- United States

- /

- Software

- /

- NasdaqGS:CRWD

Should You Reconsider CrowdStrike After Shares Surged 67% and More Growth Is Priced In?

Reviewed by Bailey Pemberton

So you are thinking about what to do with CrowdStrike Holdings, and honestly, who can blame you? Just when you think this cybersecurity giant might take a breather, it surprises investors again. Over the past year, the stock has rocketed an eye-catching 67.1%, and if you zoom out a bit more, returns have stacked up to 209.1% over three years and a remarkable 280.1% over five. Even after such a stellar run, recent weeks have seen more positive momentum, with a 2.3% lift over the last seven days and 1.4% over the past month. Year to date, shares are already up a robust 44.0%.

What is fueling all this optimism? Part of it is the market’s ongoing recognition of CrowdStrike’s leadership in endpoint security and cloud protection. Many enterprises, and even government agencies, continue to double down on cyber defense. This trend plays right into CrowdStrike’s hands. News of big customer wins and the company’s expansion into new international markets have reinforced the story of long-term growth potential, even as risk perceptions shift in response to threats and innovation across the sector. These factors have added life to the price, but they also put a spotlight on how the market is valuing the company.

That brings us to the key question: does the current price tag make sense? Using six standard valuation criteria, CrowdStrike scores a 0 right now. In other words, by our usual checks, none signal the stock as undervalued. Of course, numbers never tell the full story, and some valuation approaches are more telling than others. Let’s dig into the methods most investors use to weigh value, and later, I will share what I think is the most insightful perspective of all.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

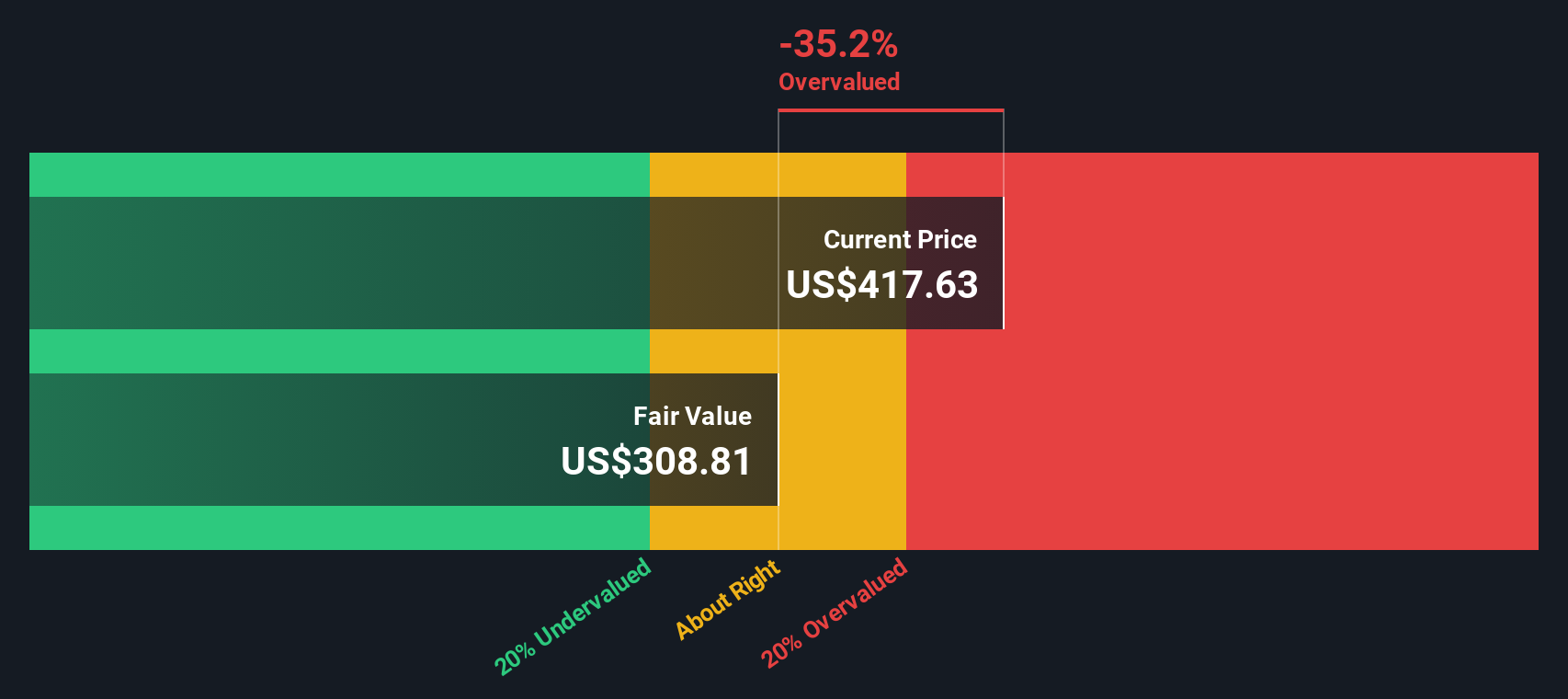

The Discounted Cash Flow (DCF) model estimates CrowdStrike Holdings' intrinsic value by projecting future cash flows from the business and discounting them to their present value using a required rate of return. This approach helps investors gauge what the company's underlying cash generation is worth today, separate from market hype.

