have your own take or want to dig deeper, you can independently analyze the numbers and craft your own perspective in minutes. Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Stock Opportunities?

Don't wait on the sidelines while new market leaders emerge. The Simply Wall Street Screener makes it easy to spot promising stocks tailored to your interests, helping you stay a step ahead in every sector.

- Tap into potential with high-yield picks by checking out these 19 dividend stocks with yields > 3% to see which companies are delivering strong income through robust dividends.

- Capitalize on the AI boom by reviewing these 24 AI penny stocks, designed to surface innovative businesses at the forefront of artificial intelligence advancements.

- Get ahead of the curve with cutting-edge tech by exploring these 26 quantum computing stocks, where quantum computing movers are laying the groundwork for the next technology leap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026