Currently, CrowdStrike has a Free Cash Flow (FCF) of $1.04 billion. Analyst estimates drive the first five years of growth, with projections reaching up to $4.58 billion in FCF by 2030. Beyond initial analyst forecasts, further FCF growth estimates are extended by Simply Wall St using a logical extrapolation model. These projections reflect the company’s anticipated rapid expansion in the cybersecurity market as well as improvements in scaling efficiency as it grows larger.

Using this model, the fair value of CrowdStrike shares is calculated at $414.88. However, with the current market price, this means the stock is around 20.5% above its estimated intrinsic value based on cash flow fundamentals. Investors are factoring in aggressive growth and future profitability, but at present, the DCF suggests the shares are trading at a premium.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 20.5%. Find undervalued stocks or create your own screener to find better value opportunities.

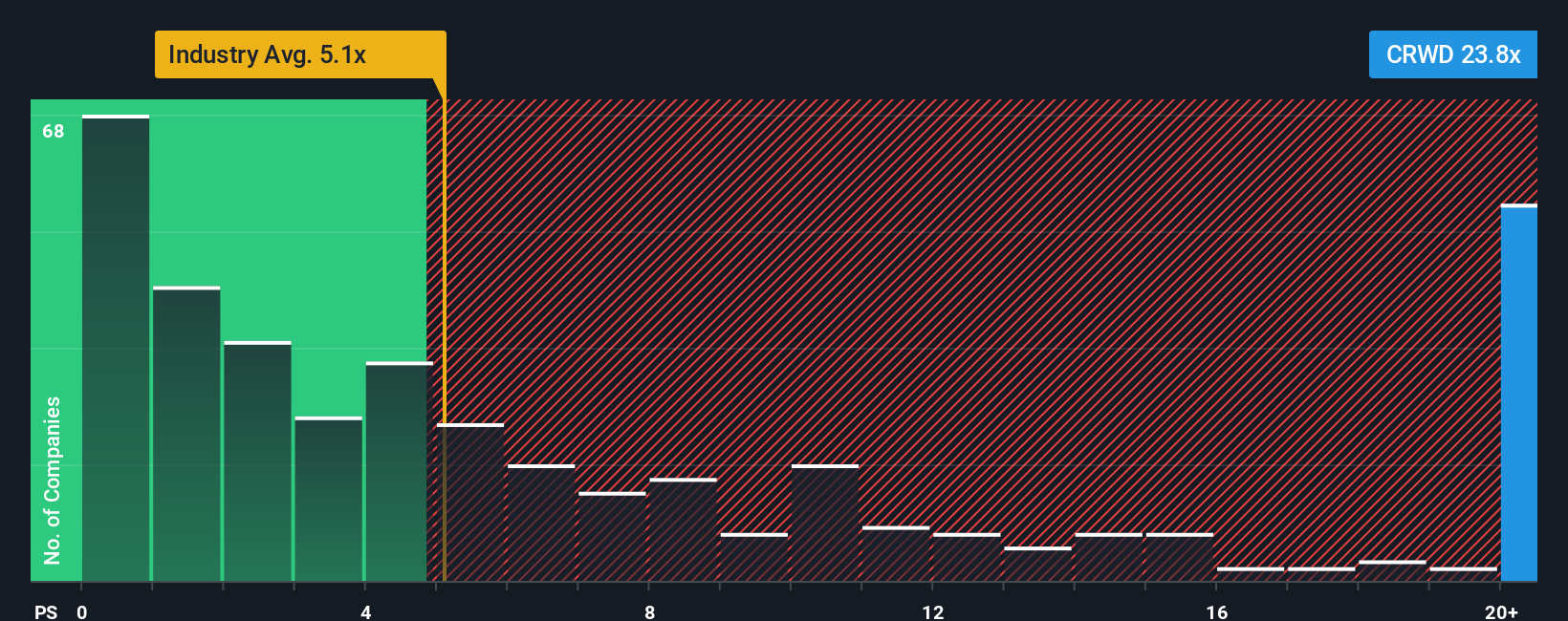

Approach 2: CrowdStrike Holdings Price vs Sales

For companies like CrowdStrike Holdings that are scaling rapidly but may not yet be consistently profitable, the Price-to-Sales (P/S) ratio is a highly useful valuation metric. It provides a window into how much investors are willing to pay for each dollar of the company’s sales, which can be more meaningful for high-growth tech companies than earnings-based multiples.

The "right" P/S ratio often depends on growth prospects and industry risk. High-growth companies or those with a significant competitive edge usually command higher P/S multiples. Riskier or slower-growth businesses tend to trade at lower valuations. It is all about how optimistic investors are about future expansion and profitability.

CrowdStrike's current P/S ratio stands at a lofty 28.9x. This sharply exceeds both the broader software industry average of 5.2x and the peer group average of 15.0x. However, Simply Wall St’s Fair Ratio for CrowdStrike, which synthesizes unique factors like growth, margins, risk, sector, and scale, recommends a P/S multiple of 17.6x. This metric gives a more tailored valuation snapshot than simple industry or peer comparisons because it accounts for what truly makes CrowdStrike different, such as its rapid sales momentum, market opportunities, and risk profile.

At 28.9x, CrowdStrike’s actual P/S remains notably above the Fair Ratio of 17.6x. This suggests the stock’s valuation is stretched based on current fundamentals and growth expectations.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

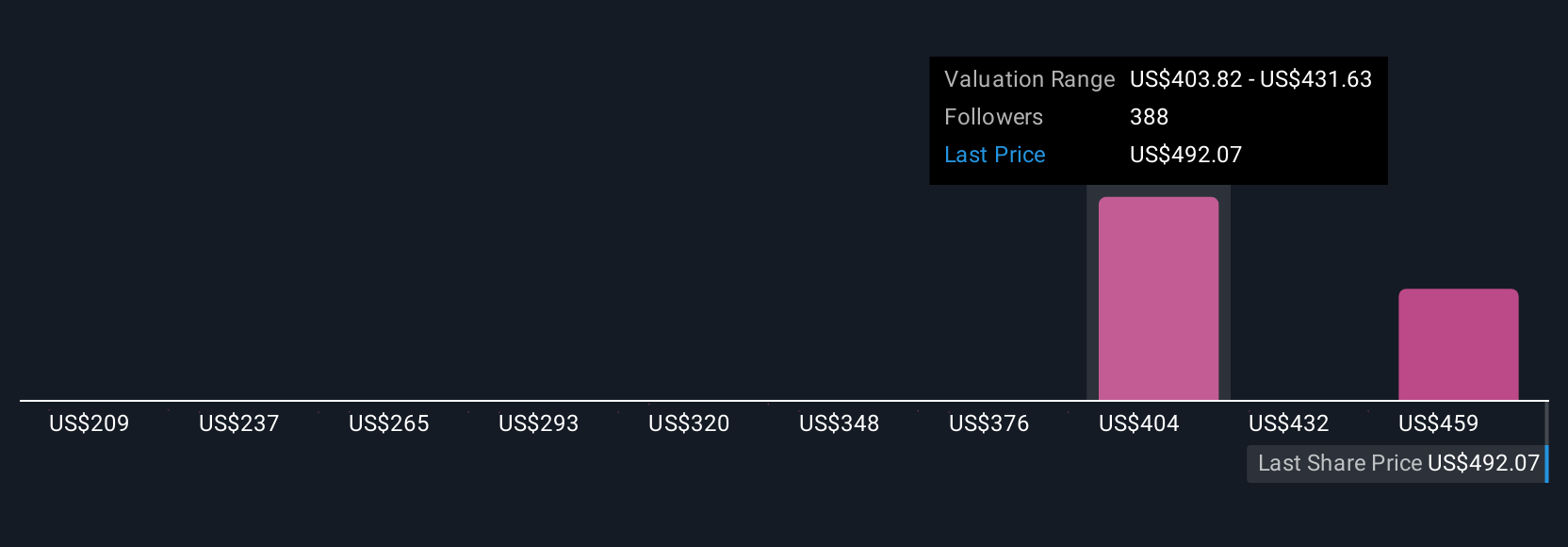

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers, your personal perspective on what is driving a company's future, which you express through your own assumptions about fair value and forecasts for revenue, earnings, and profit margins.

With Narratives, you connect CrowdStrike’s business momentum, technology, opportunities, or risks to your specific financial outlook, and then translate that story into a fair value that you can directly compare with the current share price. This approach moves beyond static ratios or formulas, allowing you to invest with a clear and grounded thesis, making it easy to decide when the stock is a buy, hold, or sell for your unique point of view.

Narratives are available on Simply Wall St’s Community page, used by millions of investors, and are kept up to date automatically whenever new news, events, or earnings reports become available, so your viewpoint and fair value always reflect the latest information.

For example, some investors see CrowdStrike’s continuous innovation and high recurring growth as justifying a fair value above $498 per share, expecting significant expansion, while others, focusing on competitive pressures or recent technical setbacks, estimate fair value closer to $331 per share. This shows just how powerfully Narratives anchor your decisions in your own research and reasoning.

Do you think there's more to the story for CrowdStrike Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives